- Coinbase reported a massive $2.27B in Q4 revenue, up 138% year-over-year, crushing expectations of $1.84B.

- CEO Brian Armstrong pointed to crypto’s growing political influence, saying the era of regulatory enforcement is fading.

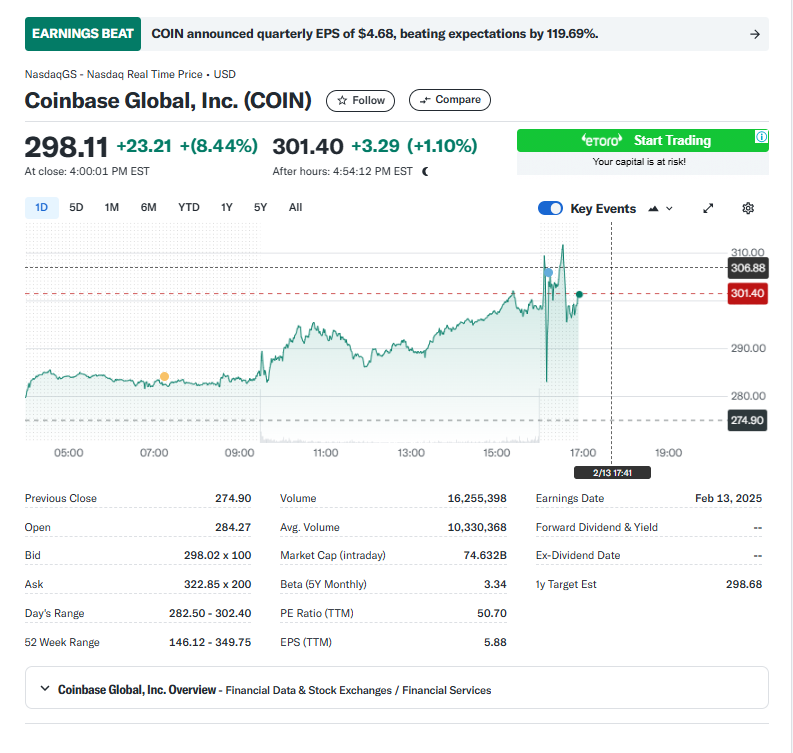

- COIN stock moved modestly after hours, but had already surged 8.5% earlier, following Robinhood’s strong crypto earnings.

Coinbase (COIN) just smashed expectations, reporting a massive 138% year-over-year revenue surge in Q4—fueled by the crypto market’s explosive rally following Donald Trump‘s election win.

The numbers? Huge.

- Revenue: $2.27B (vs. $1.84B expected, $1.26B last quarter).

- Adjusted earnings: $1.3B, topping $906.9M estimates.

- Trading volume: $439B, up 185% YoY.

- Transaction revenue: $1.56B, a 194% increase.

Brian Armstrong: Crypto’s Political Moment Has Arrived

In his shareholder letter, Coinbase CEO Brian Armstrong made it clear:

“Crypto’s voice was heard loud and clear in the U.S. elections, and the era of regulation via enforcement that crippled our industry is on its way out.”

For 2025, the company’s focus is:

- Driving revenue

- Expanding utility

- Scaling infrastructure

Regulatory clarity, especially under a more pro-crypto administration, could set the stage for another massive year.

Coinbase Stock Moves—But Gains Were Already Priced In

Despite blowout earnings, COIN shares only saw a modest after-hours move.

Why? The stock already ran up 8.5% earlier today, riding the wave of Robinhood’s strong crypto earnings report on Wednesday.

Bottom line? Coinbase just proved it’s still the dominant U.S. crypto exchange—and with 2025 looking even stronger, this might just be the beginning.