- Ethereum’s validator exit queue hitting zero signals confidence, not stress.

- Institutions are staking ETH at scale, committing capital for yield and long-term exposure.

- Locked supply and low exit pressure point to durable positioning rather than speculation.

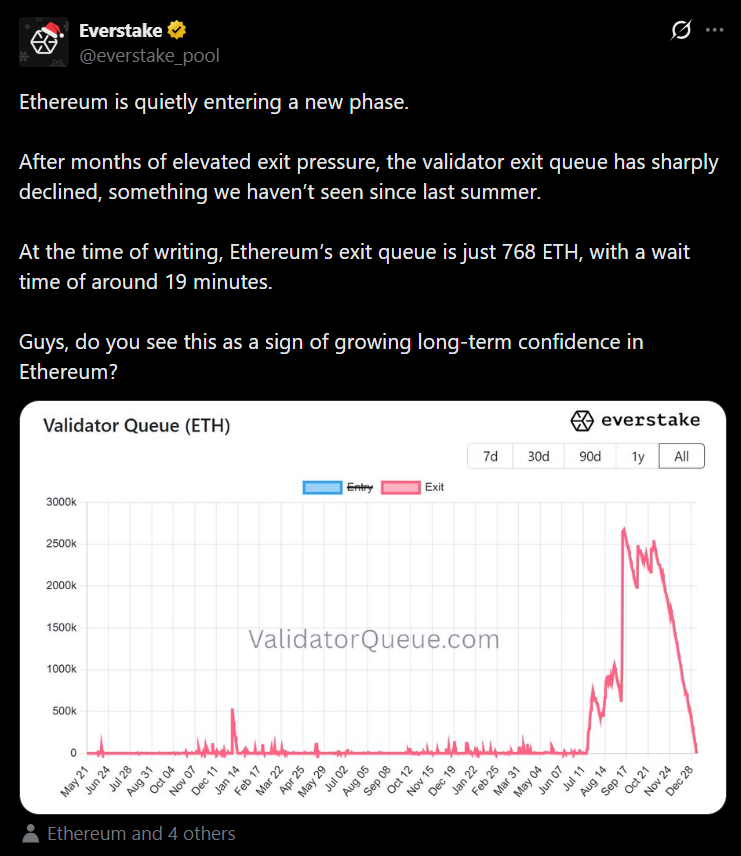

Ethereum’s validator exit queue dropping to zero is not a minor technical detail, it’s a meaningful shift in behavior. When exit queues were bloated in prior cycles, it usually reflected stress, fear, or uncertainty around yields and policy. This time, the opposite is happening. Validators are no longer rushing to leave, and selling pressure tied to unstaking has essentially disappeared. Capital looks comfortable staying parked, which quietly changes the supply picture.

Institutions Are Not Testing the Waters

This shift is being driven by serious capital, not experimentation. BitMine has been staking aggressively, building a position north of 650,000 ETH. That is not someone timing a candle or chasing a short-term move, it’s balance sheet capital being committed directly to the network. At the same time, staking-enabled ETFs are now part of the landscape. The Grayscale Ethereum Staking ETF has already begun distributing staking rewards, turning yield into actual cash flow instead of a theoretical promise.

Locking Capital Is a Clear Signal

Staking ETH comes with illiquidity, and institutions do not accept that lightly. Locking funds means confidence in price behavior, yield sustainability, and regulatory direction. With nearly 36 million ETH staked across close to one million validators, Ethereum’s network looks steady rather than fragile. Large operators like Lido DAO, Binance, and Coinbase continue to anchor the system, reinforcing stability instead of draining liquidity.

What the Exit Queue Is Really Saying

Ethereum is still trading well below its all-time high, yet institutions are choosing to lock supply instead of freeing it. That is the tell. This is not short-term speculation or momentum chasing. It’s positioning for durability, yield, and long-term scale. When exit pressure vanishes while participation remains strong, the message is straightforward. Smart money is settling in, not heading out.