Bitcoin (BTC), Ethereum (ETH), and other altcoins retreated and reversed their intraday gains after the Federal Reserve announced its third consecutive 75 basis point (bps) interest rate rise on Wednesday.

The Fed’s 0.75% increase in policy interest rate extended the interest hike into the 3 to 3.25 percentage range. The figure represents a significant increase since March when the Federal funds rate was close to zero. The subsequent increases in interest rates mean the Federal Reserve’s fastest policy shift in four decades.

Prices of cryptocurrencies rallied ahead of the news, suggesting that traders had “priced in” the 75 basis points rate hike. However, shortly after the Fed’s rate hike decision, Bitcoin and altcoins fell in tandem with U.S. stocks.

Bitcoin Loses The Crucial $19,000 Support

Bitcoin’s price plunged approximately 9% from its intraday high of $19,949 on Coinbase, hitting lows of $18,153 a few minutes after the statement by the Federal Open Market Committee (FOMC). This decline was parallel with a sudden drop in U.S. stock prices, with the S&P 500 correcting 0.5%.

Ether’s drop was the most severe, shedding 12% of its value from highs above $1,400 to close the day around $1,245. The losses were 6% for Binance Coin (BNB), 11.8% for XRP, and 8.5% for Cardano (ADA).

On the other hand, the U.S. dollar index (DXY), which measures the dollar’s strength against a set of top foreign currencies, spiked to 111.6 after the Fed’s announcement, the highest in 20 years.

The 10-year U.S. Treasury note yield increased to 3.6% after teetering around 3.5% a few minutes before the interest hike. Likewise, the 2-year Treasury note yield surged from 3.98% to 4% over the same period.

The central bank predicted that the policy interest rate would peak at 4.6% in March 2023. Therefore, it could drop to 3.9% in 2024 and 2.9% in 2025.

The strengthening dollar and the falling BTC after the Fed’s decisions reflect investors’ increasing appetite for cash and cash-based tools compared to riskier assets.

The Fed’s hawkish stance and attempts to bring down inflation from the current levels of 8.3% continue to weigh down Bitcoin’s price. At the time of writing, BTC was exchanging hands at $18,920, with buyers fighting to push it back above the $19,000 level.

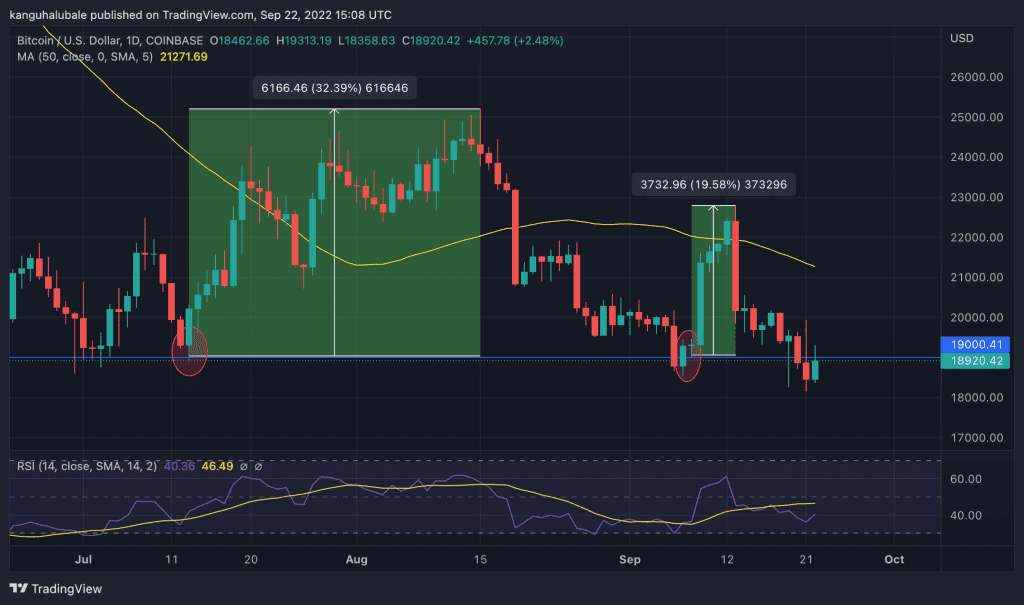

Note that the big crypto has held this level since September 9. BTC’s price action on the daily chart shows that $19,000 is a significant level for the flagship cryptocurrency. The first time it bounced off this demand zone, the price rallied 32.% to areas above $25,000. The second time, this level provided a launching pad in early September, propelling the cost of the pioneer crypto by 19.58% to $22,800.

As such, Bitcoin needs to flip this level back to support to ensure safety. A daily candlestick close below this level will signal weakness amongst buyers with a possibility of a retest of the $18,000 psychological level.

The 50-day simple moving average (SMA) and the relative strength index (RSI) were facing downward, suggesting that the price action favored the downside. The price strength at 40 indicated that the bears controlled the price. This technical outlook indicates more pain for Bitcoin and the broader crypto market.