- Ethereum Price Recovery: ETH bounced back above $2,500 with an 8% gain over the week, showing resilience despite a brief dip.

- Retail Traders Still Absent: Unlike past bull cycles, retail investor activity remains low, hinting that Ethereum’s rally might still be in its early phase.

- Institutional Demand Rises: Spot Ethereum ETFs saw $248M in net inflows last week, led by BlackRock’s ETHA and Grayscale’s ETHE—showing strong institutional confidence.

Ethereum dipped just under $2,500 for a moment—but that didn’t last long. It clawed its way back above that mark and even managed to post a solid 8% gain over the past week. Despite this bounce, though, something feels off: the usual crowd of retail traders? Nowhere to be found.

Where Are the Retail Traders?

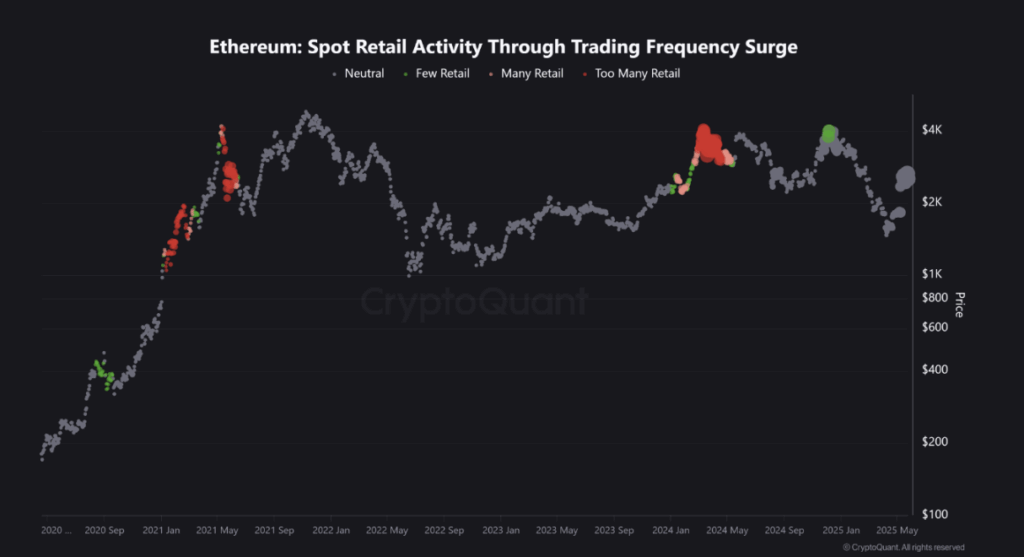

Back in 2021, retail interest in ETH was on fire. Prices would jump and small-time investors would flood in—classic cycle. But now? Not the same story. According to a fresh CryptoQuant report, retail activity is strangely muted this time around.

Even with Bitcoin skyrocketing from $16K to past $111K, Ethereum isn’t showing the same kind of altcoin momentum we’re used to seeing in a bull run. There was a flicker of retail excitement late last year, around December 2024—but that quickly fizzled after Trump’s tariff-related policy shakeups spooked the markets. Since then? Crickets.

CryptoQuant summed it up like this: “Retail hasn’t entered the arena yet. And when retail is missing, you know what that means — the rally might still be in its early innings. There could be unpriced upside hiding in ETH.”

Big Players Still Buying In

While smaller investors stay cautious, institutions are steadily buying the dip. Ethereum-based spot ETFs pulled in a combined $248 million over the last week. Not a single one of the nine active funds saw outflows. That’s a pretty loud signal of growing confidence from the big money.

BlackRock’s iShares Ethereum Trust (ETHA) led the charge, raking in $136.4 million in inflows. Grayscale’s Ethereum Trust (ETHE) followed with $43.75 million, and Fidelity’s Ethereum Fund (FETH) added another $38.82 million.

Even Grayscale’s newer Ethereum Mini Trust (ETH) saw solid activity, bringing in $24.64 million, while Bitwise’s ETHW fund added a modest $5.69 million.