- $2.4B in ETH options are set to expire, with bulls aiming to push prices above $2,700.

- Weak Ethereum network activity and rising altcoin competition could limit upside.

- Most put options are underwater if ETH holds above $2,600, setting up a win for call buyers.

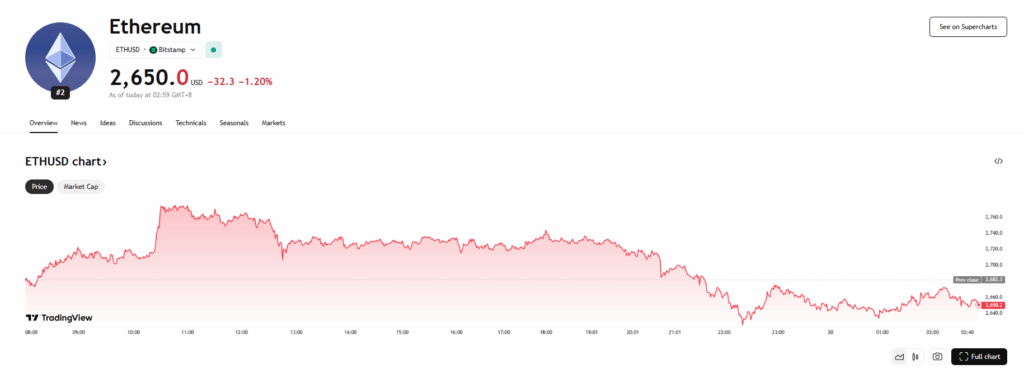

On May 30, roughly $2.4 billion worth of Ether options are expiring. That’s a pretty big number, and it could be just enough fuel to help ETH finally break above $2,700 for the first time in over three months. It’s had a decent bounce lately, but zoom out and ETH’s still down 21% for 2025. Meanwhile, the broader crypto market? Up around 5%. Not exactly keeping pace.

ETH bulls are hanging onto that $2,600 level like their lives depend on it—and in a way, they kinda do. With this monthly expiry looming, staying above that line could be key. The issue? Ethereum’s network activity has been kind of… weak. And that’s a problem when you’re trying to push higher.

Demand’s There—But So Are Headwinds

Despite the sluggish onchain vibes, ETH still has some things going for it. It’s the only altcoin with a spot ETF in the U.S.—a pretty big edge. Between May 19 and 27, these ETFs pulled in $287 million in net inflows, mostly from institutional buyers. That shows confidence, at least from the suits.

But while Wall Street warms up to Ether, its network’s looking a little cold. Activity’s dropped, fees are low, and other chains like Solana, Tron, and BNB are starting to eat away at Ethereum’s dominance. ETH doesn’t even rank in the top 10 by fees anymore—which is wild, considering how clogged and expensive it used to be. Less activity means less demand to hold ETH, which can crank up inflationary pressure if supply outpaces usage.

Options Market Is Lopsided—and That Matters

Now, let’s talk options. Out of the $2.4 billion expiring, $1.3 billion are call (buy) options. You’d think that’s bullish, but not necessarily. A lot of those traders are playing complex strategies with different expiry dates, so just because calls dominate doesn’t mean they’re doubling down if ETH goes higher.

On the flip side, there’s $1.1 billion in puts (sell options)—and 97% of those are underwater if ETH stays above $2,600. That’s wild. Basically, those contracts are toast if bulls can just hold the line until 8:00 a.m. UTC on May 30. But don’t get too comfy. Calls above $2,800 might end up worthless too if ETH doesn’t move much from where it’s sitting now.

Price Scenarios? Here’s How They Could Shake Out

There are a few likely zones ETH could land in—each with different implications:

- $2,300–$2,500: $420M in calls vs. $220M in puts → calls win by $200M.

- $2,500–$2,600: $500M calls vs. $130M puts → net $370M to the bulls.

- $2,600–$2,700: $590M calls vs. just $35M puts → calls ahead by $555M.

- $2,700–$2,900: $780M calls vs. $10M puts → a monster $770M win for bulls.

So yeah, there’s a lot riding on ETH staying strong—or better yet, breaking through $2,700. But keep in mind, crypto doesn’t move in a vacuum. Stocks are still calling the shots, and with the S&P 500 in the mix, macro factors and earnings data might end up being the real drivers here. The bulls have a shot—but the bigger picture could still steal the show.