- The European Union approves the first comprehensive regulatory framework for cryptocurrencies called Markets in Cryptoassets (MiCA).

- MiCA addresses consumer protection, disclosure, transparency, and environmental concerns, promoting a more secure and stable crypto market.

- The regulation paves the way for a unified EU-wide regulatory environment, attracting digital-asset companies and pressuring other jurisdictions to follow suit.

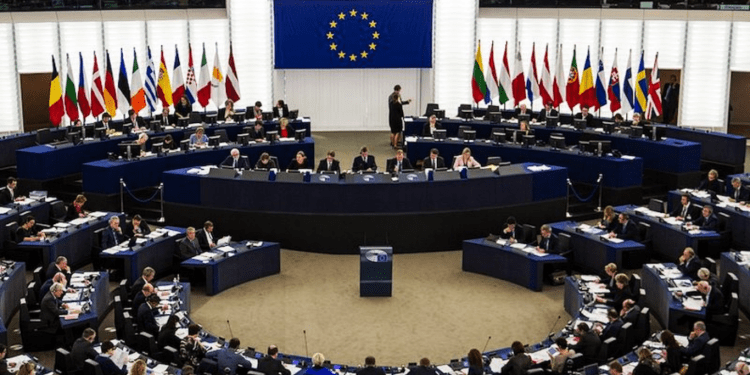

The European Union has taken a bold step forward in the world of cryptocurrency by approving the first-ever comprehensive regulatory framework for the industry. The EU’s Markets in Cryptoassets (MiCA) regulation received its final approval on April 20, 2023, and is expected to come into effect progressively over the next two years. The new rules will create a unified EU-wide regulatory environment, making the bloc more attractive to digital-asset companies and putting pressure on other jurisdictions to follow suit.

MiCA – An Alternative Approach to Crypto Regulation

The development of MiCA has taken three years and has been welcomed by crypto executives as an alternative to the US approach of policing the sector through enforcement actions. The new regulations aim to create a more stable and secure environment for investors by addressing many issues that have plagued the crypto industry in recent years, including high-profile collapses of crypto exchanges like FTX. Once implemented, MiCA will require any company offering crypto-related services in the EU to gain registration in one of the bloc’s member states, which will then allow them to operate across the entire bloc.

The European Banking Authority and the European Securities and Markets Authority will ensure that crypto platforms comply with the rules, including having adequate risk management and governance processes to avoid another FTX-style collapse. While critics argue that the law is outdated before even taking effect, many see it as a vital first step towards a more regulated and secure crypto market.

The Impact of MiCA on Crypto Markets and Investors

The approval of MiCA marks the start of a new era of regulatory scrutiny on unregulated crypto markets, which have caused massive losses to many first-time investors and provided a haven for fraudsters and criminal organizations for over a decade. The new rules are expected to provide excellent consumer protection and reduce risks associated with investing in crypto assets.

MiCA will impose several requirements on crypto platforms, token issuers, and traders regarding transparency, disclosure, authorization, and supervision of transactions. For instance, media will be required to inform consumers about the risks associated with their operations, and sales of new tokens will also come under regulation. Stablecoins, such as Tether and Circle’s USDC, will be required to maintain ample reserves to meet redemption requests in the event of mass withdrawals. Furthermore, MiCA will address environmental concerns by forcing firms to disclose their energy consumption and the impact of digital assets on the environment.

The approval of MiCA by the European Parliament is a significant milestone for the global crypto industry. With the EU leading the charge in creating a comprehensive regulatory framework for digital assets, other jurisdictions like the UK and the US may soon follow suit. The new regulations are expected to make the EU a more attractive destination for crypto companies, fostering innovation and growth within the industry.

As crypto executives have said, having a regulatory framework in place is better than having no guidance. The MiCA regulation signifies a crucial shift towards a more secure and stable crypto market, providing investors with increased protection and promoting responsible growth within the sector. While some challenges remain unaddressed, the approval of MiCA marks a significant step towards a more regulated and mature crypto industry.