- The U.S. Marshals Service is suspected of selling roughly $6.3 million in forfeited bitcoin from the Samourai Wallet case, a move that may conflict with Executive Order 14233 requiring such assets to be held in the U.S. Strategic Bitcoin Reserve.

- Blockchain data suggests the BTC was routed directly to a Coinbase Prime address and likely liquidated, bypassing long-term government custody and raising questions about discretionary decision-making within the DOJ and SDNY.

- The episode has renewed doubts about whether the federal “war on crypto” is truly ending, despite pro-Bitcoin signals from the Trump administration and ongoing debate over developer prosecutions.

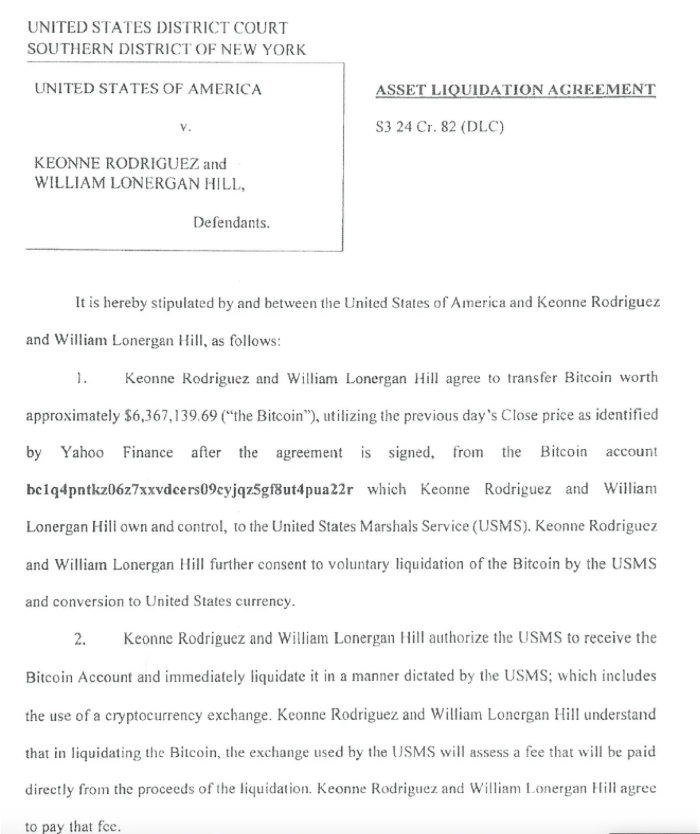

It appears the U.S. Marshals Service may have quietly sold the bitcoin forfeited by Samourai Wallet developers Keonne Rodriguez and William Lonergan Hill, a move that’s raising eyebrows across the crypto and legal communities. The amount in question, roughly $6.3 million worth of BTC, was paid to the Department of Justice as part of the developers’ guilty plea.

If that sale did happen, it could place the agency in direct conflict with Executive Order 14233. That order clearly states that bitcoin obtained through criminal or civil asset forfeiture should be retained as part of the United States’ Strategic Bitcoin Reserve, not liquidated on the open market.

The situation becomes more sensitive given that the case was handled in the Southern District of New York. That district has, in the past, developed a reputation for acting with a degree of independence that sometimes runs against broader federal direction. If EO 14233 was ignored here, it wouldn’t be without precedent.

Where Did the Bitcoin Go?

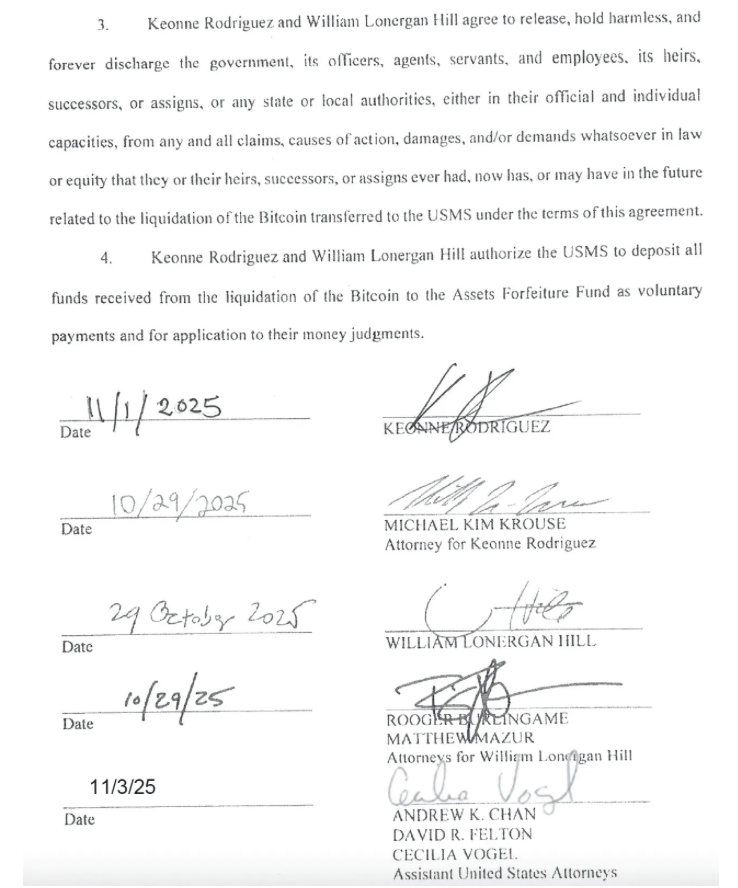

According to an “Asset Liquidation Agreement” obtained by Bitcoin Magazine, the bitcoin forfeited by Rodriguez and Hill was earmarked for sale, or may have already been sold. The agreement shows that 57.55353033 BTC, valued at $6,367,139.69 at the time, was transferred on November 3, 2025, after being signed by Assistant U.S. Attorney Cecilia Vogel.

Instead of passing through a visible U.S. Marshals Service wallet, the funds appear to have been sent directly to a Coinbase Prime address. Arkham Intelligence links that address to the brokerage. Notably, the wallet now shows a zero balance, which strongly suggests the BTC has already been liquidated.

That detail matters. If the bitcoin never entered long-term government custody and was routed straight to an exchange, it points toward an intentional decision to sell rather than hold.

A Possible Violation of Executive Order 14233

Executive Order 14233 leaves little room for interpretation. Bitcoin obtained by the government through forfeiture, referred to in the order as “Government BTC,” is explicitly not to be sold and must instead be added to the Strategic Bitcoin Reserve.

If the Marshals Service proceeded with a sale anyway, it would not have been due to any legal requirement. Instead, it would reflect discretionary action by officials who may still view bitcoin as an asset to offload, rather than something to hold strategically, despite direct guidance from the executive branch.

That mindset would align closely with the posture of the previous administration, which was openly hostile toward noncustodial crypto tools and their developers. The Samourai case itself originated during that period, and critics argue the handling of the forfeited BTC fits a broader pattern.

What the Law Actually Says About Forfeiture

A legal source familiar with the case says the forfeiture was carried out under 18 U.S. Code § 982(a)(1), tied to violations of unlicensed money transmitter statutes. That law requires forfeiture of property involved in the offense, but it does not require liquidation.

Even when § 982 incorporates 21 U.S.C. § 853(c), the statute only addresses ownership transfer to the United States. It says nothing about converting forfeited assets into cash. The same applies to other forfeiture-related statutes cited in EO 14233. They govern how proceeds are handled, not whether assets must be sold.

The executive order goes even further, classifying bitcoin as a “Government Digital Asset” and explicitly stating that agency heads are not permitted to sell such assets except under narrow conditions. None of those exceptions appear to apply in the Samourai case, and most would require direct involvement from the U.S. attorney general.

The Southern District of New York Factor

Viewed through that lens, the SDNY’s role stands out. Often referred to, half-jokingly, as the “Sovereign District of New York,” the office has long been known for operating with unusual autonomy within the federal system.

Its decision to pursue cases against the Samourai developers, and against Tornado Cash developer Roman Storm, came even after Deputy Attorney General Todd Blanche issued a memo in April 2025 instructing prosecutors to stop targeting developers of noncustodial crypto tools for the actions of their users.

In the Samourai case, prosecutors moved forward even after FinCEN officials reportedly suggested the wallet did not qualify as a money transmitter due to its noncustodial design. That context makes the apparent sale of the forfeited bitcoin feel less like an oversight and more like part of a pattern.

Is the War on Crypto Really Ending?

For many in the crypto industry, this episode has reopened uncomfortable questions. President Trump campaigned on a pro-Bitcoin stance and issued EO 14233 as a clear signal that the government should treat bitcoin as a strategic asset, not contraband.

If that vision is to hold, agencies like the DOJ and USMS would need to fully align with those directives. That includes honoring the order to retain forfeited bitcoin and following guidance to stop prosecuting developers of noncustodial tools.

Trump has recently hinted he may consider pardoning Rodriguez. A pardon, combined with a formal review of why the forfeited bitcoin was sold, would send a much stronger signal that the administration’s pro-crypto posture is more than just rhetoric.