- FARTCOIN jumped 26% to $1.06 with $650M+ in trading volume, driven by whale and smart money accumulation.

- Technicals point toward a possible run to $1.74 if momentum holds, but $0.74 remains a risk target on demand drop.

- Meme coin market is rallying broadly, but volatility and regulatory uncertainty remain key risks.

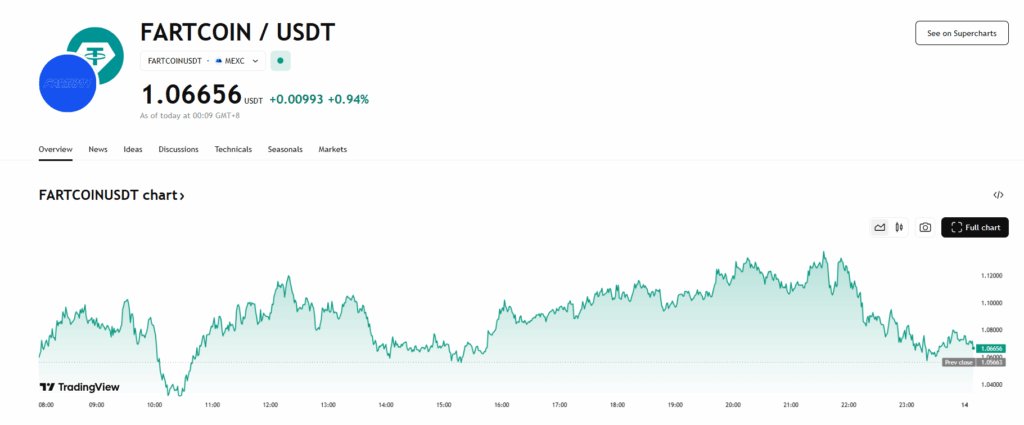

FARTCOIN, the Solana-based meme token, has been on a tear—surging 26% in the last 24 hours to hit $1.06. On-chain data shows trading volume blasting past $650 million, a clear sign that buying pressure is heating up fast.

Whales are a big part of the story here. Nansen data reveals that large holders boosted their FARTCOIN bags by 2% in a single day, now controlling 207.42 million tokens. That’s not small change—it’s a strategic accumulation move that hints at expectations for even more upside. Meanwhile, “smart money” wallets have been getting in on the action too, adding 3% more to their positions, bringing their collective stash to 19 million tokens. This kind of confidence from seasoned players tends to catch retail traders’ attention… and can snowball into short-term momentum surges.

Technical Setup Shows Room to Run

On the charts, the daily MACD is still looking strong—green histogram widening, signal line staying well below price, and momentum leaning bullish. If this trend keeps up, analysts say we could see FARTCOIN shoot toward $1.74. That said, the flip side isn’t pretty—a drop in demand could send it down to $0.74 just as quickly. Key level to watch right now? $1.085. A clean break above it could set the stage for $1.15 and reinforce the ongoing rally.

The backdrop is helping too. Meme coins are in the spotlight again, with the entire crypto market adding nearly $400 billion in market cap over the past week. FARTCOIN and PEPE have been leading the pack, fueled by a cocktail of retail hype and macro optimism.

Risk Still Lurks Under the Surface

Of course, none of this erases the fact that FARTCOIN is a speculative play, and regulation could still throw a wrench in the works. If whale buying dries up or broader sentiment sours, we could see sharp pullbacks. For now, though, both retail and institutional hands are in the game—and as long as that’s the case, the market’s watching to see if this rally still has legs.