- Trump’s election win is expected to usher in a “golden age of crypto” in the US by improving the regulatory landscape and boosting crypto prices

- The new administration is anticipated to take a more supportive stance towards crypto, potentially ending restrictive practices like the SEC’s “regulation by enforcement” approach

- While crypto prices surged after Trump’s victory, investors are cautioned to be selective as not all projects will thrive despite a more favorable environment

The election of Donald Trump as president in 2024 is expected to lead to major changes in the regulatory landscape for cryptocurrencies in the United States. According to Matthew Hougan, CIO of Bitwise Asset Management, Trump’s victory will kick off a “Golden Age of Crypto” as the new administration looks to take a more crypto-friendly stance.

Regulatory Barriers Fall

One of the first changes under the new administration will likely be a shift away from the “regulation by enforcement” approach taken by the SEC and other regulators in recent years. The SEC has often been criticized for its hostile stance towards crypto, frequently filing lawsuits alleging unregistered securities violations without providing clear guidance on rules.

This restrictive stance has stifled innovation and growth according to many in the industry. However, the election of Trump and appointment of new leadership at the SEC is expected to usher in more transparent rulemaking and a generally more supportive regulatory environment. Practices like “Operation Choke Point 2.0” may come to an end, allowing crypto firms to work more freely on innovation and integration into the mainstream.

Propelling Prices

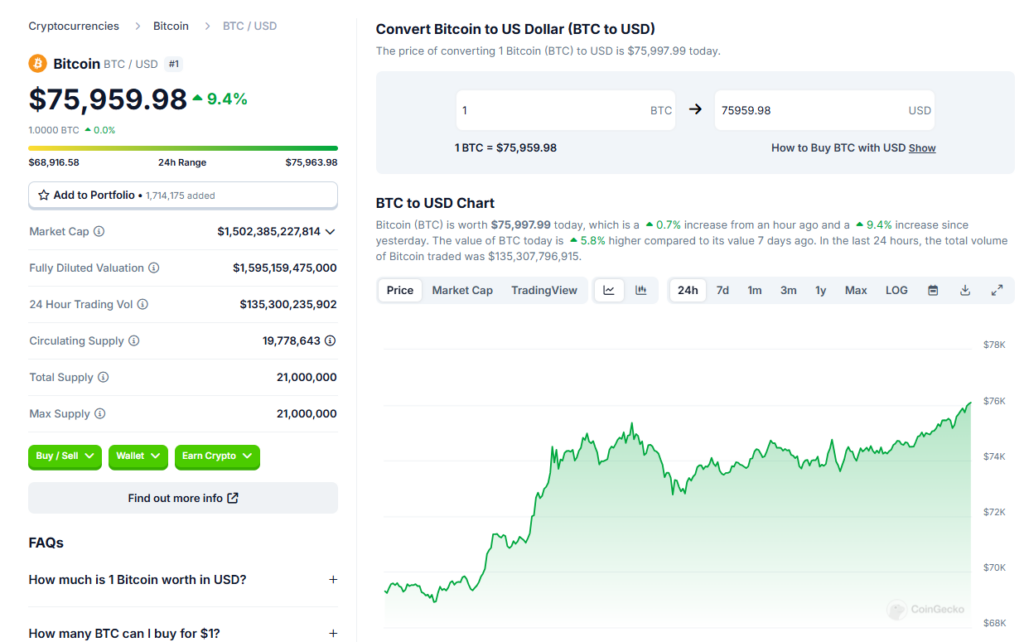

While crypto fundamentals were already strong pre-election, a crypto-friendly administration could provide a significant boost. Robust institutional demand, April’s halving, and growing use cases have laid the groundwork for growth. However, reduced regulatory burdens may accelerate adoption and provide tailwinds for further price increases.

Still, not all cryptocurrencies are equal – investors should take a disciplined approach to identify quality projects even in a more supportive environment.

Selecting Good Investments

The coming reset of the regulatory landscape will provide an even playing field for crypto projects to sink or swim based on their own merits. Investors should be selective in choosing investments, as many projects will still struggle and underperform. The outlook may be increasingly positive, but discipline is key to identify promising investments versus those likely to disappoint.

Conclusion

The election of Donald Trump and a new SEC leadership marks a watershed moment for crypto regulation in the US. With regulatory barriers falling, prices propelled upwards, and an increased focus on project quality, the long winter of regulatory uncertainty may finally be ending – ushering in a new “Golden Age of Crypto.”