- Ethereum’s value capture is slipping, as L2s benefit from the Dencun upgrade while paying minimal fees to the L1 — hurting ETH’s “ultrasound money” narrative.

- Alternative data layers and miner competition are adding pressure, while based rollups like Taiko show promise but aren’t prioritized in upcoming Ethereum upgrades.

- ETH price faces key resistance and support zones, with $1,450–$1,550 acting as a critical range to hold amid weakening technical indicators and heavy liquidations.

Ethereum’s not having the best week. It dipped just under $1,600 in early Thursday trading, down about 1% in the Asian session. But it’s not just price action that’s got people talking — it’s the bigger picture. A new report from Binance Research says Ethereum’s current data availability roadmap might actually be doing more harm than good when it comes to ETH’s value.

Dencun Boosted Scaling — But At a Cost

After the Dencun upgrade back in March 2024, Ethereum’s scalability went through the roof — we’re talking a 15.95x scale increase. Sounds great, right? Not so fast.

According to Binance Research, while Layer 2s (L2s) have become faster and cheaper, they’re also paying next to nothing in L1 fees. And since Ethereum’s whole “ultrasound money” thesis relies pretty heavily on those gas fees… yeah, not great for ETH holders.

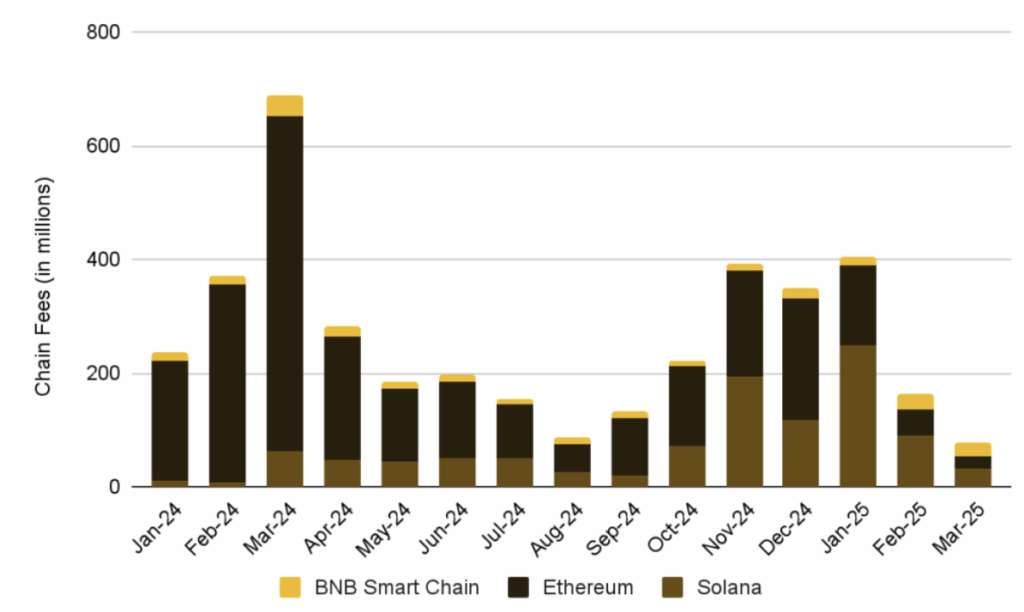

Meanwhile, Solana and BNB Chain have been quietly gaining ground — not in tech, necessarily, but in terms of fees captured. That’s what matters when you’re talking value accrual.

Fixes? Maybe… But It’s Tricky

There’s talk in the Ethereum community about repricing blob fees as a way to balance things out — basically, trying to make L2s pay a bit more without scaring them off. But L2s are businesses, and like most businesses, they’re price-sensitive. If Ethereum gets too expensive? They’ll look elsewhere.

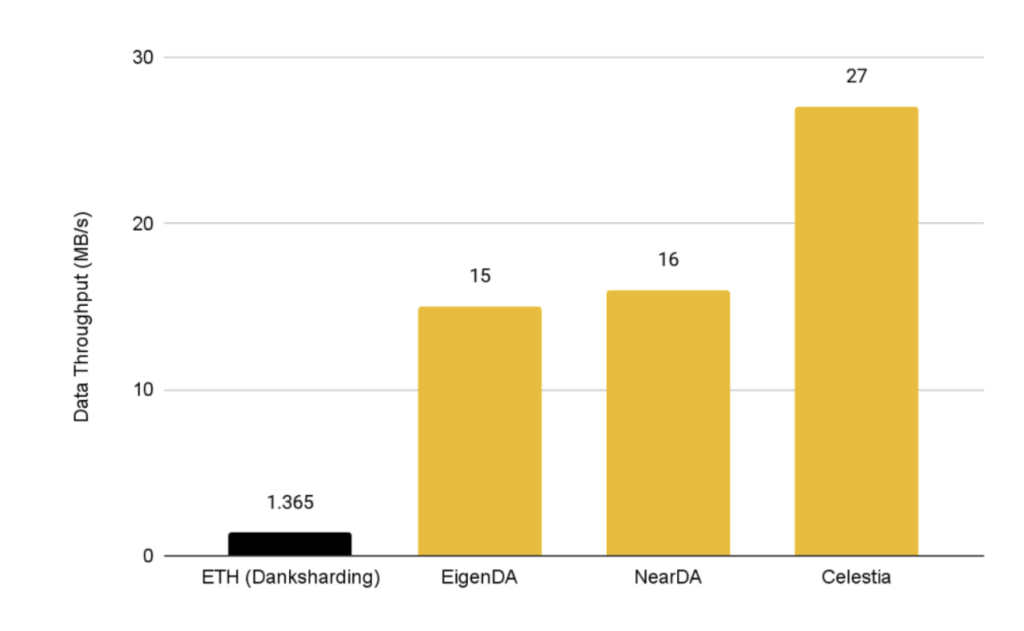

Other data availability solutions — like Celestia, EigenLayer, and NearDA — are already offering higher throughput at dirt-cheap prices. So the competition’s very real.

Still, Ethereum’s got one major edge: security. It’s not even close. ETH has over 1 million active nodes, compared to Celestia’s 100 or EigenDA’s 170. That kind of decentralization is hard to beat.

Based Rollups Might Be the Key — Eventually

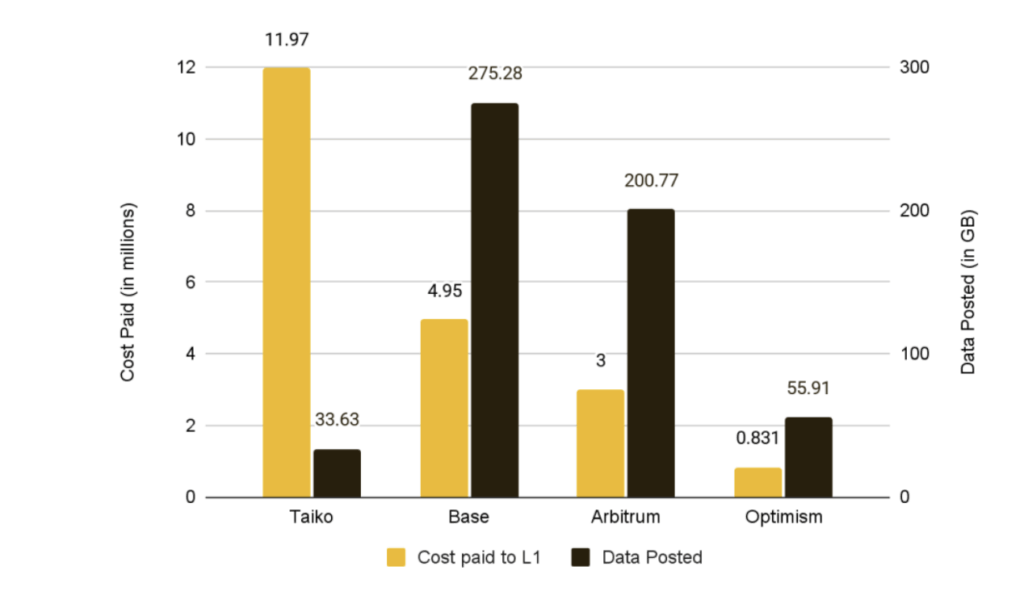

One interesting highlight from the report is the potential of based rollups — which use L1 for sequencing — to restore some value back to Ethereum’s core layer. One example? Taiko. It actually contributed more in fees to ETH than the top three L2s combined, while using less data. Pretty wild.

But here’s the catch: despite their potential, based rollups aren’t even a priority in the next big Ethereum upgrades — Pectra and Fusaka, slated for May 7 and Q4 2025, respectively. So, it’s not happening anytime soon.

ETH Price Outlook: Holding Support or Breaking Down?

From a market standpoint, ETH’s been under pressure. It saw $57 million in liquidations in the last 24 hours — with most of that ($38M) coming from long positions getting wrecked. Oof.

After getting rejected at $1,688 earlier this week, the top altcoin has been trending slightly down. The 50-day SMAand a downward-sloping trendline (from March 23) are acting as brick walls for now. Unless ETH flips those into support, it’s hard to see a big move up happening soon.

Still, the $1,450–$1,550 range is shaping up as solid support. Last time ETH hit that zone, buyers stepped in heavy — like 1.2 million ETH worth, according to Glassnode. So bulls might defend it again.

Technical indicators? Kinda mixed. The RSI is below neutral and flirting with its average line, while MACD is showing weaker bullish momentum (those green bars are fading fast). A drop below both could mean more downside pressure’s on the way.

So yeah — Ethereum’s scaling like a beast, but it might be doing it a little too well for its own good. Until L1 starts capturing more value again, ETH could be stuck in a weird spot: super efficient, but… not exactly profitable.