- Ethereum’s TVL remains structurally strong even as total DeFi capital pulls back from recent highs.

- Capital is becoming more selective, concentrating around core infrastructure like Ethereum rather than speculative protocols.

- Growing stablecoin and RWA adoption positions Ethereum as the primary settlement layer for the next DeFi phase.

Ethereum’s position at the heart of decentralised finance doesn’t seem to be slipping, even as the wider DeFi market cools off a bit. While total capital across DeFi has pulled back from recent highs, Ethereum itself is still holding on to a surprisingly strong base. That contrast matters, and it says a lot about where capital feels safest right now.

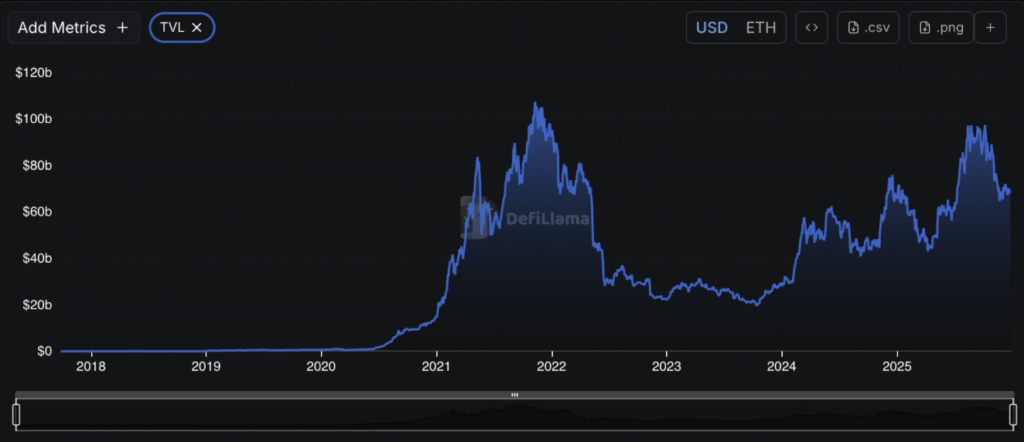

Data from DeFiLlama shows Ethereum’s total value locked remains structurally elevated compared to earlier cycles, despite the volatility that’s shaken the market again. At the same time, broader ecosystem data from Sentora paints a different picture. Overall DeFi TVL has retreated from multi-year peaks, hinting at consolidation rather than a mass exit. Put together, it looks less like capital is leaving DeFi, and more like it’s getting picky.

Ethereum TVL Holds a Higher Floor

Looking back at Ethereum’s TVL since 2020, the pattern is familiar. Big expansion, sharp contraction, then recovery. The difference this time is where things settled after the 2022 drawdown. Instead of resetting to old lows, Ethereum established a much higher baseline, one that carried through 2024 and into 2025 before the latest pullback. As of now, Ethereum’s TVL sits around $68.6 billion, still well above levels seen in past downturns.

That resilience isn’t accidental. Ethereum hosts most of DeFi’s core infrastructure, stablecoins, lending markets, liquid staking, restaking, the plumbing that everything else depends on. Even as speculative yield plays fade in and out, these layers keep pulling capital in. Usage feels less about chasing returns and more about staying positioned in systems that actually get used, day after day.

Broader DeFi TVL Tells a Different Story

Zooming out, Sentora’s view of total DeFi TVL across all chains shows a clearer pullback. After hitting multi-year highs earlier this year, total TVL has slipped to roughly $182 billion. On the surface, that looks bearish. But the details matter more than the headline number.

The composition of that TVL has changed. Capital is clustering around heavyweights like Aave, Lido, EigenLayer-linked protocols, and major liquid staking platforms. Smaller, more experimental protocols are taking up less space than before. That divergence suggests investors aren’t abandoning DeFi, they’re narrowing their focus, choosing what feels essential over what feels optional.

Institutions Are Quietly Shaping the Shift

Some of this selectivity lines up with how institutions tend to move. SharpLink’s Joseph Chalom has pointed out that stablecoins, tokenised real-world assets, and institutional participation are setting the stage for the next phase of crypto growth. In that framework, Ethereum naturally emerges as the main settlement layer.

Stablecoins often act as the entry point. Firms start there, then expand into tokenised funds, onchain money markets, and eventually credit. That gradual progression lowers the barrier to adoption, but it also favors networks with deep liquidity and a long track record of security. Ethereum checks those boxes, and then some.

If stablecoin usage and RWA adoption accelerate the way many expect, Ethereum’s existing dominance puts it in a strong position. Chalom has even suggested Ethereum’s TVL could grow tenfold by 2026, an ambitious call, but not entirely detached from the data.

What the Data Is Really Pointing To

Taken together, this doesn’t look like a DeFi collapse. It looks more like a reset. Capital is still onchain, but it’s moving with more discipline. Instead of spreading everywhere, it’s concentrating around infrastructure that feels durable, liquid, and proven.

That shift might mean fewer explosive headline gains in total TVL, at least for now. But it also hints at something more sustainable underneath. A smaller, more focused base can end up being a stronger one, even if it’s quieter along the way.