The crypto market’s been wobbling a bit lately, with most major assets seeing small daily dips. Total market capitalization is still sitting near $3.5 trillion, and trading volume has held steady around $157 billion, so it’s not chaos — more like the market just catching its breath.

Dogecoin cools off but starts to rebound

Dogecoin (DOGE) hasn’t been immune to the broader cooldown. The token slipped from around $0.1777 down to roughly $0.171 amid a wave of light selling pressure earlier in the day. Since then, it’s managed to claw back a bit, recovering toward $0.176 as of this writing. It’s not a huge rebound, but it does show that buyers are slowly creeping back in after a quick shakeout.

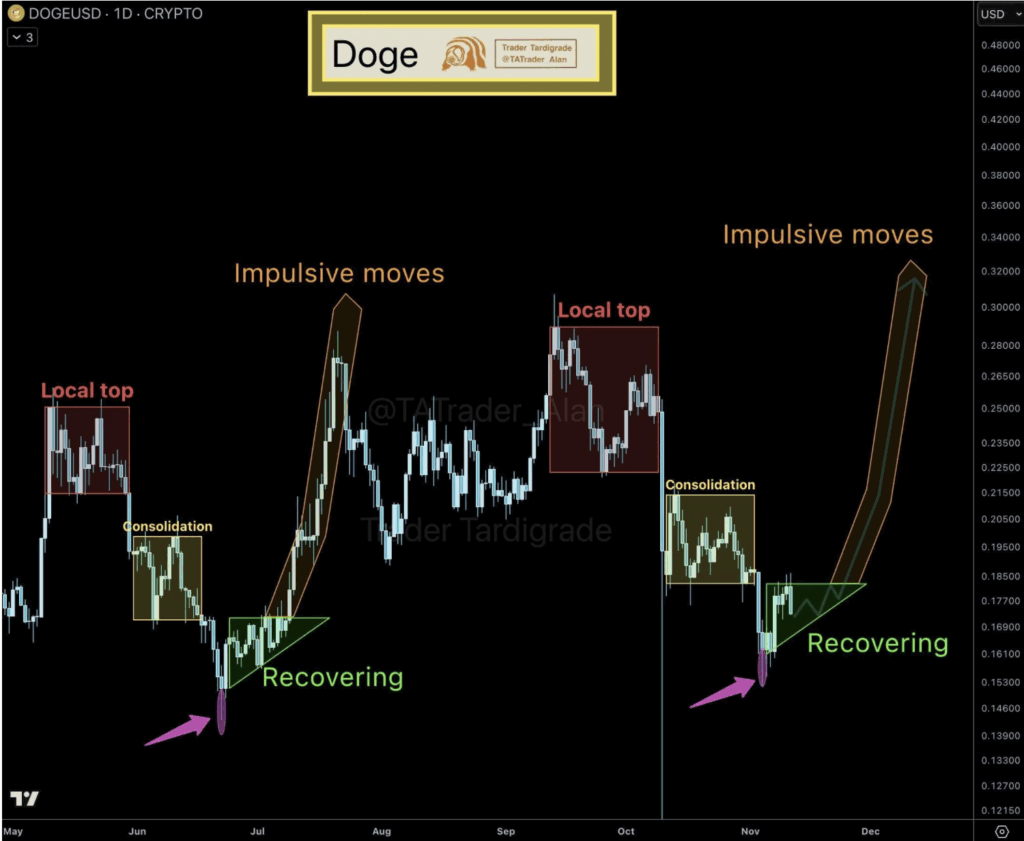

The move looks like a mini correction rather than a trend reversal. It’s the kind of pause DOGE has seen before in past cycles — a sharp rally, followed by sideways consolidation, then a push higher once momentum returns. The price structure is starting to look like a repeat of those earlier runs, which could be a good sign for traders who’ve seen this movie before.

Familiar pattern forming again

Analyst Trader Tardigrade pointed out that Dogecoin’s current setup looks strikingly similar to what played out in earlier bull markets. In those cycles, DOGE formed a local peak, consolidated in a tight range, then broke out in an impulsive rally once accumulation wrapped up.

Right now, the same ingredients seem to be lining up again — steady accumulation, fading volatility, and early signs of renewed buying pressure. If the pattern holds true, DOGE could be preparing for another strong leg up, possibly aiming toward the $0.30 region. It’s a familiar rhythm for the coin: quiet build-up, brief hesitation, and then — out of nowhere — a sharp vertical move that catches the market off guard.

Of course, it’s not guaranteed. Market sentiment still feels a little fragile, and a lot will depend on how the next few sessions play out. But the structure looks textbook DOGE — calm before the storm kind of energy.

Technicals show slow but steady improvement

On the 1-day chart, Dogecoin is sitting just above $0.17, slowly working its way out of a short-term downtrend. The nearest strong support remains around $0.16, where buyers have stepped in multiple times. Overhead resistance is still close — around $0.19 — a level that’s rejected price a few times before. For now, it’s a tug-of-war between cautious optimism and hesitant sellers.

The RSI is hovering near 43.7, climbing gradually out of oversold territory, which hints that bullish momentum is quietly improving. Meanwhile, the MACD line has just nudged above the signal line — a small but meaningful sign that buying pressure might be returning. The histogram’s still pretty shallow, though, which suggests the market hasn’t fully committed to a breakout yet.

What’s next for DOGE?

If Dogecoin manages to hold above the $0.16 support and push through $0.19, it could kickstart another upward leg. History shows that once DOGE breaks out of a consolidation zone, momentum tends to build quickly. But if it slips back below $0.16, the next few weeks could stay choppy until fresh volume enters the picture.

For now, it feels like DOGE is quietly setting the stage — the kind of low-key build-up that often leads to something much bigger.