- Dogecoin surged over 12%, breaking a long-standing descending trendline

- Exchange-held DOGE supply has risen sharply, complicating the bullish setup

- Heavy long positioning increases upside potential but also liquidation risk

Momentum has crept back into Dogecoin just as the data starts sending mixed signals. At press time, DOGE surged more than 12% in a single session, finally breaking above a long-standing descending trendline. The move came after weeks of tight consolidation and fading volatility, the kind of quiet stretch that often precedes something larger.

Technically, the breakout looked clean. DOGE pushed through short-term resistance levels and momentum indicators flipped bullish. Still, the rally didn’t come without complications, as on-chain data showed a noticeable rise in exchange-held supply, adding a layer of uncertainty beneath the surface.

Exchange Supply Ticks Higher, Raising Questions

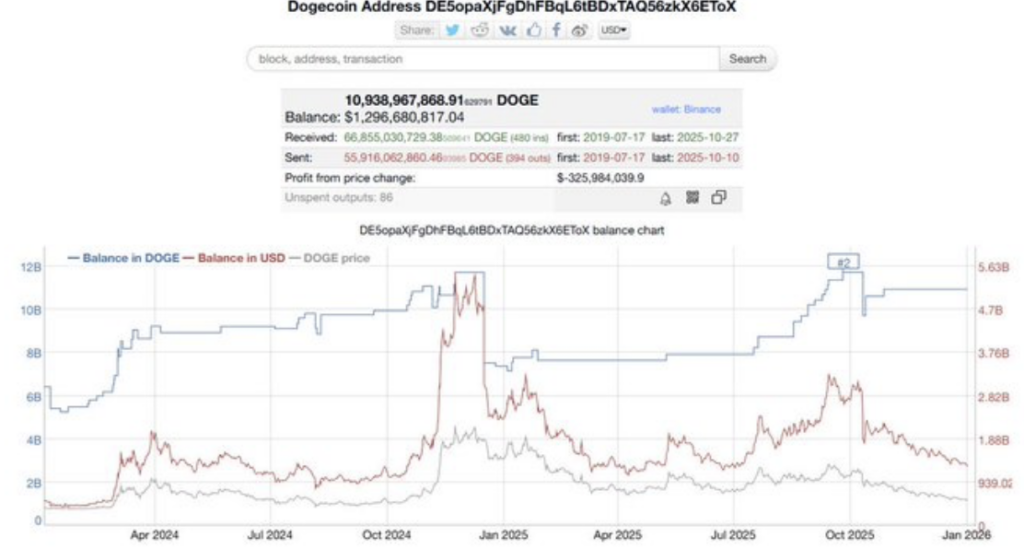

On-chain data shows Dogecoin balances on Binance grew from roughly 7.9 billion DOGE to about 10.9 billion DOGE throughout 2025. Rising exchange supply usually means more tokens are becoming liquid, and historically that’s raised eyebrows during fast price moves. More coins on exchanges often translate to more potential sell pressure, at least in theory.

That said, increased exchange balances don’t automatically signal an imminent dump. In some cases, they simply reflect traders positioning for higher volatility or providing liquidity during active market periods. The real test is whether incoming demand can continue absorbing this added supply without tipping the balance toward distribution.

Leverage Leans Heavily Bullish

Derivatives data paints an even more aggressive picture. Futures markets are currently stacked heavily toward the long side, with roughly $850 million in long positions compared to just $22 million in shorts. That imbalance suggests traders are betting hard on continued upside, maybe a little too confidently.

While strong bullish conviction can fuel follow-through moves, leverage cuts both ways. If price momentum stalls or reverses, liquidation risk rises quickly. In setups like this, sustained price strength becomes essential to keep the structure intact.

Technicals Support the Breakout, for Now

Despite the rise in exchange supply, DOGE continued trading higher, hovering around $0.132 on the 4-hour chart. The breakout above the descending trendline coincided with RSI climbing to around 72, signaling strong momentum but also brushing against overbought territory.

MACD remained positive as well, with the MACD line holding above the signal line, a sign buyers still control the short-term trend. However, elevated RSI levels tend to invite pullbacks, especially when supply is increasing in the background. A slowdown here could quickly change the tone.

Opportunity Meets Elevated Risk

Right now, Dogecoin sits at an interesting crossroads. Price strength suggests demand is still present, but rising exchange balances and leverage-heavy positioning add risk beneath the rally. If DOGE can hold above its breakout levels with solid volume, the move may extend further.

If it fails, though, the downside could move fast. For the moment, the setup offers opportunity, but it’s the kind that demands caution, not blind optimism.