- Ethereum must stay above $2,000 to trigger a potential breakout and rally.

- Analysts set price targets at $3,244, $3,813, and $4,504, signaling possible bullish momentum.

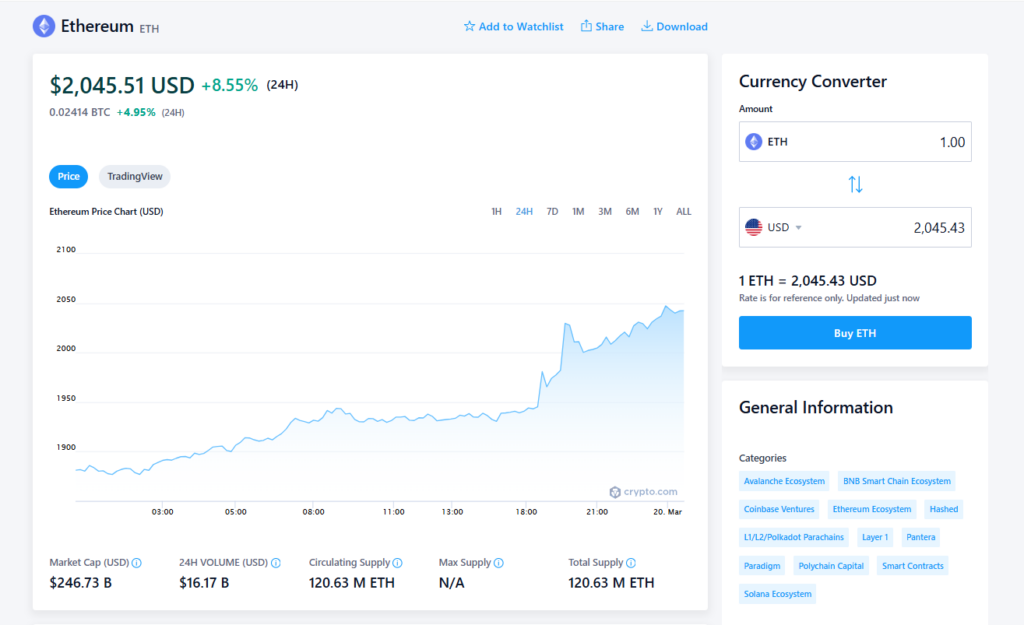

- ETH is up 7.36%, with strong investor interest in DeFi, smart contracts, and NFTs.

Ethereum is hovering near a critical support level, and analysts believe this zone could be the launchpad for a significant price breakout. In a recent post on X, Rose Premium Signals shared a technical chart highlighting the importance of ETH staying above $2,000 to fuel the next major upward move.

Ethereum’s Potential Price Surge

If Ethereum can hold its ground above this level, it might trigger a strong rally, pushing prices toward higher resistance zones. Trading consistently above $2,000 could signal the start of a new uptrend for the crypto market.

The analyst outlined three key price targets that Ethereum could hit in the coming weeks:

- $3,244.68 – A major milestone that would confirm a strong upward momentum.

- $3,813.21 – A breakout above this point could attract more buyers, strengthening the bullish trend.

- $4,504.37 – If reached, this would mark Ethereum’s return to some of its highest levels in recent memory.

Long-Term Bullish Outlook for ETH

Ethereum has performed consistently well in recent months, drawing attention from both retail and institutional investors. Its long-term success is largely fueled by its utility in DeFi applications, smart contracts, and the booming NFT sector.

The market has been closely watching Ethereum’s movements, as price action around the $2,000 threshold could signal whether ETH is ready for a significant upswing. As of now, ETH is trading at $2,028, reflecting a 7.36% increase in the past 24 hours.

What’s Next for Ethereum?

Market participants will be watching for key signals that might indicate whether Ethereum’s bullish momentum can continue or if a reversal is on the horizon. However, as long as ETH remains above critical support, analysts expect further gains in the long run, reinforcing its strong bullish outlook.