- DOGE surged nearly 9% to $0.2346, pushing market cap above $35B.

- Trading volume spiked 120%, confirming heavy buyer activity.

- Key resistance sits at $0.24, while macro data next week could decide DOGE’s next move.

Dogecoin pulled off a strong comeback today, jumping almost 9% to trade at $0.2346 after Jerome Powell’s Jackson Hole remarks lit a spark under markets. Traders rushed back in, sending DOGE’s daily trading volume soaring more than 120%—a clear sign of heavy buyer interest. The rally also pushed its market cap past $35 billion, even overtaking Circle for the spot. Not bad for a meme coin that started as a joke.

The surge helped DOGE erase nearly all of its monthly red, trimming losses down to just about 3% over the past 30 days. For an asset that’s been on the ropes for weeks, today’s move felt like a reset, giving bulls back some breathing room.

Technicals Were Already Pointing Up

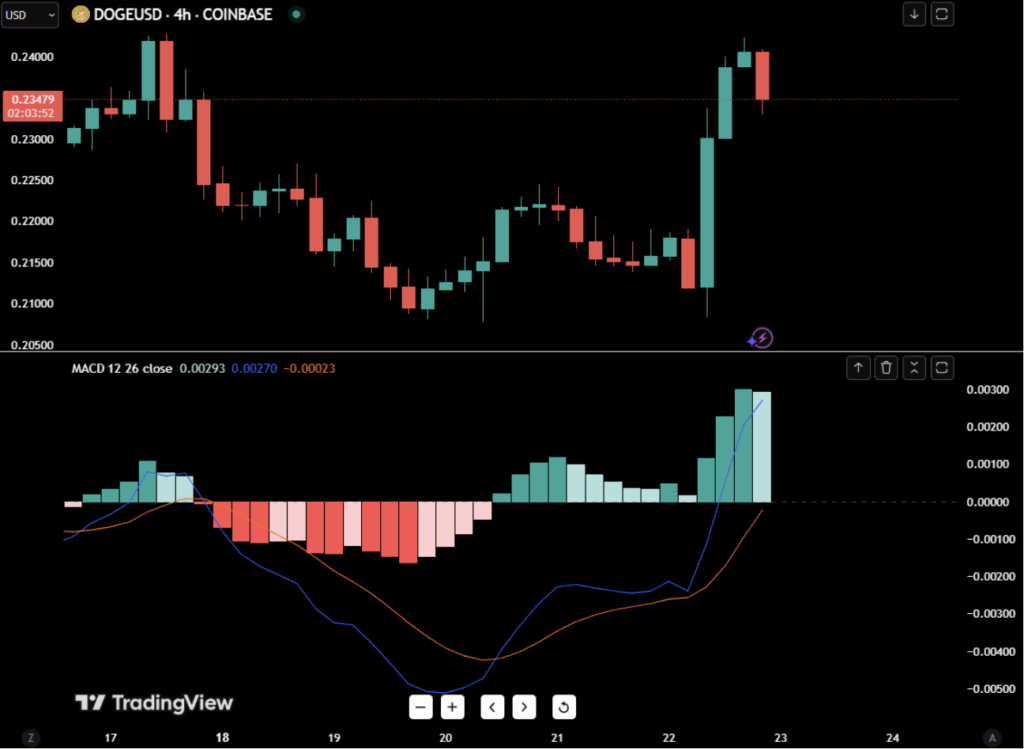

On the charts, the signals were there before the breakout. The MACD on the 4-hour timeframe flipped bullish two days ago after DOGE slid 13.6%. Since then, momentum has only grown—today’s rally widened the MACD and Signal lines, while the histogram stacked strong green bars, showing that the bullish energy is no fluke.

That said, DOGE did hit resistance near $0.24, a level that’s been stubborn all year. Every time price approaches this zone, sellers tend to step in, cutting short multiple short-term rallies. For bulls to keep control, they’ll need to finally flip this resistance into support.

What Comes Next

The bigger question is whether today’s risk-on sentiment will stick. Markets will have plenty to chew on next week, with macro prints like GDP and the Fed’s preferred inflation gauge, the PCE price index, set to land. If inflation runs hotter than expected, it could dampen hopes for rate cuts and take the wind out of crypto’s sails. But if the data shows cooling inflation, bulls may have room to push higher again, not just in DOGE but across the broader market.