- Chainlink is stuck in a $12.50–$15.00 range, with no clear breakout yet.

- Derivatives data shows fading interest, as traders wait on direction.

- A break above $15.30 could launch LINK toward $18–$22; failing support risks a fall to $10.

Chainlink (LINK) is kinda stuck in limbo right now. It’s floating around $13.26—barely moved the needle with a 0.76% gain on the day. Volume’s hovering at $157 million, which isn’t much to shout about. And honestly? The price action’s been stuck in a sideways chop between $12.50 and $15.00 for weeks now, ever since June kicked off.

Yeah, we had that sweet run up to $22 back in December 2024, but since then? Lower highs… and more hesitation. Bulls just haven’t shown up in force. Not yet, anyway.

LINK’s Playing Ping-Pong Between $12.50 and $15.00

To be fair, support around $12.50 has held up like a champ—tested again and again in Q2. Every dip down there’s been bought up. But on the flip side, $15.00? It’s like running into a brick wall. Rejected. Again. And again. Ali Martinez, one of the more tuned-in voices on X, pointed out $15.30 as the real line in the sand. If LINK can punch through that? Different story.

Until then, it’s just ping-ponging in this tight little channel.

Derivatives Say: “Meh”

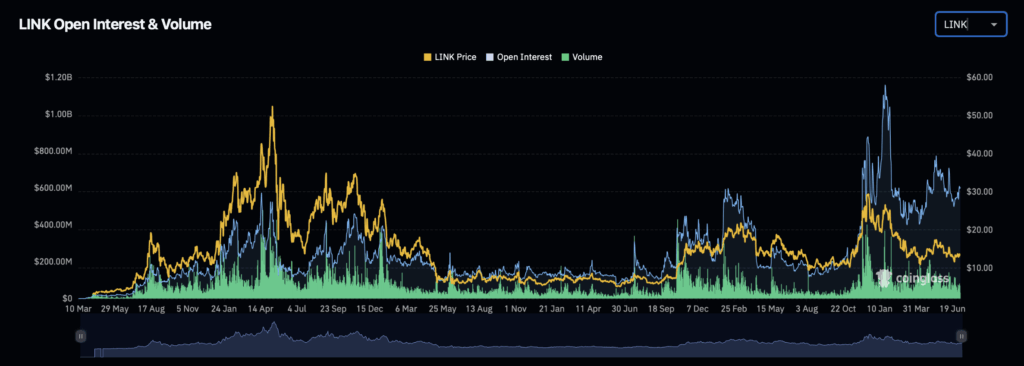

So here’s the thing—LINK’s derivatives market is showing signs of cold feet. Open interest hit over $1.1B earlier this year, but now? It’s cooled off to about $590 million. That’s a huge drop. Basically, traders are playing it safe. No one’s making big leveraged bets right now.

Looking at the historical chart, it’s clear that major price moves have always followed big volume spikes—think April ‘21, October ‘21, and early ‘24. But lately? Volume’s been snoozing. So unless we see a big jump in activity, don’t expect fireworks.

Could $18 Be Next?

Here’s where things get interesting. If LINK somehow claws above $15.30—and that’s a big if—it could kick off a run toward $18. Maybe even back to $20 or $22 if things really heat up. But until that level gets cleared with volume backing it? This is just chop.

Now if the bottom falls out and we lose $12.50, watch out. A drop toward $10 isn’t outta the question. That’s a psychological level, plus a solid floor from the past.

Chainlink’s still laying down good fundamentals—growing oracle integrations and solid dev work—but price needs a reason to move. A convincing breakout above $15.30 could be that reason. Otherwise? More waiting.