- Ethereum whales have accumulated nearly 4.8 million ETH since late November, defending the $2,796 long-term holder cost basis

- ETH dominance is rebounding toward 13%, hinting at underlying strength despite weak altcoin rotation

- Rising leverage and the lack of a macro catalyst leave ETH vulnerable to volatility if whale conviction fades

Despite the broader market leaning risk-on again, capital still isn’t rotating the way many traders expected. Bitcoin remains the main gravity well, soaking up attention and liquidity, while alternative assets struggle to attract consistent follow-through.

Historically, this kind of setup keeps portfolios BTC-heavy for longer than people like to admit. On the surface, this cycle feels familiar. But one metric is quietly suggesting that something slightly different may be forming underneath.

Ethereum Dominance Hints at Quiet Strength

On the daily charts, Ethereum’s dominance has been holding its ground better than expected. After dipping to roughly 11.5% in late November, ETH dominance printed a series of lower highs before rebounding toward the 13% area. That move lines up closely with ETH price chopping sideways between $3,000 and $3,500.

This kind of consolidation doesn’t look random.

Instead, it appears supported. On-chain data shows Ethereum whales repeatedly defending their $2,796 cost basis, which represents the realized price for long-term holders. Price has bounced off that level three separate times now, suggesting deliberate positioning rather than passive holding.

When you overlay this with the structure in ETH dominance, the picture becomes clearer. Ethereum’s range-bound action around $3,000 has been actively supported by large holders. The open question is whether ETH’s return profile eventually justifies that conviction, or whether it starts to test it.

Whales Defend ETH Without a Macro Safety Net

What makes this situation more interesting is the absence of a clear macro tailwind. There’s no fresh liquidity wave, no policy pivot, no obvious catalyst to lean on. That leaves conviction doing most of the work.

Ethereum whales have leaned into that role. Since November 21, they’ve accumulated roughly 4.8 million ETH, about 4% of the circulating supply. Their combined holdings rose from 22.4 million ETH to 27.2 million over that period, a sharp and intentional shift.

It’s no coincidence that Ethereum dominance stabilized during the same window. The $2,796 realized price has effectively become a line in the sand, one that whales appear unwilling to give up easily.

At current prices, those positions sit on an estimated $4.8 billion in unrealized profit. That cushion matters, but it doesn’t eliminate risk.

Leverage Builds as Risk Lingers

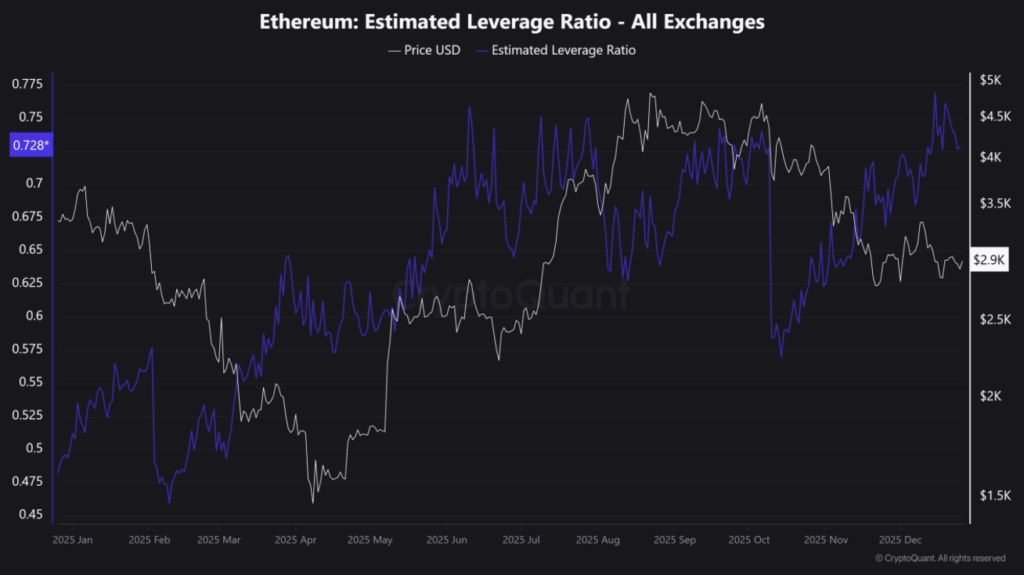

The real pressure point now is leverage. Ethereum’s estimated leverage ratio recently climbed to a six-month high near 2.96. In simple terms, for every dollar of ETH held without leverage, there’s almost three dollars worth of borrowed exposure layered on top.

That kind of structure can work beautifully in a clean uptrend. In a choppy, catalyst-light market, it becomes fragile.

With leverage rising, volatility still elevated, and rotational flows into altcoins remaining weak, the risk of a sudden unwind hasn’t disappeared. If whales begin to de-risk or take profits near resistance, ETH could quickly slip into another liquidation-driven move lower.

For now, Ethereum remains supported. But support built on conviction alone has a habit of being tested, especially when the broader market hesitates to follow through.