- China has quietly re-emerged as the third-largest Bitcoin mining hub, capturing 14% of global hashrate.

- Excess electricity, economic incentives, and rising BTC prices are fueling the comeback.

- Soft, informal policy flexibility in provinces is allowing mining to flourish despite the national ban.

Bitcoin mining is making an unexpected comeback in China, four years after the country imposed a sweeping ban that wiped out its global market share overnight. Now, despite no official policy reversal, new data shows China has re-emerged as the third-largest Bitcoin mining hub, reclaiming about 14% of global hashrate as of late October.

The resurgence is happening quietly — powered by excess electricity, local incentives, and booming data center activity across energy-rich provinces like Xinjiang.

Mining Returns as China Reclaims 14% of Global Hashrate

Before the 2021 ban, China controlled more than half of the world’s Bitcoin mining capacity. When authorities cracked down on crypto mining and trading, the country’s share dropped to zero as miners fled to North America, Kazakhstan, and the Middle East.

But according to Hashrate Index, China is back in the top three. ASIC manufacturer Canaan also confirmed a major rebound in domestic machine sales — further evidence that mining is alive again inside the country.

One private miner in Xinjiang explained the incentive plainly:

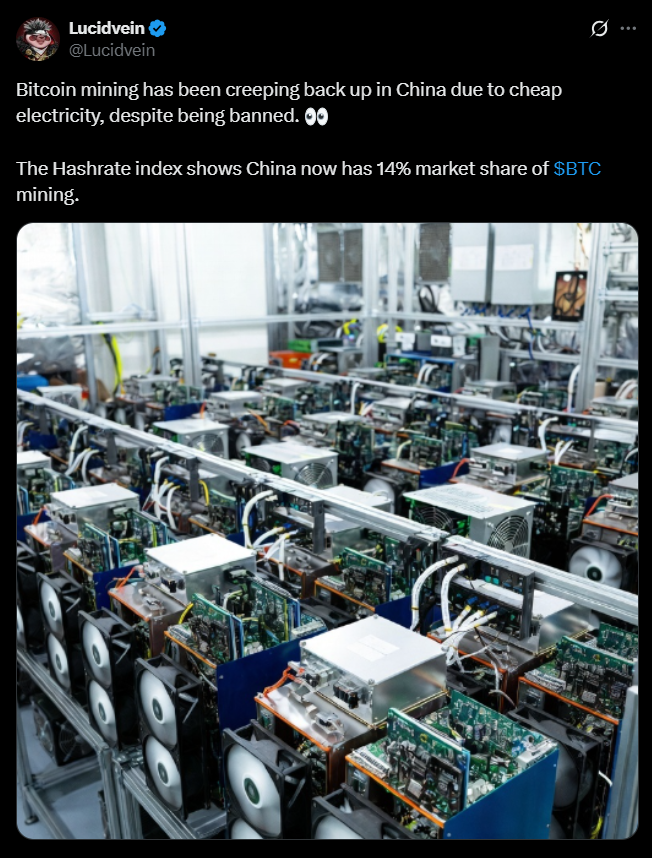

“A lot of energy cannot be transmitted out of Xinjiang, so you consume it in the form of crypto mining… People mine where electricity is cheap.”

Why Mining Is Returning Now

Analysts say a combination of economic and political factors is fueling the resurgence:

- Cheap excess electricity in remote provinces creates ideal mining conditions.

- Record Bitcoin highs in October, boosted by pro-crypto U.S. policies under President Trump, made mining extremely profitable.

- China’s flexible enforcement allows local regions to quietly tolerate mining when economic incentives are strong.

- Distrust in the U.S. dollar has driven Chinese entities back toward alternative stores of value like BTC.

Patrick Gruhn, CEO of Perpetuals.com, called the revival “one of the most important signals the market has seen in years,” indicating that mining demand from China could offer strong long-term support for Bitcoin’s price.

Beijing Hasn’t Changed the Policy — But Local Incentives Matter

China has not officially overturned the mining ban. The National Development and Reform Commission did not comment on the situation, and no national policy shift has been announced.

However, experts note that decentralized enforcement is typical in China — and provinces with excess power generation often bend the rules when local revenue is on the line.

Even subtle hints of loosened restrictions, analysts say, could help strengthen the narrative of Bitcoin as a resilient global asset that can survive — and thrive — even in hostile policy environments.

The Bottom Line

China is not openly welcoming Bitcoin mining back — but miners are returning anyway. Cheap energy, strong incentives, record demand, and the shifting global macro environment have created a perfect window for mining to operate in the shadows again.

And now, with China quietly reclaiming a double-digit share of global mining, Bitcoin’s geopolitical footprint is changing once more — whether Beijing acknowledges it or not.