• Monthly DEX to CEX trading volume ratio crossed 20% for the first time in crypto history

• This milestone could signal a potential shift towards growing interest in decentralized trading platforms

• Decentralized exchanges have generated nearly $10 billion in trading volume since the start of the year

In a groundbreaking development for the crypto world, the monthly trading volume on decentralized exchanges (DEX) has surpassed 20% of the activity executed on centralized platforms (CEX), marking a first in the history of crypto trading.

Understanding the DEX to CEX Trading Volume Ratio

The DEX to CEX trading volume ratio is an essential metric in understanding the dynamics of the crypto market. It is calculated by dividing the monthly trading volume on decentralized exchanges by that on centralized platforms and representing it as a percentage. Recent data from The Block and DefiLlama revealed that the DEX to CEX ratio crossed the 20% mark for the first time. However, it’s crucial to note that these figures are based on incomplete January data and could change before February.

Historical Perspective on DEX to CEX Ratio

January’s DEX to CEX percentage is at its highest point since May 2023 when the ratio hit 14%. This increase occurred amid a broader market recovery following the challenges of 2022. This upward trend indicates changing dynamics in the crypto market, with a shift towards decentralized platforms.

Implications of the Rising DEX to CEX Ratio: A Shift in Crypto Trading?

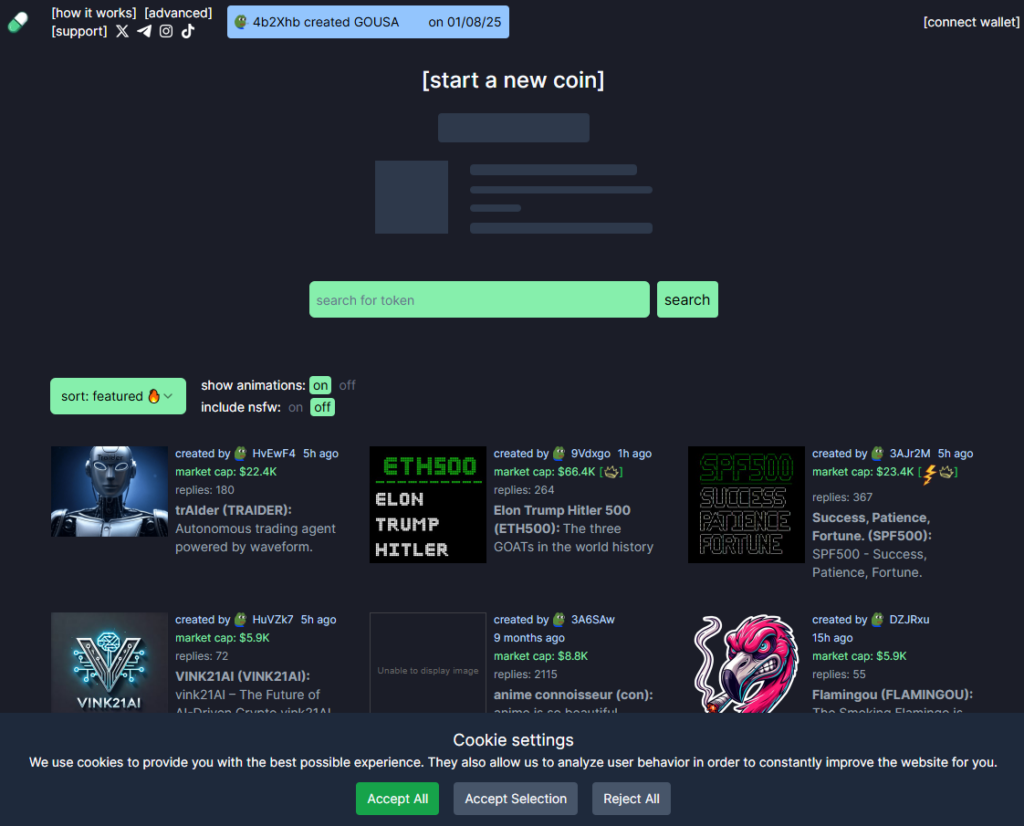

The 20% milestone might signal a potential shift in trading behavior as we progress through 2025. Analysts suggest this could reflect a growing interest in decentralized platforms. Launchpads, like Pumpfun, that simplify launching tokens have incentivized investor appetite for low-cap virtual assets. These assets typically trade first on DEXs after their launch. Centralized exchanges like Binance, Coinbase, and Kraken, although providing easy access to digital assets, are slower to list new coins, often waiting weeks or months before adding them in limited batches.

Role of Decentralized Platforms in Crypto Trading

Decentralized platforms such as Uniswap continue to play a significant role in crypto trading. These DEXs align more closely with the decentralized ethos and support new token launches without restrictions. On-chain data shows that decentralized exchanges have generated nearly $10 billion in trading volume since the start of the year.

Conclusion

The rising DEX to CEX ratio indicates a growing shift towards decentralized platforms in the crypto market. As decentralized exchanges continue to facilitate new token launches and generate significant trading volumes, their role in shaping the future of crypto trading cannot be underestimated. Whether this trend continues will be one of the key things to watch in 2025.