- Avalanche Sees Activity Surge Amid Price Dip: AVAX dropped 1.13% to $23.66, but on-chain activity spiked with a 221% jump in Active Addresses and a 109% rise in Transaction Count, largely driven by NFT transactions on OpenSea.

- Fee Revenue Rises, But Liquidity Outflows Persist: Avalanche’s fee revenue increased from $19,500 to $24,300, indicating higher network usage, but the total value locked (TVL) slid 3.26% as $50 million worth of AVAX was sold off.

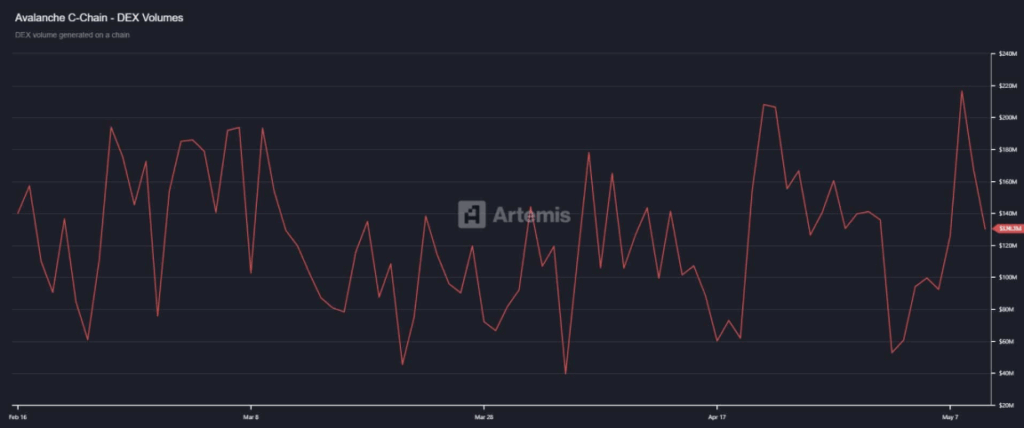

- Trading Volume Declines as Demand Weakens: DEX trading volume dropped from $216.5 million to $130.3 million, suggesting that despite strong on-chain metrics, AVAX still needs broader demand recovery to sustain a breakout.

Avalanche (AVAX) took a slight hit, dropping 1.13% in the last 24 hours to trade at $23.66. But despite the pullback, some analysts still see room for gains – as long as the network can shake off the selling pressure that’s been building up.

Surge in On-Chain Activity – Is AVAX Gearing Up?

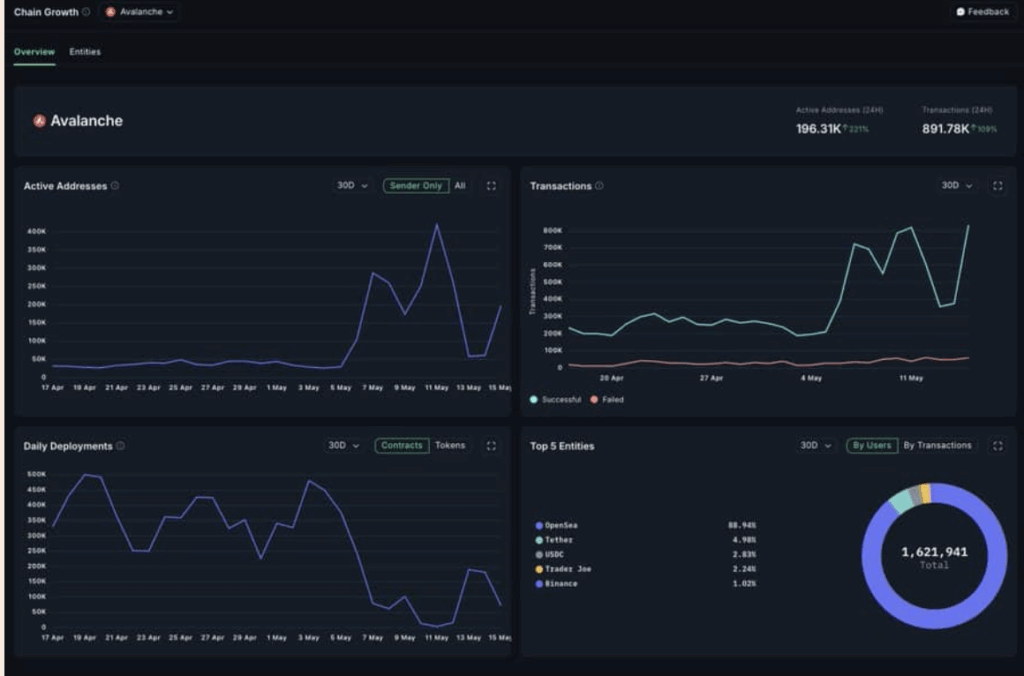

Activity on Avalanche has been anything but quiet. According to Nansen, Active Addresses spiked by 221% while Transaction Count jumped 109% in just one day. That’s a lot of movement – and most of it is tied to OpenSea, the NFT marketplace. AMBCrypto’s research found that 89.94% of those transactions were OpenSea-related, hinting that NFTs are driving a lot of the current action on the network.

This aligns with a broader trend. NFT apps have been the second-best performing sector in the past 30 days, posting a solid 78.1% growth. If this momentum keeps up, it could push AVAX higher in the near term.

Fees Climb as Network Usage Rises

The increased activity is also showing up in fee generation. Avalanche’s fee revenue climbed from $19,500 on May 11 to $24,300 at press time – a sign that people are actually using the chain more. And while that’s a good look, it’s only part of the picture.

Liquidity Outflows and Weak Exchange Activity

Here’s the flip side – liquidity is still bleeding out. Data from DeFiLlama shows that the total value locked (TVL) in Avalanche protocols dipped 3.26% over the past few days, sliding from $1.519 billion to $1.469 billion. That’s $50 million worth of AVAX sold off.

And it’s not just liquidity. Trading volume on decentralized exchanges (DEXs) dropped from $216.5 million to $130.3 million, suggesting that demand isn’t quite there yet. For AVAX to break out of its current range, that demand needs to pick up – both on-chain and across trading platforms.

Bottom Line – Mixed Signals

Avalanche is flashing some conflicting signals right now. On-chain activity is heating up, driven by NFT-related transactions and rising fee revenue. But at the same time, liquidity outflows and weak exchange volumes are dragging on price action. If AVAX can attract fresh demand across all channels, it might regain its bullish footing. But for now, the market remains in wait-and-see mode.