- Jupiter has grown from a swap aggregator into a full-scale Solana DeFi ecosystem, offering swaps, perpetuals, staking, and launchpads.

- Its native token, JUP, powers governance, incentives, and long-term ecosystem growth, with major burns and strong adoption signaling sustainability.

- With institutional attention, deep liquidity, and a roadmap targeting stablecoins and cross-chain expansion, Jupiter is shaping the future of Solana DeFi.

Jupiter, the leading Solana-based decentralized exchange aggregator, has grown from a niche token swap platform into a full-scale decentralized finance ecosystem. Since its launch in 2021, the platform has consistently demonstrated innovation, leveraging Solana’s high-speed, low-cost blockchain to offer advanced trading, liquidity, and staking features.

With a growing user base, dominant trading volume, and a vision to redefine decentralized adoption, Jupiter has established itself as a cornerstone of the Solana DeFi ecosystem. So let us take a closer look at the project that turned token swapping into an art form and built an ecosystem that refuses to be ignored.

What Is Jupiter?

Jupiter is a decentralized finance protocol built on Solana, operating primarily as a DEX aggregator. Its primary mission is to find the best token swap prices by routing trades across multiple decentralized exchanges on Solana. Unlike a traditional exchange, Jupiter does not hold or match orders directly.

Instead, it acts as a sophisticated routing layer, analyzing liquidity across dozens of Solana-based exchanges and calculating the most efficient trading path for users. This architecture allows Jupiter to provide users with minimal slippage, optimized execution, and access to liquidity pools that would otherwise be fragmented across the ecosystem.

The platform has since evolved beyond simple token swaps. It now encompasses features such as perpetual futures trading, advanced order types like limit orders, strategic investment tools like dollar-cost averaging and value averaging, liquid staking, token launchpads, and community governance through its native token, JUP.

Jupiter has become the dominant DEX aggregator on Solana, handling over half of the blockchain’s DEX trading volume. This dominance has positioned the platform as a critical infrastructure element in the growing Solana DeFi landscape, attracting both retail and institutional participants.

What Problems Does It Solve?

Jupiter was born out of the chaos of fragmented liquidity. In the early days of DeFi, token value was scattered across dozens of pools and exchanges, creating inefficiencies, slippage, and vulnerability to manipulation. Traders had to manually search for the best prices, often settling for suboptimal execution.

Jupiter solves this by aggregating liquidity across Solana’s DEXs and AMMs, offering a single interface that finds the best route for any token pair. It eliminates the guesswork, reduces slippage, and increases the success rate of transactions. For traders navigating volatile markets or chasing exotic memecoins, Jupiter provides a reliable and efficient trading experience.

Beyond swaps, Jupiter tackles the lack of advanced trading tools in DeFi. By introducing features like limit orders, dollar-cost averaging, and value averaging, it empowers users to execute sophisticated strategies without relying on centralized platforms. Its perpetuals exchange and liquidity pool further expand the protocol’s reach, offering leveraged trading and yield opportunities in a trustless environment.

How Does It Work?

At the heart of Jupiter’s swap engine lies Metis, a real-time routing algorithm that analyzes liquidity pool health and exchange rates across Solana’s DEXs. When a user initiates a trade, Metis calculates the most efficient path, often splitting the trade across multiple pools and tokens to optimize execution.

Metis is not static. It refreshes quotes in parallel and updates routes dynamically. If a better path is discovered before the trade is executed, Metis replaces the old route with the new one. This ensures that users always receive the best available price, even in volatile conditions.

Jupiter’s smart contracts, built on Solana’s account-based architecture, facilitate these interactions. Each contract is a self-executing program that manages swaps, staking, perpetuals, and launchpad operations. The protocol interacts with liquidity pools, order books, and staking mechanisms in real time, executing trades directly from the user’s wallet without custody or intermediaries.

Utility and Offerings

Jupiter’s utility and offerings span a wide array of DeFi functions, each with its distinct role and importance in the ecosystem. This includes:

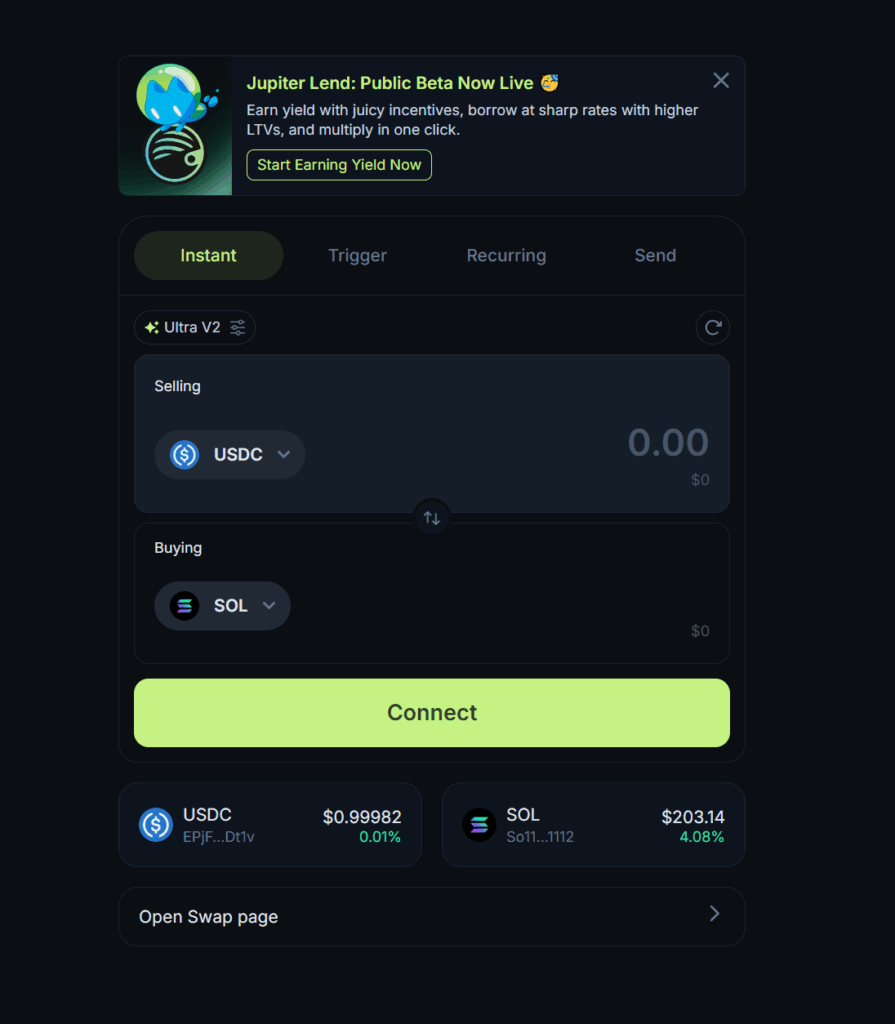

Swap Aggregator

The core product, Jupiter’s swap aggregator, connects users to the best prices across Solana’s DEXs. It supports hundreds of token pairs and offers customizable settings for slippage, priority fees, MEV protection, and DEX exclusions. This flexibility allows both beginners and power users to tailor their trades to their preferences.

Limit Orders

Jupiter brings traditional finance functionality to DeFi with its limit order feature. Traders can set specific buy or sell prices, and the protocol monitors on-chain prices to execute the trade when conditions are met. Partial fills are supported, ensuring that trades are completed even in low-liquidity environments.

Dollar-Cost Averaging (DCA)

DCA allows users to automate recurring buys or sells over time. This strategy reduces market timing risk and smooths out price volatility. Jupiter supports DCA intervals ranging from minutes to months, making it ideal for passive investors and long-term accumulation.

Value Averaging (VA)

VA is a more dynamic strategy that adjusts investment amounts based on portfolio targets. When prices are low, the protocol buys more; when prices are high, it buys less. This approach helps users reach specific value goals while adapting to market conditions.

Perpetual Futures Exchange

Jupiter’s perpetual exchange enables leveraged trading of SOL, ETH, and wBTC with up to 100x leverage. Trades are executed using liquidity from the Jupiter Liquidity Pool, bypassing traditional order books. This model offers deep liquidity, zero slippage, and real-time position management.

Jupiter Liquidity Pool (JLP)

The JLP consists of SOL, ETH, wBTC, USDC, and USDT. Liquidity providers deposit assets into the pool and earn fees from perpetual trading. The pool acts as a counterparty to leveraged trades, generating yield for contributors while supporting the exchange’s liquidity needs.

ApePro and Jupiter Launchpad

ApePro focuses on trading emerging Solana memecoins, while the Launchpad supports new project token distributions and liquidity deployment. These initiatives expand Jupiter’s utility beyond simple swaps, fostering project growth and community engagement.

Jupiter Lock

Jupiter Lock is an open-source tool for developers to lock tokens and implement vesting schedules. It adds transparency and trust to token launches and team allocations.

Ecosystem Highlights

Jupiter has grown from a niche swap tool into the backbone of Solana’s DeFi ecosystem. It consistently ranks among the top protocols by volume, with over 47 billion dollars traded in March 2024 alone. This figure surpassed Uniswap, despite Jupiter being Solana-only.

The launch of the JUP token in January 2024 marked one of the largest airdrops in Solana’s history. While the token’s price has not skyrocketed, it remains among the top 100 cryptocurrencies by market cap. In January 2025, Jupiter burned 3 billion JUP tokens, reducing supply and signaling long-term commitment to sustainability.

Institutional interest is rising. Jupiter’s performance, transparency, and open-source architecture have attracted developers, liquidity providers, and governance participants. Its integration with major wallets and support for hardware devices like Ledger further enhance its credibility.

Roadmap and Plans Ahead

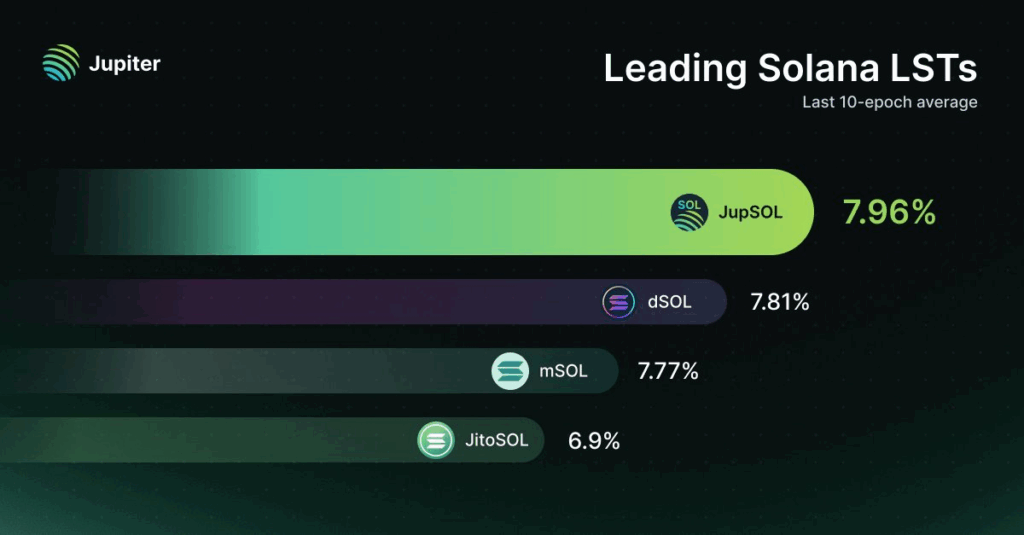

Looking forward, Jupiter aims to expand its DeFi suite and continue driving adoption of decentralized financial tools. Key priorities include further development of perpetual trading, deployment of a stablecoin backed by liquid staking tokens, and enhanced cross-chain integration to connect Solana liquidity with other blockchain ecosystems.

The platform plans to iterate on its DAO governance model, enabling the community to steer development priorities and ecosystem growth. Expansion of the Launchpad and ApePro platforms is expected to foster more Solana projects and enhance market liquidity. Continued refinement of the Metis routing engine and support for advanced trading APIs will further solidify Jupiter’s position as a leading full-stack DeFi protocol.

Community engagement remains a central focus, with ongoing airdrops, token incentives, and governance participation. By balancing innovation, security, and user-centric design, Jupiter aims to maintain its market dominance while evolving into a fully integrated DeFi ecosystem that appeals to both professional traders and everyday users.

Final Thoughts

In conclusion, Jupiter has transformed token swapping into a sophisticated, full-featured DeFi ecosystem on Solana. By combining advanced trading tools, deep liquidity, and community-driven governance, it sets a new standard for decentralized finance. So, as it continues to expand its offerings and drive adoption, it will be interesting to see how Jupiter shapes the future of Solana DeFi and influences the broader crypto landscape.