- Over $1.6 billion in stablecoins flowed into ETH in 24 hours, showing massive buying power waiting.

- Binance data shows bearish positioning, but that could trigger a short squeeze if buyers step in.

- Analysts suggest ETH could dip to $3,700–$3,800 before rallying toward $10,000 by 2026.

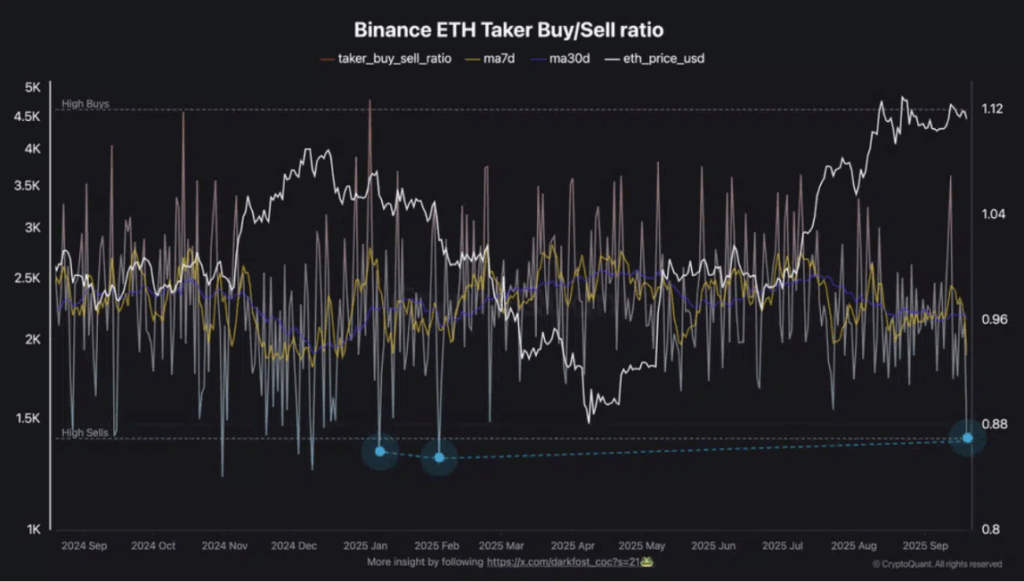

The market’s got eyes on Ethereum right now. Despite hitting near record highs, the mood on Binance looks surprisingly bearish. Buy activity is unusually low, and short positions are stacking up, leaving traders wondering if ETH is about to tank… or explode. At the same time though, more than $1.6 billion in stablecoins poured into Ethereum in just one day, hinting that big buying power is waiting in the shadows.

Ethereum Price Analysis: Breakout or Correction Ahead?

On September 19th, data showed the taker buy/sell ratio on Binance dipped below 0.87. That’s only happened twice earlier this year—and both times ETH fell hard. Back then, the drops pushed prices under $1,500, so naturally, nerves are high. The 7-day average is also sitting at the lowest point of 2025 so far, showing sell pressure is dominating. Still, when things get this lopsided, short squeezes often follow. If buyers step in, it could catch bears completely off guard.

Ethereum Prediction: Will ETH Pull Back Before the Next Big Rally?

Analyst TedPillows pointed out that ETH is consolidating just below its old 2021 ATH. His charts suggest a familiar pattern: after tagging highs, Ethereum usually pulls back 25% or more before continuing higher. That kind of correction now would drag ETH to the $3,700–$3,800 zone. But here’s the flip side—stablecoin reserves on Ethereum have blasted to a record $173 billion, up $50B since January. That’s a war chest of liquidity sitting on the sidelines, ready to fire up the next rally. If history rhymes, ETH could very well make its way toward $10,000 by early 2026.

Key Ethereum Levels to Watch: Support and Resistance for Traders

For the short-term, ETH is hovering around $4,470–$4,500. The chart shows support holding at $4,460, while immediate resistance sits tight at $4,495. RSI looks neutral, MACD slightly bearish—but no strong trend just yet. Break $4,495 cleanly, and bulls could push toward $4,550. Lose $4,460, and the door opens to $4,400. In other words, Ethereum’s at a crossroads: either a sharp dip or the beginning of a much bigger breakout.