- U.S. stagflation fears rise as service sector slows, prices climb, and jobs fall, fueling Fed-Trump rate cut tensions.

- Ethereum rebounds from record BlackRock ETF outflows, backed by corporate accumulation and bullish analyst calls.

- Key U.S. inflation data this week could decide whether the market holds onto hopes for three Fed rate cuts in 2025.

The fight between the Trump administration and the Federal Reserve over interest rates is getting sharper as U.S. jobs data keeps sliding. Markets are jumpy — reacting almost instantly to every new inflation or employment release. Last week’s trigger was the ISM Services PMI, showing the service sector cooling, prices rising, and employment shrinking since Trump’s tariff war kicked off in April. That combo — higher prices with falling jobs — screams stagflation, a nightmare scenario that ties the Fed’s hands on rate moves.

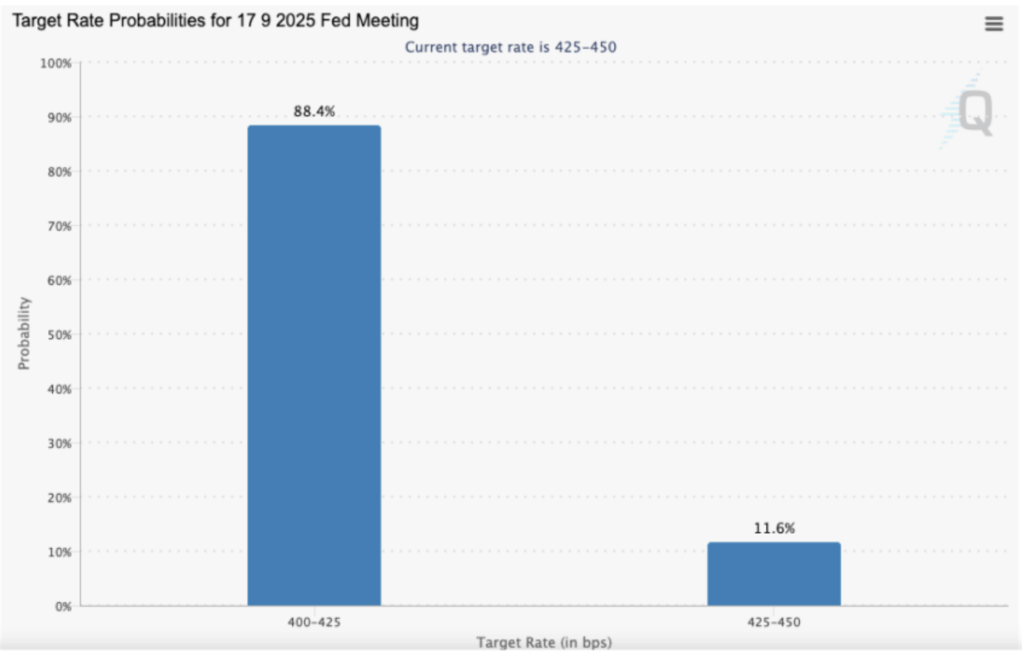

The probability of three rate cuts this year has now dipped to two, with risk assets like crypto swinging in lockstep with each shift in expectations. Trump’s appointment of Stephen Miran, his close economic advisor, to the Fed board only added fuel, with Wall Street reading it as a direct push toward more aggressive cuts. By week’s end, stocks closed on hopes of three cuts before year’s end.

Ethereum Bounces Back After BlackRock Shock

Ethereum had a wild ride after Fed Vice Chair Michelle Bowman publicly backed three rate cuts, sending ETH above $4,300. But the optimism was tested when BlackRock suddenly pulled $375 million from its Ethereum spot ETF (and $292 million from its Bitcoin ETF) — ending ETH’s 21-day inflow streak. The market wobbled, yet Ethereum clawed back losses faster than Bitcoin, helped by heavy buying from U.S.-listed companies and Bitmain’s growing stash, now over 830K ETH.

Wall Street veteran Tom Lee called buying Ethereum “the most important trade” of the next decade, while Standard Chartered’s Geoff Kendrick suggested ETH-heavy company stocks could be even more attractive than ETFs.

Trump’s Pro-Crypto Moves & Market Outlook

Adding to ETH’s bullish week, Trump signed executive orders protecting lawful crypto businesses from debanking and opening retirement markets to crypto. ETH ended the week up 25%, far outpacing Bitcoin’s 5.4% climb, while Solana gained 15%. Now, attention shifts to this week’s CPI release on Aug. 13, which could make or break the “three cuts” narrative.

If CPI overshoots expectations, the Fed’s rate cut plans — and the crypto rally — could hit turbulence. PPI data and industrial production numbers later in the week will add more fuel to the debate. Chicago Fed President Austan Goolsbee’s midweek remarks could also sway traders hunting for clues ahead of the September FOMC meeting.