- DOGE briefly hit $0.11, then dropped over 11% in 24 hours

- The move looks tied to Bitcoin’s rebound, not a memecoin-specific breakout

- DOGE may be near a bottom, but downside risk still depends on BTC

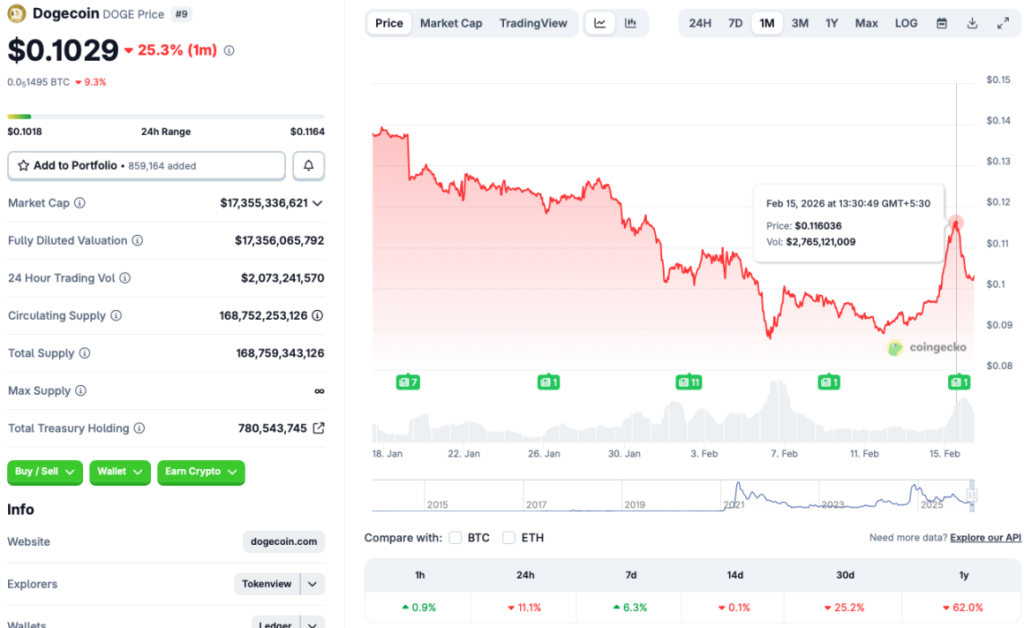

Dogecoin (DOGE) saw a short-lived bounce over the weekend, climbing to $0.11 on Feb. 15, 2026. But the rally didn’t hold. According to CoinGecko data, DOGE has since fallen more than 11% in the last 24 hours. Over the bigger window, the memecoin remains down about 25% over the past month and roughly 62% since February 2025.

So while the price action looked encouraging for a moment, it didn’t feel like a clean reversal. It felt like DOGE catching air during a broader market rebound, then falling back the moment Bitcoin lost momentum again.

Bitcoin Still Controls the Dogecoin Story

The reason DOGE moved up is probably not complicated. Bitcoin briefly reclaimed the $70,000 level and dragged the rest of the market with it. When BTC slipped back toward $68,000, DOGE followed. That’s been the pattern all cycle. Dogecoin isn’t trading like a standalone asset right now. It’s trading like a high-beta passenger in Bitcoin’s vehicle.

If Bitcoin has truly found a bottom in this range, DOGE may stabilize as well. But if BTC breaks down again, memecoins usually don’t “hold strong.” They tend to overreact.

The Bear Case: If BTC Breaks, DOGE Breaks Harder

Some analysts are still floating much lower Bitcoin targets. Stifel, for example, has suggested BTC could fall to $38,000 this year. If that kind of downside scenario plays out, Dogecoin likely doesn’t just dip a little. It would probably see another deep leg down, because memecoins are usually the first place traders cut risk when the market gets ugly.

That’s the uncomfortable part about trying to call a bottom in DOGE. You’re really calling a bottom in Bitcoin first.

The Bull Case: Forecasts Still See a Bounce Window

CoinCodex analysts anticipate DOGE could rally in the coming weeks, projecting a move toward $0.1287 by March 10, 2026. But even their outlook includes choppiness, with expectations of a pullback back toward $0.11 soon after. That kind of forecast matches what the chart already shows: unstable rebounds, quick retraces, and a market still lacking confidence.

It’s not a “new uptrend” vibe. It’s more like a damaged market trying to breathe.

Musk Still Exists as a Wildcard, But It’s Not a Floor

The Elon Musk narrative still hangs over Dogecoin like a permanent option contract. Musk has said he wants to put an actual Dogecoin on the moon in 2027, and he’s repeatedly hinted at Dogecoin being integrated into payments in some form. That kind of story can absolutely trigger a speculative wave when the market turns bullish again.

But it’s not a price floor. In bear phases, memes don’t trade on dreams. They trade on liquidity.

Conclusion

Dogecoin may be approaching a bottom, but the chart still looks dependent on Bitcoin’s next move. The $0.11 bounce was real, yet it wasn’t strong enough to shift the trend. If BTC stabilizes, DOGE can grind higher from here. If BTC loses support again, Dogecoin will likely fall harder than most major assets.