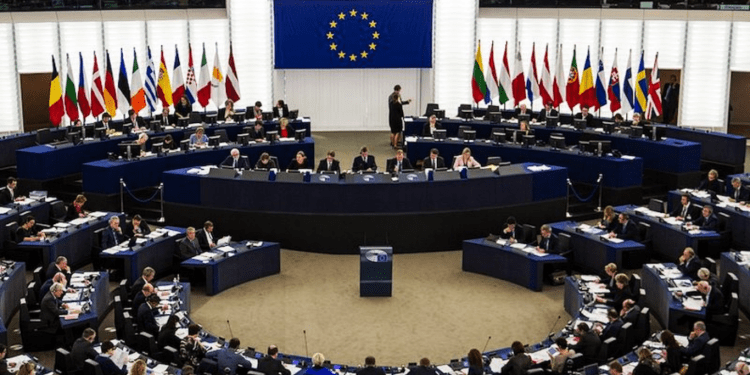

A proposal to ban large crypto transfers from anonymous self-hosted wallets is up for a vote in the European Union and could have a huge effect on the cryptocurrency market.

- On March 28, 2023, legislators in the European Union will vote on new anti-money laundering regulations.

- The crypto market may be significantly impacted by the restriction on privacy-enhancing coins, mixers, and tumblers.

Announcement

On March 28, 2023, the European Union will vote on new anti-money laundering regulations after months of deliberations on how to stop the use of cryptocurrencies, non-fungible tokens (NFTs), and the metaverse in financial crime. Documents state that MPs will vote on a bill prohibiting massive cryptocurrency asset transfers from self-hosted anonymous wallets.

The Proposal

The proposed regulation would prohibit dealers from sending or receiving anonymous cryptocurrency transfers worth more than 1,000 euros ($1,080). The transaction would be permitted, though, provided the customer’s identity could be confirmed or if a regulated crypto provider was engaged. In addition, the proposal prohibits enterprises from receiving cash payments of more than 7,000 euros and establishes the AMLA as a new anti-money laundering body for the EU.

Private-party cryptocurrency transactions, such as sizable payments between two friends, would still be permitted. Anonymous cryptocurrency transfers over EUR 1,000 would be prohibited, though. As many traders utilize self-hosted wallets to store and move their cryptocurrencies, this would significantly impact the cryptocurrency market.

The usage of privacy coins, mixers, and tumblers is also included in the draft legislation as additional consideration for evaluating the danger of money laundering. This implies that using coins that increase anonymity, like zcash, monero, and dash, may be a risk factor for money laundering. The recommendations also include NFT platforms in the definition of decentralized autonomous organizations (DAO) and money laundering regulations to the degree that a named individual manages them.

Impact on the Cryptocurrency Industry

Self-hosted wallets are preferred by traders who place a high priority on security and privacy. By enabling consumers to keep their cryptocurrency offline, they lower the possibility of theft and hacking. They also make it challenging to track the origin and destination of cryptocurrency payments, which draws money launderers to them.

With the proposed ban, traders must make extensive payments through authorized crypto providers or produce identification documentation. This might make bitcoin transactions more expensive and complicated, decreasing their appeal to dealers. Also, it might push some traders toward unregulated cryptocurrency service providers, raising the possibility of money laundering and other illegal actions.

These instruments are used to increase the security and anonymity of bitcoin transactions. They also make it challenging to track the origin and destination of cryptocurrency payments, which draws money launderers to them.

Conclusion

The planned ban on large crypto transactions from anonymous self-hosted wallets by the European Union may affect the cryptocurrency market. That might make bitcoin transactions more expensive and complicated, decreasing their appeal to dealers. Also, it might push some traders toward unregulated cryptocurrency service providers, raising the possibility of money laundering and other illegal actions. Prohibiting coins, mixers, and tumblers that provide anonymity could significantly affect the bitcoin market. Although these tools make it more difficult to track the origin and destination of bitcoin transfers, they also increase the secrecy and security of cryptocurrency transactions, which attracts money launderers. It is still uncertain whether the planned prohibition will pass into law and how it will ultimately impact the bitcoin market.