- COIN stock hit a new 52-week high at $369.25, nearing its record 2021 close, with gains of 133% since April driven by Bitcoin’s rally and strong revenue growth.

- Q1 revenue jumped 24.2% year-over-year to $2.03B, led by a 36.3% rise in subscription and services income, especially from stablecoins.

- Coinbase’s partnership with Circle and its top spot in the VanEck MVDAPP index reinforce its leading position in the crypto equities space.

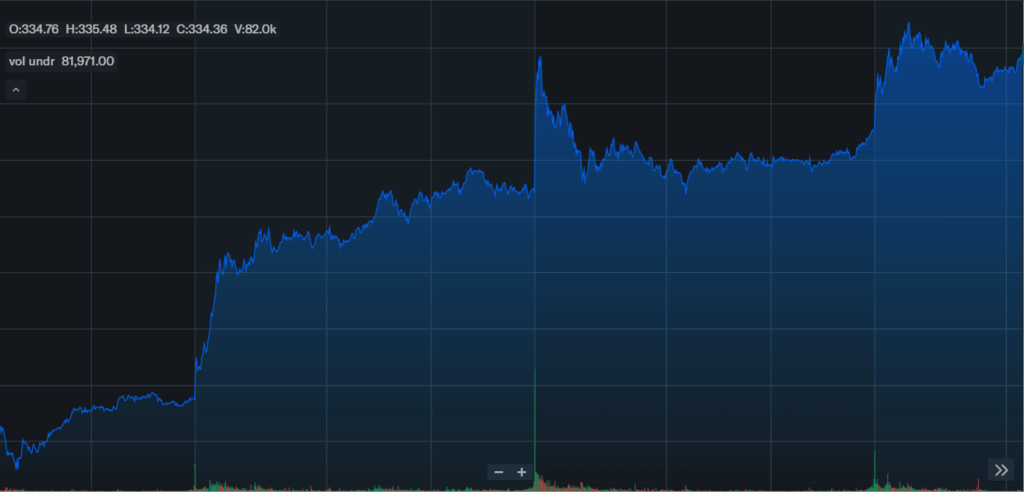

Coinbase stock (COIN) continued its strong ascent on Wednesday, climbing as much as 7.1% in early trading to hit $369.25—its highest price in the past 52 weeks. While it later pulled back slightly to trade near $352, the move places it within 2% of its all-time record close from November 2021, which stood at $357.39. The surge reflects renewed momentum across the crypto industry, fueled by Bitcoin’s rally and improved sentiment in digital assets.

Momentum Fueled by Bitcoin and Industry Tailwinds

COIN has gained an eye-popping 133% since its April bottom, which followed a market-wide dip triggered by President Trump’s surprise “Liberation Day” tariffs. The stock has also added over 42% in 2025 alone, riding the wave of surging Bitcoin prices, pro-crypto regulatory signals in the U.S., and rising service-based revenues. In Q1, Coinbase posted a 24.2% year-over-year revenue bump to $2.03 billion, with subscription and services income jumping 36.3% to $698.1 million—thanks mostly to its expanding stablecoin business.

Partnership With Circle Adds Fuel to the Rally

Coinbase is also gaining traction from its ongoing partnership with Circle Internet Group, the issuer of the USDC stablecoin. Circle’s recent IPO was a blockbuster, debuting at $31 and shooting up to over $200 per share. Coinbase, which holds an equity stake in Circle, is a major player in the USDC ecosystem, which has helped reinforce investor confidence. Though Circle briefly took the top spot in VanEck’s MVDAPP index, which tracks top crypto stocks, Coinbase has since reclaimed its position as the largest component.

What It Means for Investors

With a market cap nearing $90 billion, Coinbase is now firmly established as the most valuable crypto-native public company. Its upward trajectory reflects not just optimism about crypto, but also its strengthening fundamentals and strategic partnerships. However, continued success may depend on the pace of Bitcoin’s growth, evolving regulations, and how well Coinbase can maintain service revenue momentum amid rising competition.