- Coinbase accused the SEC of purposefully trying to destroy the crypto industry by refusing to provide clear rules and regulations.

- Coinbase claimed the SEC is creating a “Catch-22” situation where crypto firms are expected to comply with securities laws, but the SEC won’t provide needed rulemaking.

- The dispute stems from the SEC’s denial of Coinbase’s petition for rulemaking last December, which Coinbase is now challenging in court.

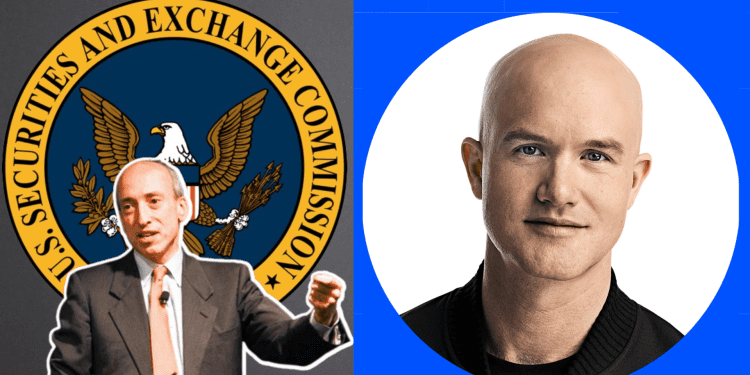

In a recent legal filing, Coinbase accused the SEC of trying to destroy the crypto industry by refusing to provide regulatory clarity. This comes amid an ongoing dispute between the exchange and regulator over the need for new crypto rules.

Background on Coinbase vs SEC

- In 2021, SEC sued Coinbase for offering unregistered securities through its staking services. Coinbase disputes these allegations.

- After SEC denied Coinbase’s petition for crypto rulemaking in late 2021, the exchange challenged this in court.

- Earlier this month, SEC said crypto firms’ difficulty complying with current laws doesn’t require immediate rulemaking.

Coinbase’s Latest Accusations

- In its May 27 court filing, Coinbase said the SEC’s actions amount to “a purposeful effort to destroy an industry.”

- The exchange accused the SEC of demanding the impossible from crypto firms while prosecuting those that fail to comply.

- Coinbase described this as a “Catch-22” for the industry, with SEC calling for compliance while denying needed rules.

Coinbase’s Conclusions & Request

- Coinbase concluded the SEC is trying to “choke” the crypto industry by denying requested rules.

- The exchange asked the court to vacate the SEC’s rulemaking denial and force the agency to engage in the process.

- The SEC maintains its denial provided sufficient explanation and it should further review any petition.

Conclusion

The legal battle between Coinbase and the SEC continues with no clear resolution in sight. The crypto industry awaits regulatory clarity, but the SEC so far refuses calls for rulemaking. This dispute highlights the challenges facing crypto companies seeking to comply with securities laws.