- Dogecoin could double fast thanks to hype and liquidity, but history suggests it rarely holds those gains.

- XRP’s growth is backed by real-world use cases, bank integrations, and tokenized asset initiatives.

- While DOGE may jump first, XRP’s structure makes it more likely to double and stay doubled long-term.

Crypto investors right now are stuck between two very different bets—one fueled by hype, the other by utility. On one hand, you’ve got Dogecoin, still swinging off sentiment and social buzz. On the other, XRP’s quietly building out use cases with real-world utility. So if you had to pick… which one actually doubles and stays there?

Dogecoin Could Go Boom—But Will It Hold?

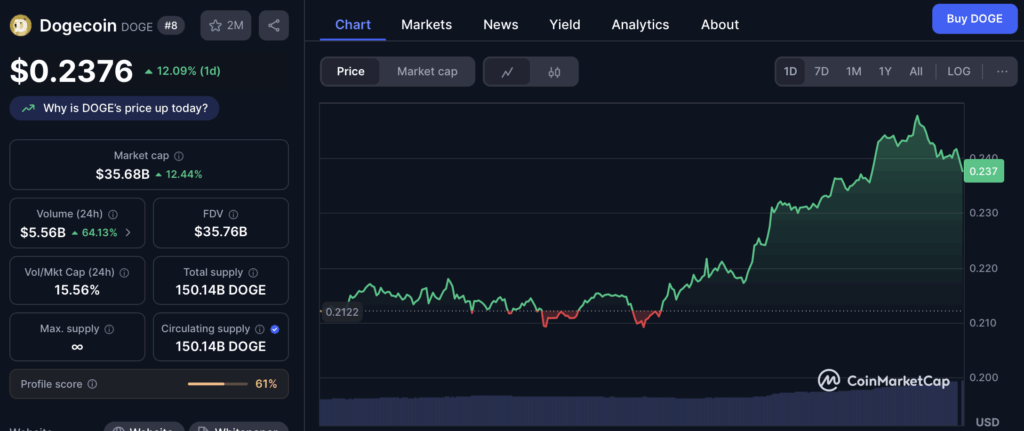

DOGE is sitting around $0.24 at the moment. That’s already a solid run, but getting to $0.42 (a clean 2x) wouldn’t be that wild—especially considering it hit $0.72 back in 2021. With a market cap at $36B, a doubling would just push it to ~$60B. Sounds doable.

Thing is, Dogecoin lives and dies by two things: liquidity and memes. That’s it. In late 2024, it shot up fast, had everyone hoping for a repeat of its old highs… then fizzled just as fast. And in 2025, the mood’s been kinda fragile. There’s not much happening behind the curtain—no updates, no real development—just vibes.

And that’s the problem. When the hype fades, what’s left to keep folks holding? Not much. It’s like a party that empties out once the DJ stops. DOGE can double, sure—but keeping it there for more than a few weeks? That’s a different story.

XRP Has the Engine to Make a Real Climb

Now XRP, trading around $3.50 with a hefty $206B market cap, needs a lot more juice to double. Hitting $6.10 would push its cap to over $600B. That’s a big ask. But here’s the thing—it’s got the framework to maybe make it happen.

Ripple, the company behind XRP, is rolling out infrastructure like it’s playing long ball. They’ve launched a new platform to tokenize U.S. Treasuries on the XRP Ledger, added compliance rails to cater to big institutions, and are eyeing serious money management—on-chain. Even if those flows are small now, they’re setting up to catch a trillion-dollar wave over the next decade.

Plus, Ripple’s new dollar-pegged stablecoin is here, meant to ease cross-border transactions and cut out legacy banking middlemen. All of this folds neatly into their rebranded Ripple Payments system, letting banks skip the headache of pre-funding foreign accounts. That’s utility you can measure—not just hope for.

The Verdict? DOGE Might Jump First, XRP Might Stay Higher

Dogecoin might still explode again (because, well, Twitter and TikTok), but history says it’s just as likely to come crashing down a few weeks later. XRP, meanwhile, is building something that could actually stick. And with banks, stablecoins, and compliance-first systems in play, it’s shaping up to be more than just a speculative bet.

If you’re chasing fireworks, DOGE is your pick. But if you’re looking for something that might climb and hold that level long enough to matter—XRP’s probably the better horse in this race.