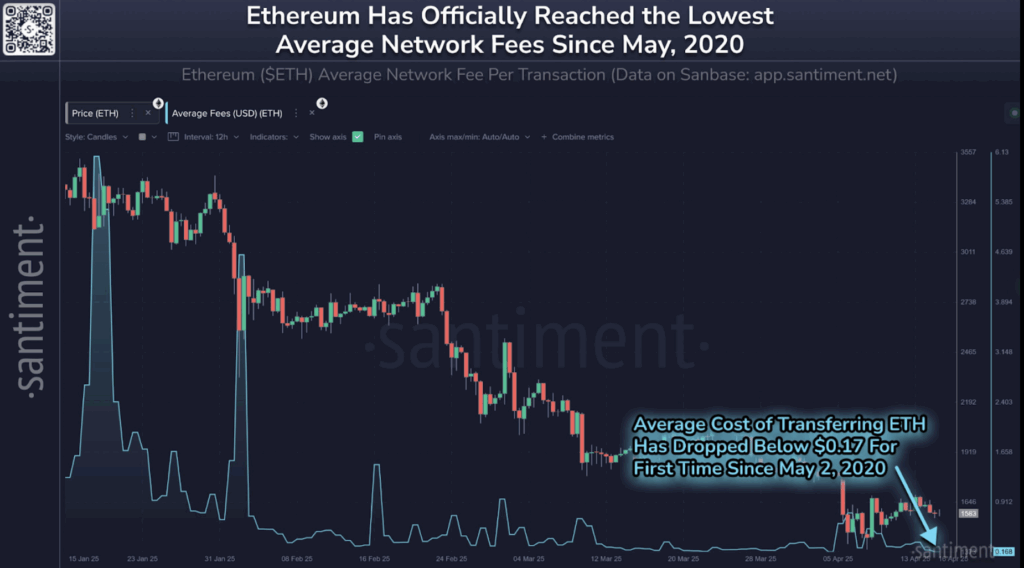

- Ethereum transaction fees have dropped to $0.168, the lowest since 2020, mainly due to reduced network activity and declining user engagement.

- The upcoming Pectra upgrade (launching May 7, 2025) promises to improve scalability and reduce costs, with features like Layer-2 blob support, stablecoin payments, and a higher staking limit.

- ETH is holding above $1600, with potential to rally toward $2000–$2500 if bullish momentum builds, but bears still have room to push price toward $1526 if sentiment weakens.

Ethereum transaction fees are now the lowest they’ve been since 2020 — sounds great, right? Well… not so fast. While paying just $0.168 per transaction might sound like a dream, the drop comes with a quiet warning: fewer people are using the network.

That’s according to data from Santiment, and it’s got folks in the Ethereum camp a bit on edge. Is this just a calm before the next storm of activity? Or a sign that users are drifting away?

Cheaper Fees — But at What Cost?

The low fees aren’t some new breakthrough in efficiency — they’re mostly the result of lower network usage. Fewer users. Less smart contract activity. Just… less going on overall.

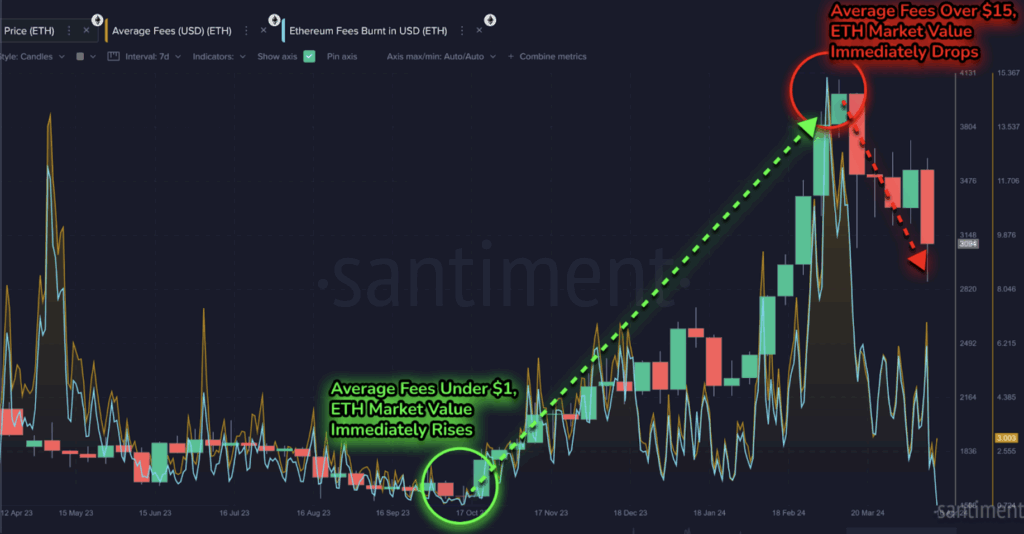

Brian Quinlivan, Marketing Director at Santiment, explained it pretty clearly: When Ethereum’s hot, users are basically bidding up fees just to get their transactions through faster. But when things cool down — like now — there’s no rush, no competition. So fees drop. And that’s exactly what we’re seeing.

With retail investors stepping back and general uncertainty (economic, political, and otherwise) swirling around, Ethereum’s once-busy lanes are now a little quieter.

Is the Pectra Upgrade the Shot in the Arm Ethereum Needs?

Hope isn’t lost though — far from it. Ethereum’s got a big update coming: the Pectra upgrade, set to start rolling out May 7, 2025.

So what’s in it?

- Layer-2 blob support, which should make transactions way more efficient.

- Stablecoin payments in USDC and DAI, a big plus for users who hate dealing with gas price volatility.

- A staking limit increase to 2,048 ETH, a move aimed at attracting bigger institutional players.

And that’s just phase one. The second stage, coming later this year or early 2026, brings in a new data structure to boost scalability even more.

In short: lower costs, better performance, and broader appeal. If that doesn’t revive user activity, what will?

ETH Price: Calm Now, But That Could Change Fast

Price-wise, Ethereum’s been holding above $1600, staying somewhat stable while everything else seems to be slipping. The bulls are lurking, trying to break out of that descending channel and head for the $2000 zone.

But let’s be honest — the bears haven’t left either.

If things turn sour, ETH could slide toward $1526. But if buyers step in and break through $1904, then hey — a retest of $2000 is on the table, maybe even $2500 if we get a real rally.

Final Thoughts: Quiet Phase, or Just the Beginning?

Yeah, Ethereum’s fee drop and slowdown in user activity might look like a red flag — but in context? It could be a setup for something much bigger.

With the Pectra upgrade on the horizon, Ethereum’s laying the groundwork for scalability, efficiency, and a better user experience. Sometimes the quiet before a breakout is just that — quiet. And when the network’s ready? The users usually come back.

So while things might feel slow now, it might be wise not to look away. Ethereum’s next chapter could be just around the corner.