- Dogecoin is up 77% in July and just broke out of a multi-month range.

- On-chain activity is rising without extreme spikes, hinting at steady, healthy growth.

- The next target is $0.357, but a short-term pullback could offer a solid buying chance.

Dogecoin’s been on a heater lately. Seriously—DOGE has popped off with a massive 77% gain just in July alone, leading the memecoin pack by a mile. It’s the biggest rally among the top 3 meme coins, and yeah, the numbers on-chain are starting to show some serious life again.

Network Buzz Picking Up (Quietly)

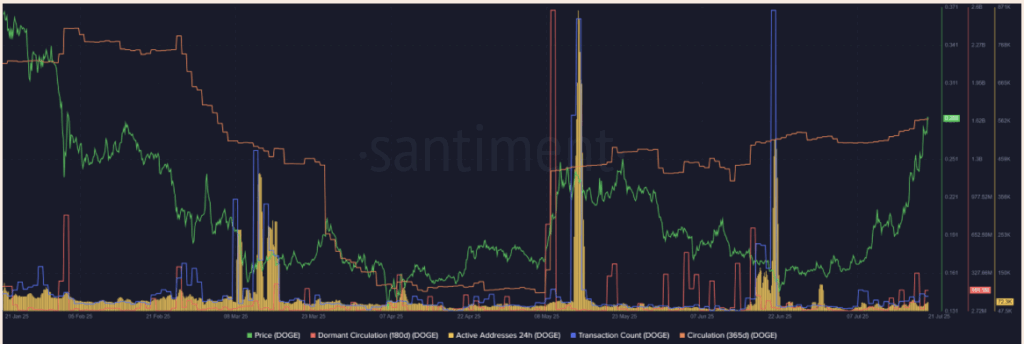

Data from Santiment shows that daily active addresses spiked hard in May and mid-June—those surges lined up with local tops and bottoms. But now? It’s been climbing more slowly. Not too fast, not too loud—just kind of quietly grinding up. Same thing with the transaction count: July’s been steady, no crazy spikes, no signs of hype-driven blow-off tops. That’s actually a good thing.

What’s even more interesting is the 365-day circulation—it’s nudging higher. Which might mean old holders are taking profits, while new folks are jumping in. Feels like a shift’s happening. So, is DOGE actually gearing up for more upside?

Breaking Out of the Range—Finally

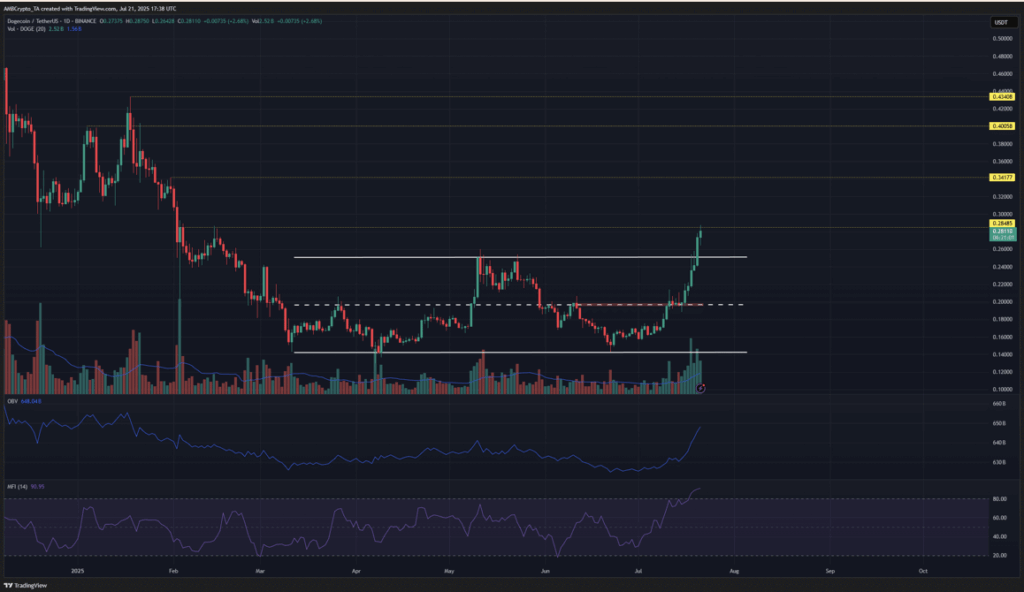

Since March, DOGE has been stuck in this range from about $0.142 to $0.25. But that changed on July 20. Volume’s been pumping above the average for nearly two weeks, and that finally pushed Dogecoin through the tough $0.25 resistance wall.

Now that it’s broken above the range high, the breakout implies we could see at least $0.33, based on technicals. As of now, DOGE is hanging around the $0.285 level, testing resistance that dates back to February.

What to Watch in August

Looking up, the $0.4 mark could be tricky. That level acted as a major ceiling between November ‘24 and January ‘25. So if DOGE gets there again, it might take a few tries to punch through.

Still, things are looking strong. The price target over the next few weeks? Around $0.357. That’s what the range breakout’s pointing to. In the short term, if there’s a dip back to the $0.25–$0.26 zone, it might actually be a sweet entry point for swing traders looking for that next leg up.