- DOGE is down across all major time frames amid heavy market liquidations.

- Geopolitical tensions and risk-off sentiment are driving selling pressure.

- Lower prices may offer opportunity, but downside risk remains elevated.

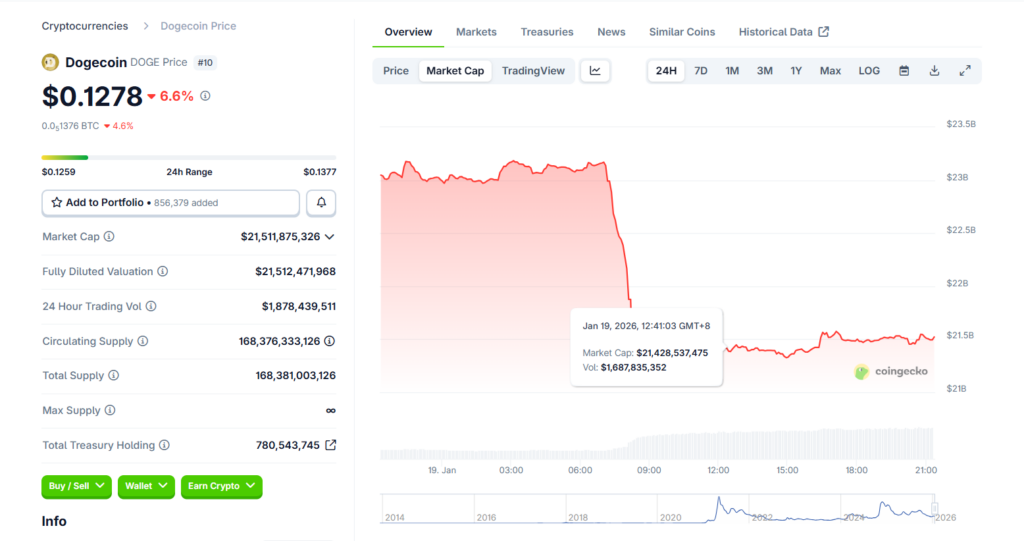

Dogecoin is firmly in the red today after a sharp selloff that pushed the memecoin lower across every major time frame. According to CoinGecko data, DOGE is down 7.2% in the last 24 hours, nearly 10% on the week, more than 15% over the past two weeks, and roughly 68% since January 2025. Even on the monthly chart, DOGE has failed to hold ground, slipping 3.3%. The speed of the decline has reignited the usual question among holders and sidelined traders alike: is this a dip worth buying, or just another leg lower?

Why Dogecoin Is Selling Off

Dogecoin’s drop isn’t happening in a vacuum. The broader crypto market has entered a sharp risk-off phase, with nearly $870 million in leveraged positions liquidated over the past 24 hours, according to CoinGlass. When forced liquidations accelerate, memecoins like DOGE tend to feel it first and hardest due to their higher speculative exposure.

Geopolitical stress is also adding pressure. Rising tensions between the United States and NATO allies over Greenland have rattled global markets, especially after President Trump announced new tariffs targeting countries backing Denmark. France, Germany, and other NATO members have publicly offered support to the Danish Kingdom, increasing uncertainty and pushing investors away from high-risk assets like cryptocurrencies.

Capital Is Rotating Elsewhere

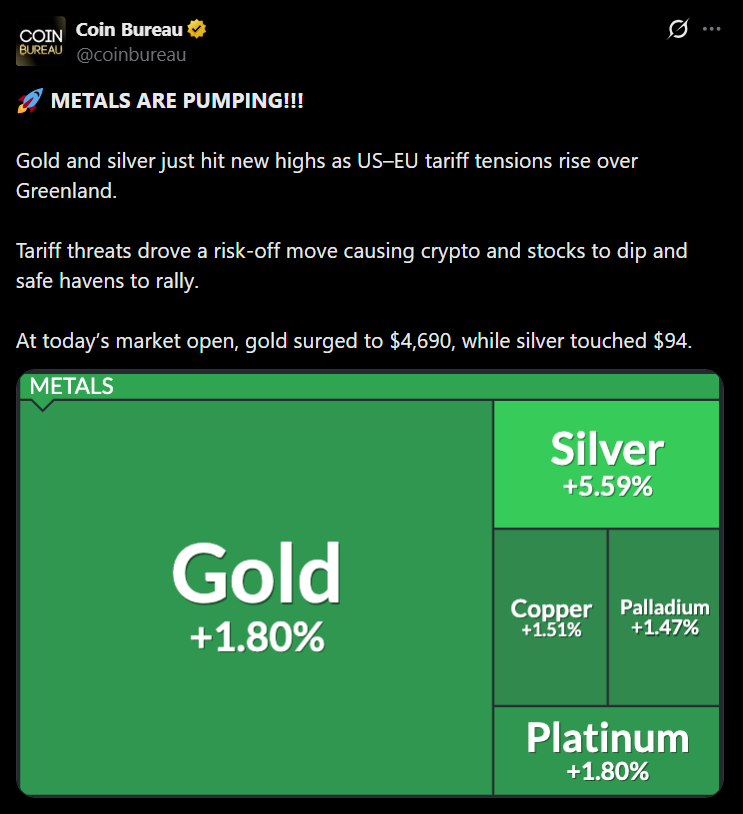

While DOGE and the broader crypto market slide, traditional safe havens are doing the opposite. Gold and silver have pushed to fresh all-time highs as investors seek protection from political and economic uncertainty. That rotation matters. When capital moves into metals, speculative assets tend to struggle for sustained upside, regardless of short-term bounces.

Should You Buy the Dip or Wait?

Dogecoin remains one of the riskiest assets in the crypto market. As a memecoin, it lacks the defensive fundamentals that might soften prolonged downturns, and price action is heavily sentiment-driven. If geopolitical tensions remain elevated and the macro environment stays fragile, DOGE could continue drifting lower before finding a meaningful base.

That said, deep drawdowns are often where long-term DOGE believers begin accumulating. Lower prices can offer opportunity, but patience matters. For now, DOGE looks more like a volatility play than a confirmed rebound candidate, and waiting for clearer signs of stabilization may be the safer approach.