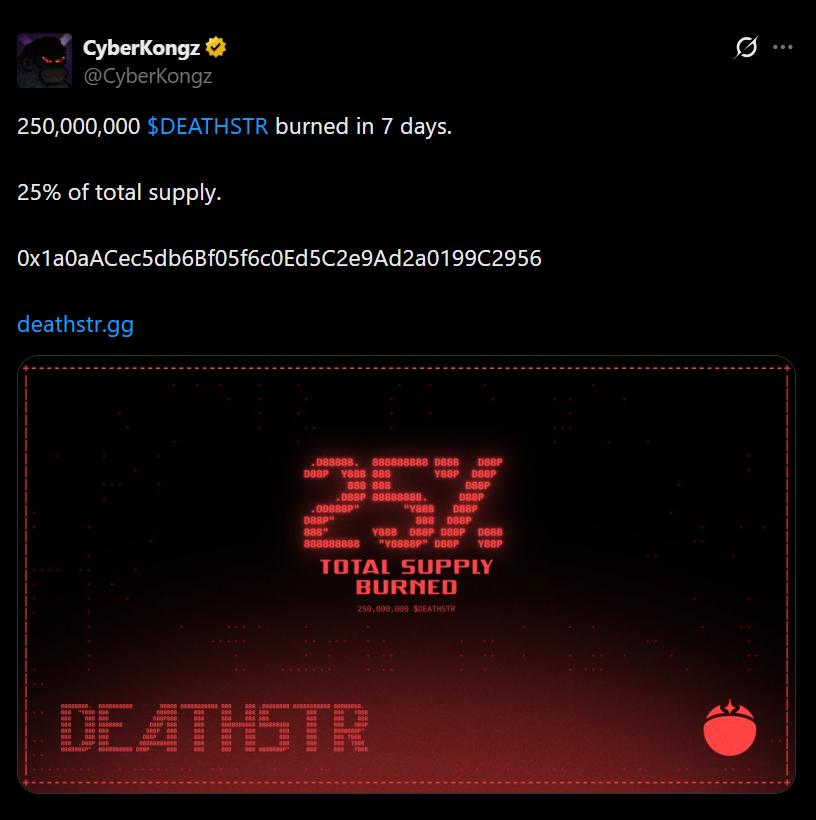

- DEATHSTR burned 250M tokens in 7 days, or 25% of total supply

- The token gates discounted NFT access through lock-and-vote mechanics

- Its high-velocity burn and resale loop sets it apart from typical strategy tokens

DEATHSTR is an ERC-20 token on Ethereum with a maximum supply of 1 billion tokens. Launched by CyberKongz as an experimental “NFT trading machine,” the core idea is simple but very crypto-native: concentrate trading volume, capture fees, buy NFTs, burn tokens, and repeat the cycle fast.

The token migrated to a new contract in February 2026, requiring holders to convert 1:1 via the official site. The stated purpose was to prevent third-party liquidity pools from siphoning off fees and to re-center activity inside the intended loop. That move alone signals the project’s obsession with keeping volume contained and fees internal.

The Burn Loop Is the Headline, but Velocity Is the Engine

The strongest verified datapoint so far is that 250,000,000 DEATHSTR were burned in seven days, framed as 25% of total supply. A 26% figure is often cited, but 25% is the clearest official number. With a max supply of 1 billion, that implies roughly 750 million tokens remaining at that point in time.

Burns alone do not move price. Markets care about demand, not labels. But supply compression does matter when paired with sustained activity. If volume stays concentrated and fees continue flowing back into buybacks and burns, the effective float shrinks while participation remains active. That combination can amplify price moves, especially at lower market caps.

The Real Hook Is Discounted NFT Access

Where DEATHSTR diverges from many strategy tokens is its access mechanic. To participate in NFT raffles, users must lock at least 1,000,000 DEATHSTR. Each additional million increases raffle entries. The system runs in 36-hour cycles, with 24 hours of voting and a 12-hour cooldown, constantly shifting focus to new NFT targets.

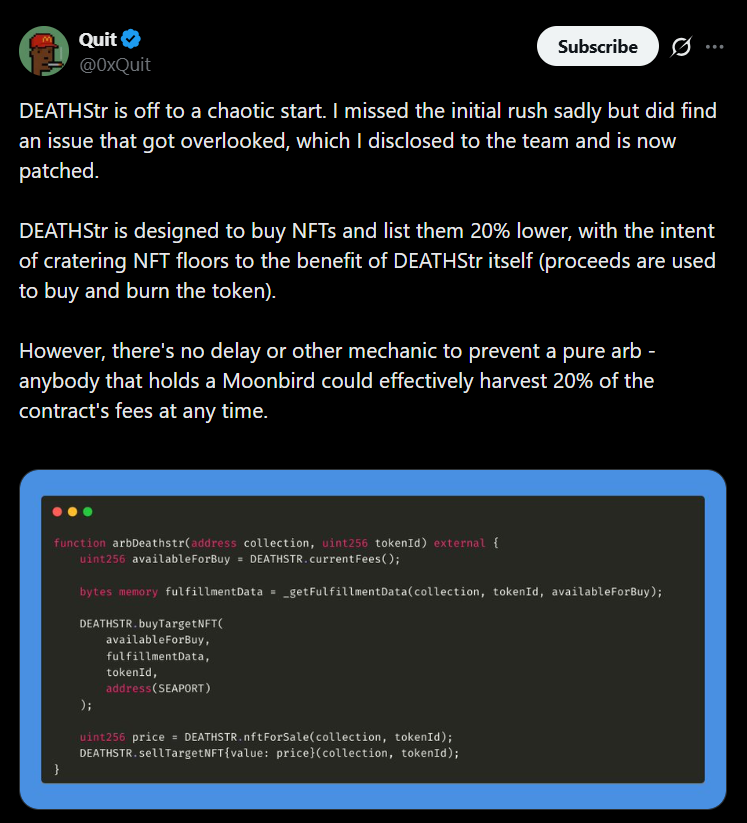

The strategy typically buys NFTs and lists them at prices below prevailing floor levels, often described as around a 20% discount. If that discount holds in practice, it creates tangible utility. Holders are not just speculating on burns. They are buying a shot at acquiring desirable NFTs at favorable pricing. That turns DEATHSTR from a pure burn narrative into an access token with scarcity measured in entry units.

Why the 10x Case Isn’t Pure Hype

A 10x move from a low single-digit million market cap puts DEATHSTR in the mid-eight-figure range. That valuation sits comfortably within the bounds of other established NFT strategy tokens, not in some absurd outlier territory. It doesn’t require category domination, just meaningful share within a niche that already supports similar valuations.

DEATHSTR’s differentiation is velocity. Markup-based NFT strategies rely on strong markets and patient buyers. DEATHSTR’s discount-driven resale model aims to clear inventory quickly, reset capital, and spin the loop again. If cycles remain tight and trading volume stays focused, the burn rate remains meaningful. If NFT liquidity fades or traders lose interest, the flywheel slows.

What Actually Determines If It Goes Higher

The early 10x reflects a market that understands the mechanics. Concentrated trading feeds fees. Fees fund NFT purchases and burns. Burns reduce effective float. But sustainability depends on execution, not headlines.

The real test is whether inventory keeps clearing and participation stays active. If the raffle-gated discount continues to attract lockers rather than just short-term traders, DEATHSTR maintains its edge. If volume fragments or NFT demand weakens, the loop loses force.

A path higher doesn’t require extraordinary assumptions. It requires sustained participation, ongoing supply compression, and enough demand to justify valuations already seen in the NFT strategy category. Whether DEATHSTR becomes a lasting Ethereum niche play or just a sharp early-cycle spike will depend on one thing: consistent velocity.