- Trump’s 104% tariff on China just kicked in, shaking global markets and wiping out $5.8 trillion from U.S. stocks in 4 days — the worst hit since the 1950s.

- China vows to fight back, while Trump prioritizes trade talks with allies like Japan and South Korea. A pharma import tariff and a broader reshuffling of global supply chains may be next.

- Consumers and countries are bracing for price hikes and retaliation — from $220 sneakers to Canada’s auto tariffs, this trade war’s fallout is getting very real, very fast.

Things got real at 12:01 a.m. — the U.S. officially slapped a staggering 104% tariff on imports from China. Despite the abrupt move, the Trump administration says it’s already prepping talks with allies like Japan and South Korea, aiming to calm the storm it just kicked up.

Meanwhile, Wall Street isn’t taking it well. The S&P 500 closed below 5,000, a level it hadn’t touched in nearly a year. It’s now down nearly 19% from February highs, inching closer to what’s technically considered a bear market.

And the losses? They’re big. Like $5.8 trillion wiped out in four days kind of big — the worst stretch since the index was born back in the ’50s.

Global Fallout Begins

Markets around the world were hoping Trump might soften the blow with some backroom deals or last-minute tweaks. No such luck.

Japan’s Nikkei took a nosedive Wednesday morning, and other Asian markets weren’t looking much better in pre-open jitters. Italy’s Prime Minister Giorgia Meloni is scheduled to visit next week, likely with trade talks high on the list.

Trump, meanwhile, seemed unfazed. Speaking from the White House — while signing off on orders to boost coal production — he claimed over 70 countries are eager to negotiate. “We’ve had talks with many, many countries,” he said. “Our problem is, we can’t see that many that fast.”

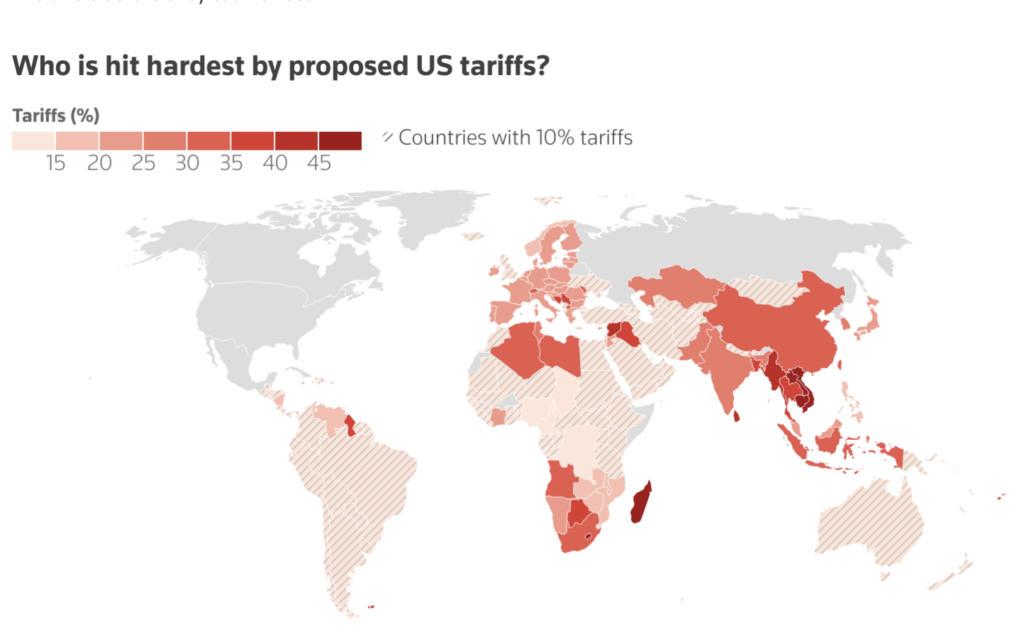

Despite all the chatter, the administration confirmed that tariffs of up to 50% on other countries are still happening. And China? They’re getting hit the hardest, after slapping their own countertariffs on the U.S. last week.

China Digs In, Allies Prioritized

China’s government isn’t backing down, accusing the U.S. of “blackmail” and vowing to fight it out. Still, the Trump team is in no rush to talk things over with Beijing.

“Right now, the focus is on our allies,” said White House economic adviser Kevin Hassett. “Japan, Korea, and others are at the front of the line.”

The White House also hinted that trade talks may factor in military aid and foreign relations, not just economics. No blanket exemptions are expected “anytime soon,” according to top trade rep Jamieson Greer.

More Tariffs Incoming—Even On Pharma

Trump isn’t done. He told GOP lawmakers he’s planning to roll out “major” tariffs on pharmaceutical imports soon. His pitch? That it’ll force drug makers to bring their manufacturing back to the U.S.

That’s left global supply chains — already under strain — rattled. Manufacturers are scrambling, some looking to move operations overseas to dodge the worst of the new duties.

Citi just cut its China growth forecast for 2025 from 4.7% to 4.2%, citing rising global risks and escalating uncertainty.

Canada Responds, Americans Brace for Price Hikes

Canada’s 25% tariffs on certain cars went live right after midnight, as a direct counterpunch. “President Trump caused this trade crisis — and Canada is responding with purpose and with force,” said PM Mark Carney.

Mexico and Canada were spared from this round of new tariffs, but older ones remain in play. Goods that follow NAFTA (or what’s left of it) terms are mostly safe… for now.

Meanwhile, U.S. consumers are already prepping for higher prices. A new Reuters/Ipsos poll found that 3 out of 4 Americans expect inflation to rise as the tariffs hit. And they’re acting on it.

“I’m buying double of whatever — beans, canned goods, flour, you name it,” said New Jersey resident Thomas Jennings, 53, as he stocked up at Walmart.

Retailers are also feeling the squeeze. Clothing companies are slowing orders, delaying hires, and passing on surcharges. A pair of sneakers from Vietnam that sold for $155? That’ll be $220 once Trump’s 46% tariff on Vietnam kicks in, according to the footwear industry.

Europe’s Turn? The EU’s Not Sitting Still

The European Commission is eyeing 25% countertariffs on everything from soybeans to sausages. Bourbon was spared (for now). Officials say they’re open to talks, but tensions are high.

With auto and metal tariffs already on the table, and a new 20% hit on other goods coming, Europe’s not in the mood for patience. Pharma firms there are warning that the tariff chaos could accelerate their move away from Europe — and toward the U.S.

Final Thoughts

This isn’t just a trade scuffle — it’s a major shift. The rules of global commerce are being rewritten in real time, and the ripple effects are touching everything from factory jobs to supermarket shelves.

Whether Trump’s gamble pays off or backfires? That part’s still playing out. But for now, one thing’s clear: this trade war just got real.