- Matrixport sees ETH momentum fading, with a likely retest below $4,355.

- Nearly $1B in ETH left Binance in two days, suggesting holders are moving to cold storage.

- Dan Tapiero highlights nine growth sectors that could trigger the next altcoin cycle.

Ethereum’s hot streak in August looks like it’s cooling off, with Matrixport warning that ETH could dip under $4,355 in the short term. At the same time, fresh data shows nearly $1 billion worth of ETH was pulled from Binance, raising new questions about where the market heads next.

Momentum Losing Steam

Matrixport’s note pointed out that Ethereum had been riding its 21-day moving average through most of August, bouncing off it every time the market dipped. That playbook worked nicely early in the month, but by the last week, gains were slowing down.

The firm now sees ETH locked in a range between $4,355 and $4,958, with a retest of the lower level looking more likely if buyers don’t step in soon. A lot of this, they argued, depends on whether treasury-style firms holding ETH can keep raising capital and pushing the narrative.

Charts alongside the report showed ETH holding above its averages for weeks, but the steady upward pressure is fading. Matrixport went as far as to call it “the biggest story in crypto right now,” warning that ignoring these signals could mean missing the next major shift in ETH’s trend.

Binance Activity Heats Up

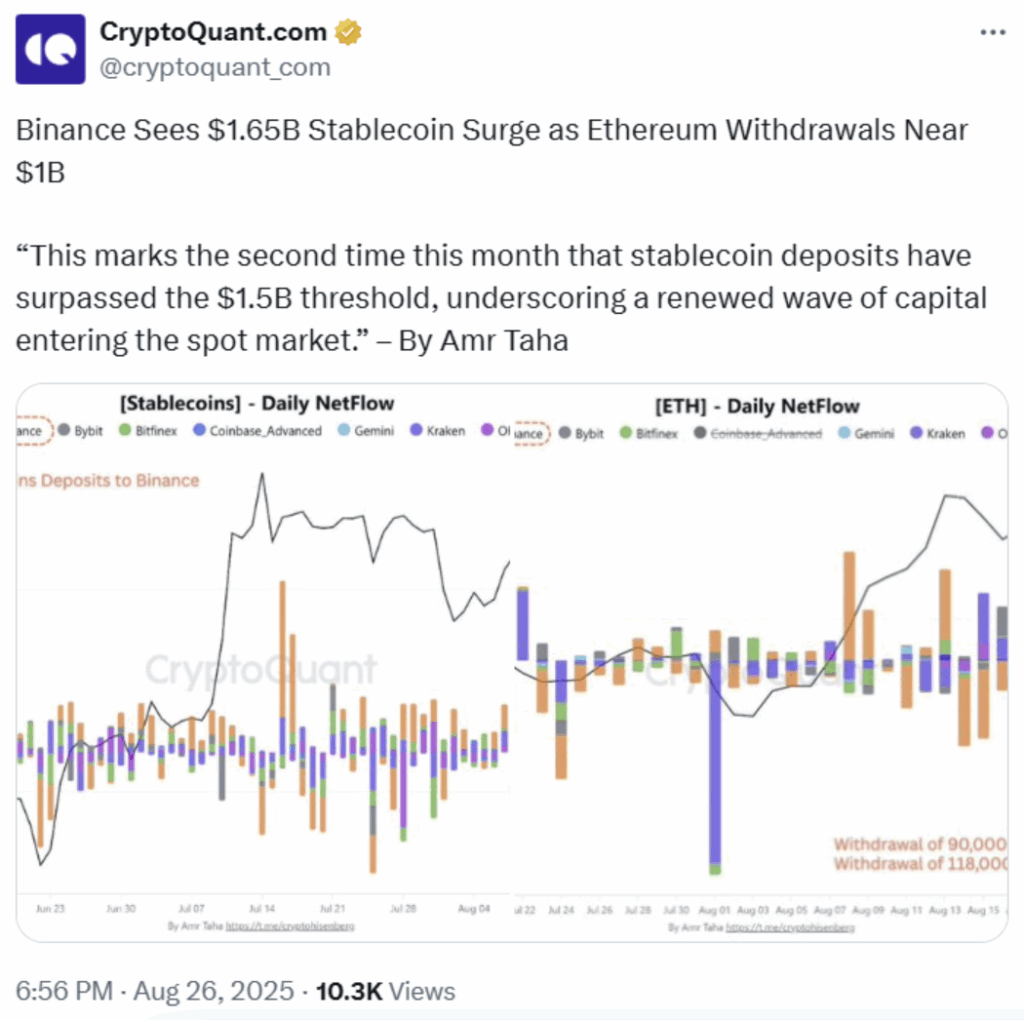

On-chain trackers also flagged some eye-catching moves out of Binance. Stablecoin deposits surged past $1.65 billion in August, crossing the $1.5B mark twice—usually a sign traders are gearing up to deploy fresh capital.

But the bigger story was ETH withdrawals. On August 24, around 90,000 ETH was taken off Binance. A day later, another 118,000 ETH followed. At current prices, that’s just shy of a $1 billion exit in 48 hours.

Large outflows like that are usually interpreted as investors shifting to cold storage, a sign they’re not looking to dump in the near term. It also means there’s simply less ETH left on exchanges, which could dampen immediate selling pressure. Binance still dominates for both deposits and withdrawals, thanks to its liquidity, low fees, and global reach.

Dan Tapiero’s Nine Catalysts for Altcoins

Adding a wider lens, Dan Tapiero of DTAP Capital laid out nine areas he thinks could fuel the next phase of altcoin growth. He noted that the altcoin market cap (excluding BTC and ETH) is basically flat compared to the 2021 peak—and barely above 2018 levels—even though the ecosystem has evolved massively since then.

Tapiero pointed to nine drivers: stablecoins, DeFi, yield products, Solana, NFTs, decentralized exchanges, real-world assets, AI integrations, and prediction markets. Each sector, he argued, is only partially valued right now and could bring serious upside if adoption deepens.

His case is that investors are still anchored to Bitcoin and Ethereum, but sooner or later capital will flow to the broader crypto stack. And when that happens, he believes a fresh alt season is on the horizon.