- Ethereum surged 9% in hours, now closing in on its $5K all-time high.

- Some traders expect a fast run to $6K once $5K is broken.

- Arthur Hayes says ETH could hit $20K this cycle, while its role in tokenization keeps expanding.

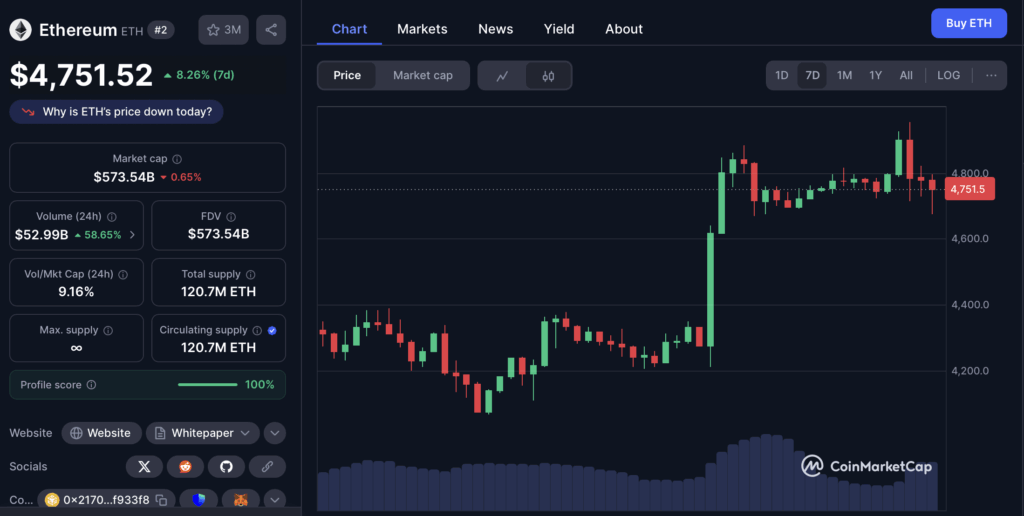

Ethereum is inching toward its all-time high near $5,000, and traders are buzzing about what comes next. The second-largest crypto by market cap has been outpacing Bitcoin all summer, driven by strong institutional interest and constant whale accumulation. After Jerome Powell’s Jackson Hole comments hinted at potential rate cuts before the end of 2025, risk assets caught fire—stocks surged, Bitcoin jumped, and ETH ripped higher.

ETH Rockets Toward New Highs

On Friday alone, Ethereum soared from around $4,400 to $4,800 in under three hours, a near 9% move that put it within striking distance of new highs. Bitcoin followed, climbing back above $116K. On-chain data added another bullish layer: Trump’s World Liberty entity scooped up 1,076 ETH for just over $5M, a sign of deep-pocketed confidence. Big buys like that tend to reinforce upward momentum.

Performance and Long-Term Potential

Performance-wise, ETH is looking stronger than ever. Over the past month, it’s up 23%, and year-over-year it has gained 76%. Zoom out five years and you’ll see a staggering 1,100% climb, cementing its position among the world’s best-performing assets. Many traders now believe that once Ethereum clears $5K, the next leg higher could come quickly, with some calling for a move toward $6K in the near term.

Arthur Hayes Bets Big on ETH

Meanwhile, some forecasts are even bolder. Former BitMEX CEO Arthur Hayes suggested ETH could mirror Bitcoin’s parabolic runs, possibly reaching $20K before this cycle ends. He revealed he’s “overweight ETH” compared to Solana, reflecting his conviction in its long-term upside. Beyond speculation, Ethereum continues to solidify its role in real-world asset tokenization and stablecoin infrastructure. With the GENIUS Act boosting stablecoin clarity in the U.S., ETH is increasingly positioned as the backbone for financial tokenization and digital money rails.