- Ethereum staking reached an all-time high with 36.8M ETH locked

- Over 30% of total ETH supply is now staked across nearly 1M validators

- Strong network security doesn’t automatically translate into short-term price gains

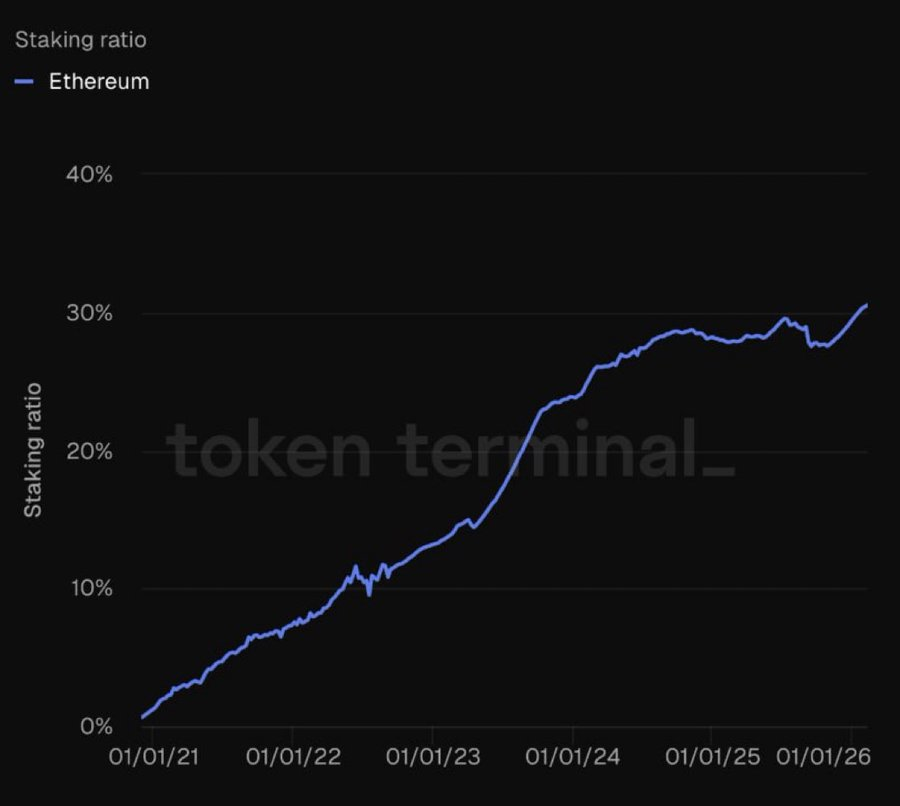

Ethereum staking has climbed to a new all-time high, according to Token Terminal data. The network now has approximately 36.8 million ETH locked, valued at around $74.3 billion. Nearly one million validators are actively securing the chain, and the staking ratio has surpassed 30% of total supply for the first time.

On paper, those numbers are impressive. More ETH locked means stronger network security and deeper long-term commitment from holders. It also signals that a significant portion of supply is effectively removed from immediate circulation, which in theory could tighten liquidity over time.

More Staking Doesn’t Mean Instant Price Gains

However, staking milestones don’t automatically trigger rallies. While rising participation suggests confidence in Ethereum’s long-term future, price action depends on broader liquidity conditions and macro flows. Right now, those forces are working in the opposite direction.

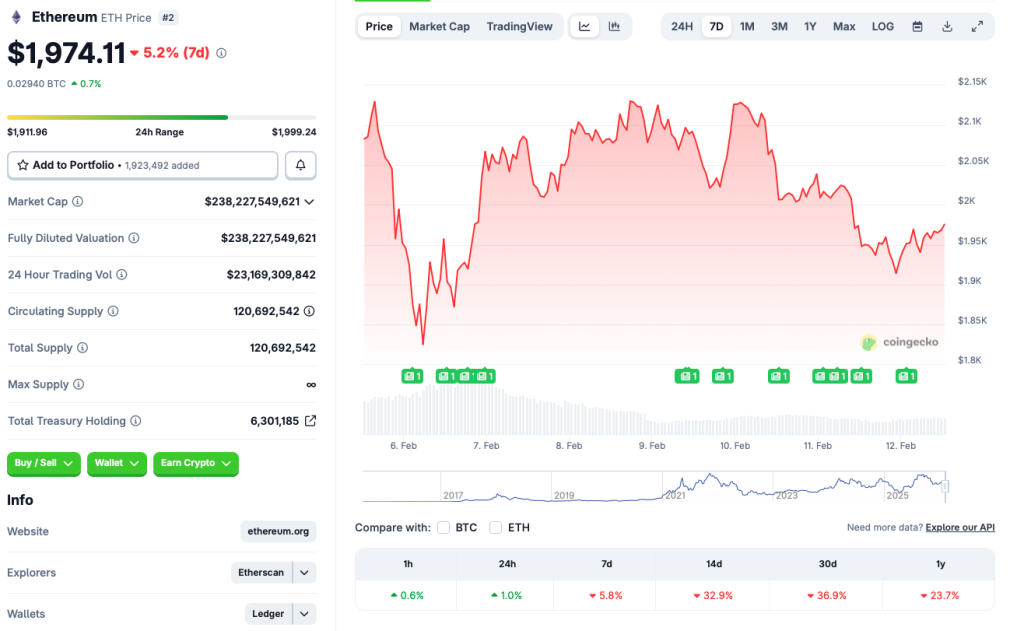

Ethereum previously hit an all-time high near $4,946 in August of last year, but it has since fallen more than 60%. According to CoinGecko data, ETH is down roughly 5.8% over the past week, nearly 33% over two weeks, and about 37% over the past month. That’s not a market reacting to staking optimism. It’s a market still digesting macro stress.

Macro Pressure Still Dominates

Ethereum’s decline has largely mirrored broader market concerns. Late last year, macroeconomic uncertainty and geopolitical tensions weighed heavily on risk assets. In 2026, a liquidity crunch added another layer of pressure, prompting capital to rotate into defensive assets like gold and silver.

In that environment, staking participation can rise even while price falls. Long-term holders may choose to stake rather than sell, especially if they believe the downturn is cyclical rather than structural. But that behavior supports network fundamentals more than it supports immediate price recovery.

Bitcoin Still Sets the Tone

Ethereum’s short-term direction will likely remain tied to Bitcoin’s trajectory. BTC has stabilized around the $67,000 level, roughly its 2021 all-time high range, but analysts warn further corrections are possible. Stifel has projected a potential dip toward $38,000 for Bitcoin this cycle.

If Bitcoin were to drop toward that level, Ethereum would likely face renewed downside pressure regardless of staking records. In crypto markets, correlation tends to tighten during stress phases, and ETH rarely escapes broader sentiment shifts.

Conclusion

Ethereum’s staking all-time high is a strong signal of long-term network conviction. With over 30% of supply locked and nearly one million validators active, the protocol’s security and decentralization look robust. But price rallies are driven by liquidity and risk appetite, not staking ratios alone.

Until macro conditions stabilize and Bitcoin confirms a sustained recovery, Ethereum’s price may continue to lag despite its strengthening fundamentals. Staking is a structural positive, but markets, at least in the short term, are still ruled by broader forces.