- Vitalik Buterin unveils “info finance,” a blockchain-based method for transparent information sharing and accurate data validation.

- Buterin advocates prediction markets to improve public access to reliable, unbiased data.

- Ether surpasses $3,000, rising 21.67% over the past week, as demand surges post-election.

Ethereum co-founder Vitalik Buterin has introduced “info finance,” a blockchain-driven framework aimed at reshaping data collection, verification, and sharing across sectors. In his recent blog post, “From Prediction Markets to Info Finance,” Buterin explores how blockchain could enhance the aggregation and organization of critical information to benefit the public.

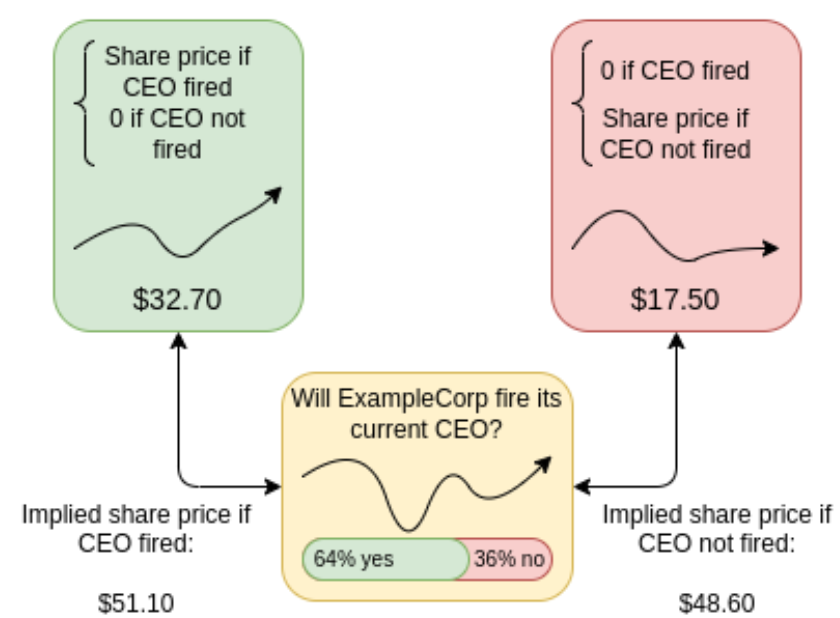

Buterin explains that info finance is designed to prompt accurate information from market participants by structuring markets around specific facts or questions. He describes info finance as a “three-sided market” where predictors make forecasts, readers consume insights, and the market itself serves as a public resource, providing data-driven perspectives without media influence.

Source: Vitalik Buterin

Prediction Markets and Blockchain as Tools for Insight

Buterin emphasizes the role of prediction markets, such as Polymarket, in collecting unbiased insights on future events. These platforms allow users to make predictions, offering the public data derived from collective expectations. He suggests that blockchain and artificial intelligence can create trustless, transparent markets where participants are rewarded for accurate forecasts, potentially enhancing public trust in data.

In Buterin’s view, the scalability of blockchain and low transaction costs could make these info finance tools accessible to a broader audience. He notes that integrating AI can also lower the cost of gathering high-quality information, making these markets viable even with minimal participation.

Ether Surges Above $3,000 as Demand Rises

Buterin’s new concept arrives as Ether (ETH) reaches a significant price milestone, exceeding $3,000 after rising by 21.67% in a week. The increase follows renewed demand post-election, with Ether moving into what venture capitalist Henrique Centieiro calls “scarcity mode” as demand and supply pressures build.