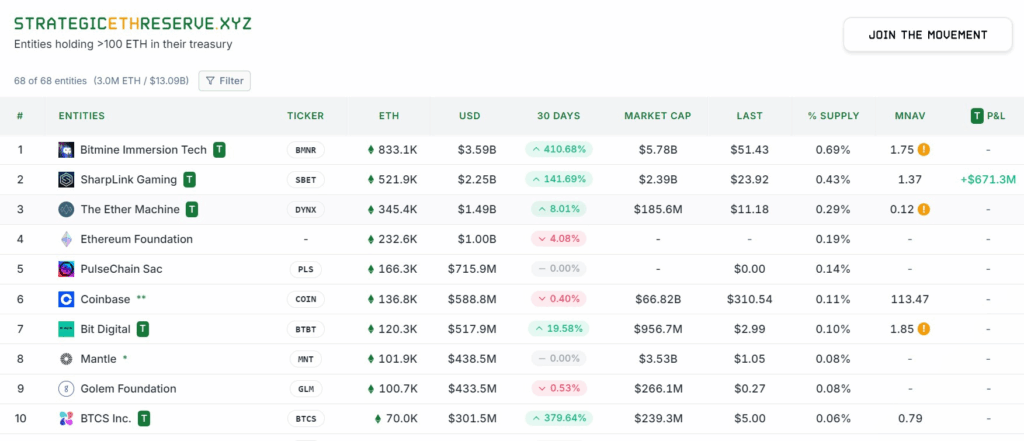

- Corporate ETH holdings have hit 3.04M ETH ($13B).

- BitMine, SharpLink, and The Ether Machine make up over half of top 10 holdings.

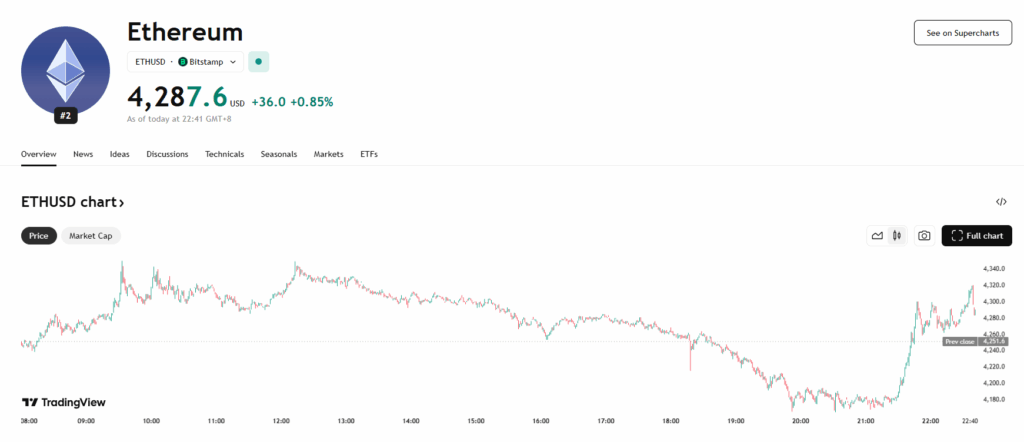

- Price surge to $4,300 has boosted valuations and unrealized gains significantly.

Ether (ETH) has seen a sharp rise in both price and institutional accumulation, with companies holding crypto treasuries now owning 3.04 million ETH, valued at over $13 billion. This increase in corporate holdings comes as ETH crossed $4,300 earlier in the week, up 20.4% over the last seven days before easing slightly to around $4,290 at the time of writing.

Big Movers in ETH Treasuries

BitMine Immersion Technologies leads the pack with 833,100 ETH, a massive 410.68% increase in just the past month. The company added over 208,000 ETH on Aug. 5 alone, bringing its holdings’ value to more than $3.58 billion—making it the first firm to hold over $3B worth of ETH.

SharpLink Gaming follows with 521,900 ETH, up 141.69% after adding more than 83,000 ETH last week. At current prices, its holdings are worth over $2.23 billion, with $671 million in unrealized gains according to Strategic ETH Reserve (SER) data.

The Ether Machine ranks third, holding 345,362 ETH (~$1.5 billion) after purchases totaling 25,600 ETH this month, including a symbolic 15,000 ETH buy on Ethereum’s 10th anniversary.

Combined, these top three companies control more than half of the ETH held by the top 10 treasury holders—together accounting for 2.63 million ETH, or about 2.63% of total supply.

Smaller but Notable Accumulations

Outside the top three, activity has been brisk as well. On Friday, Hong Kong–listed IVD Medical purchased roughly $19 million worth of ETH via HashKey Exchange, though the exact token count wasn’t disclosed.

Market Context and Implications

With ETH’s rally fueled partly by these treasury accumulations, the data underscores growing corporate confidence in Ethereum’s long-term prospects. For many of these firms, ETH exposure is now a strategic asset allocation rather than a speculative play—especially as on-chain usage, staking demand, and institutional-grade custody options continue to expand.