- Ethereum is hovering around $2,800, with price stability masking a deeper corrective phase after dropping from above $4,500.

- BitMine Immersion Technologies added 28,625 ETH (~$82M) to its treasury, reinforcing its long-term strategy and signaling strong institutional confidence in Ethereum.

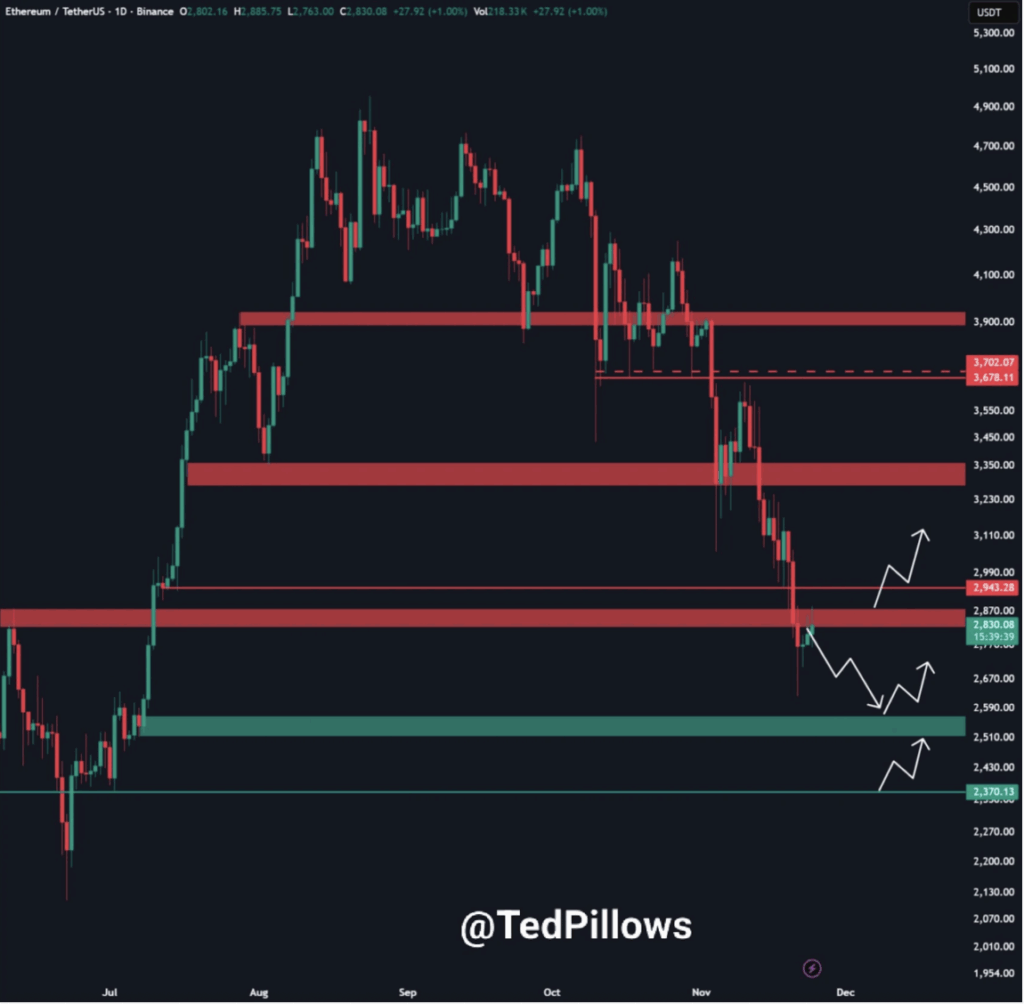

- Technically, ETH is stuck between resistance at $2,850–$2,900 and potential downside toward $2,500, with RSI near oversold and MACD still bearish, keeping both a rebound and another dip on the table.

Ethereum is trying to steady itself again, almost like it’s catching its breath after weeks of heavy swings, and the price is hovering quietly around a major support zone. At the moment, ETH is trading near $2,801.72, and although it’s not exploding upward, the market has shown a bit of calm over the last day… which is honestly rare lately.

But behind that calm, something bigger is moving. Whale Insider flagged a pretty eye-opening development: BitMine Immersion Technologies (BMNR), a publicly traded company, just scooped up another 28,625 ETH — roughly $82.11 million worth — basically stacking their treasury even heavier than before. It’s part of their long-term plan to build one of the largest corporate Ethereum holdings in the world, and analysts are treating this as a pretty loud vote of confidence, especially in a market where people are nervous to even buy a dip.

This purchase also gives BitMine more weight as an institutional holder, especially with its “Made in America Validator Network” coming in 2026, which is supposed to expand staking and build out more infrastructure. Many investors already treat BitMine like a public-market proxy to Ethereum… so their moves tend to echo how much confidence big players have in the network itself.

Technical Outlook Hints at Careful Optimism

Zooming out to the charts, Ethereum’s price history still shows how brutal this correction has been. ETH fell from above $4,500 to this $2,800 zone, and the EMAs aren’t all aligned yet. The 20- and 50-day EMAs are still pointing downward, showing the short-term pressure hasn’t eased. But the 200-day EMA is holding in the $2,583 area, and that’s acting as a deeper support cushion — one that ETH has bounced from before.

The RSI sits around 39.5, brushing against that almost-oversold zone where reversals sometimes start. Meanwhile the MACD is still deep in bearish territory, with the MACD line under the signal line and a negative histogram. Basically… the chart looks like a market still correcting, but trying to find a bottom rather than panic-dumping.

ETH Aiming for $2,900 — But $2,500 Still in Play

Analyst Ted pointed out that Ethereum keeps trying to reclaim the $2,850–$2,900 zone this week, but every time it pushes up, sellers shove it right back down. It’s like a tug-of-war where neither side has enough strength to finish the job.

If ETH can’t break that resistance soon, Ted thinks there’s a real chance the price slips back toward $2,500 — especially if market sentiment weakens further. That’s one of the last strong support levels on the chart, and traders are watching closely to see whether Ethereum can build momentum or whether the rally fizzles out again.

For now, the market is at one of those crucial pauses where a single strong push — from bulls or bears — decides the next chapter.