- Eric Trump doubled down on a $1M Bitcoin prediction at Mar-a-Lago

- He cited BTC’s ~70% average annual gain over the past decade

- The comments come as Bitcoin trades below $67K and far off 2025 highs

Eric Trump reiterated his prediction that Bitcoin will eventually reach $1 million, saying he has never been more bullish on the cryptocurrency. Speaking at the World Liberty Financial forum at Mar-a-Lago, he framed Bitcoin as one of the best-performing asset classes of the last decade and challenged critics to name something that has outperformed it.

The point wasn’t precision. It wasn’t a timeline. It was conviction. That’s why the comment traveled so quickly. In crypto, tone often moves sentiment before fundamentals do, and confidence from politically connected names hits differently than the usual influencer hype.

He’s Using Bitcoin’s Long-Term Performance as the Core Argument

Trump pointed to Bitcoin’s historical track record, arguing that BTC has averaged roughly 70% annual gains over the past ten years. He also referenced the dramatic rebound from the 2022 lows, noting that Bitcoin was around $16,000 two years ago and has since traded near the $70,000 range.

This is a classic Bitcoin-maxi framing. It ignores the brutal drawdowns and focuses on the compounding. And to be fair, it’s a compelling story when you’re speaking to a mainstream audience that still thinks Bitcoin is just a speculative toy.

The Timing Is Interesting Because Bitcoin Still Looks Weak

What makes this notable is the timing. Bitcoin is currently trading just under $67,000, after failing to reclaim $70,000, and it remains far below its 2025 peak above $126,000. In other words, this isn’t a victory lap. It’s a bullish statement made during a period of weakness.

That matters because bullish comments made at highs feel cheap. Bullish comments made while price is still bruised feel like positioning. Whether you agree with him or not, it signals that the Trump orbit is leaning harder into crypto narratives, even when the market isn’t giving easy confirmation.

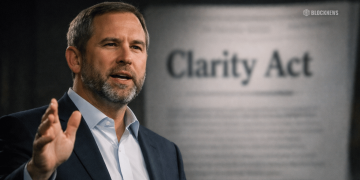

The Trump Family’s Crypto Involvement Adds Weight

Eric Trump’s renewed optimism comes as the Trump family deepens its involvement in crypto through World Liberty Financial. That context is important. This isn’t just a celebrity opinion. It’s coming from someone attached to a growing crypto venture with political visibility.

The market may not care about every quote, but it does care about what these quotes represent. Crypto is being pulled deeper into political and institutional circles, and that shift affects how regulation, capital, and public perception evolve over time.

Big Price Targets Are Psychological Markers in Crypto

The $1 million number is less about forecasting accuracy and more about framing. Big round targets act like expectation anchors. They push Bitcoin into a different mental category, not a risky trade, but a long-term macro asset with huge upside potential.

You don’t have to believe the number to understand why it matters. In crypto, belief cycles still drive liquidity. And loud confidence from recognizable names tends to shape sentiment first, then price later.