- Over 35 million ETH are now staked, locking more than $100B out of circulation

- Institutions and retail alike are staking more thanks to improved accessibility

- The trend boosts network security and could push ETH price higher over time

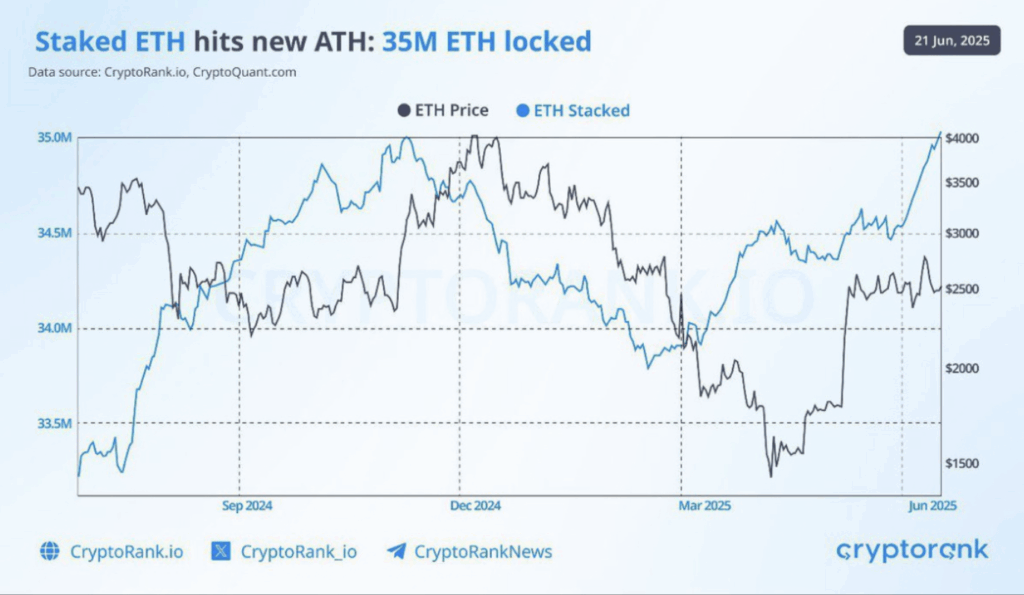

Ethereum just crossed a huge milestone. Over 35 million ETH are now locked in staking contracts—yep, that’s an all-time high. The numbers came from CryptoRank and CryptoQuant, shared on X by Merlijn The Trader. If you look at the chart, it’s been a slow and steady climb over the last year. No dramatic spikes—just constant buildup.

What’s interesting is the timing. ETH has clawed its way back after dipping to around $1,500 earlier this year. It’s trading above $3,000 again, and clearly, big-money players are paying attention. While retail’s still chasing candles, institutions are locking in tokens and playing the long game.

More ETH Getting Staked, Less ETH on the Market

Here’s the thing—staked ETH doesn’t move. Once it’s in, it’s locked. And with 35 million ETH staked, we’re looking at over $100 billion pulled out of circulation at current prices. That kind of supply squeeze? Pretty bullish if demand keeps growing.

Since Ethereum switched to proof-of-stake back in September 2022, it’s ditched power-hungry mining. Now validators secure the network and earn yield—usually between 3–6% annually—by staking their ETH. So naturally, people are jumping in. Confidence has grown, and what used to be a niche move is now a major market behavior.

Easier Staking = More Participants

What’s helped, too, is accessibility. Staking used to be kind of a hassle if you weren’t super techy. Now? You’ve got options—exchanges, liquid staking platforms, wallets, all making it easier for everyday folks to earn passive yield on their holdings.

This broader participation doesn’t just lock up tokens. It also boosts the security and decentralization of the network. That, in turn, makes Ethereum more appealing for devs, which feeds right back into the value of the ecosystem. It’s a feedback loop that’s finally starting to click.

Where Does This Lead?

Looking ahead, this trend probably keeps rolling. Institutions are wading deeper into crypto waters, and staking is an attractive way to earn steady returns without trading all day. As tools improve and awareness spreads, we could see even more ETH going into staking. That adds long-term upward pressure on price and helps solidify Ethereum as a true Web3 backbone.

So yeah, the 35 million milestone? It’s not just a stat—it’s a signal that Ethereum is maturing fast, and the market’s taking notice.