- ETH is now trading below key moving averages, confirming a shift into bearish momentum.

- Spot ETH ETFs have recorded over $1.4B in outflows this month, weakening institutional support.

- Long-term holders are selling at their fastest rate since 2021, while whales accumulate — but not enough to offset the pressure.

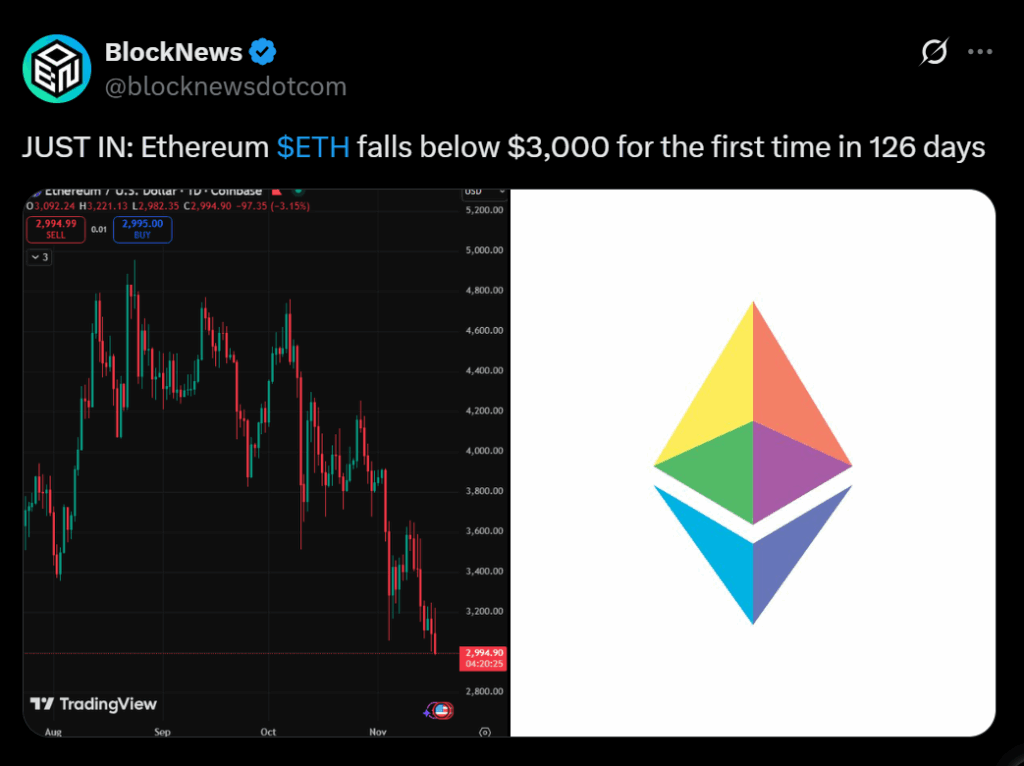

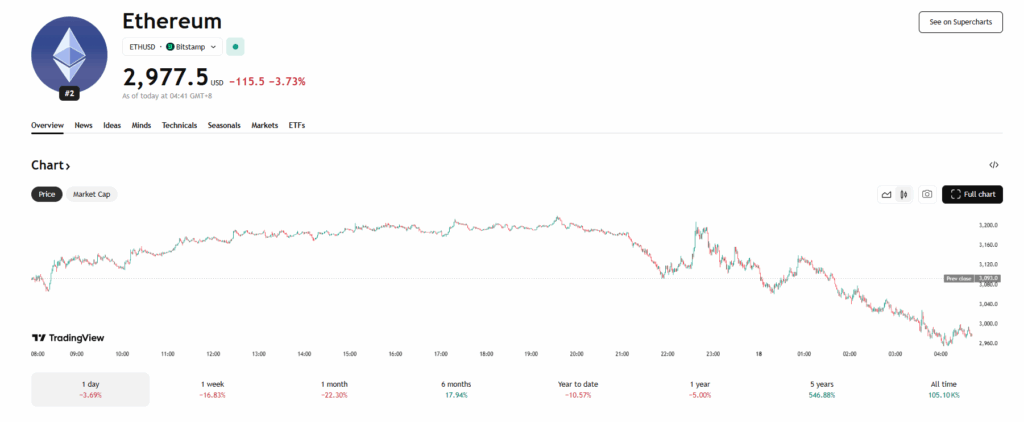

Ethereum’s price has broken deeper into a bearish structure that’s strengthened throughout the past week. With momentum weakening, ETF outflows accelerating, and long-term holders dumping at the fastest pace seen since 2021, ETH is now sliding toward a critical level: the $3,000 support zone. The pace of the decline has raised the question many traders are asking — is Ethereum preparing for an even deeper correction?

ETH Breaks Below Key Moving Averages as ETF Outflows Surge

Fresh data from 10x Research shows Ethereum now trading firmly beneath both the 7-day and 30-day moving averages, signaling a clean shift into bearish territory. ETH has fallen 6.6% over the past week, failing at every attempt to reclaim its short-term trendline. The moving averages have curled downward, confirming a clear rollover that began in early November.

At the same time, spot ETH ETFs are seeing some of their heaviest redemptions ever recorded. SoSoValue data shows more than $1.4 billion in outflows since early November — a decisive signal that institutional appetite has weakened sharply. Together, these factors have created a feedback loop: as each support level breaks, sellers accelerate, and falling ETF demand removes a major source of buy pressure.

Long-Term Holders Sell Fastest Since 2021 — But Whales Are Buying

On-chain trends add another layer to the story. Long-term ETH holders — wallets that have been inactive for three to ten years — are selling at their fastest pace since the 2021 bull cycle. These holders rarely move their coins, so when they do, the market typically feels it. Their selling has added a significant supply wave, contributing to downward pressure.

However, not all large players are bearish. Whale wallets have stepped in aggressively, accumulating over $1 billion worth of ETH during the downturn. Even so, the scale of whale buying still isn’t enough to counter ETF outflows and long-term holder selling. With these forces combined, Ethereum remains stuck in a downward-sloping trend channel.

$3,000 Now in Sight as Downtrend Tightens

ETH is currently trading near $3,182 after hitting an intraday low of $3,023 — leaving almost no room between current prices and the critical $3,000 support zone. If sellers continue to dominate and ETH fails to break above the $3,150–$3,200 range, a direct slide into $3,000 becomes increasingly likely this week.