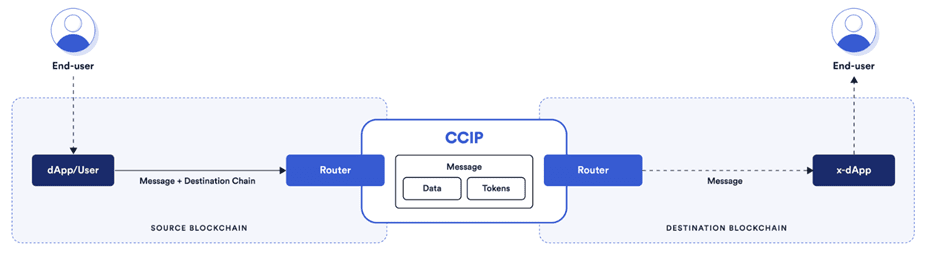

In Web3, blockchain interoperability protocols facilitate seamless connectivity between different blockchain networks. They are the foundation for enabling traditional systems and DApps to interact with multiple blockchains through a unified middleware solution.

With such protocols, organizations can avoid the arduous task of developing individual implementations for each cross-chain interaction, leading to inefficiencies and complexity.

Chainlink has just unveiled that its groundbreaking Cross-Chain Interoperability Protocol (CCIP) has entered the Mainnet Early Access phase.

On July 20, 2023, developers will have full access to CCIP across five testnets:

- Arbitrum Goerli

- Avalanche Fugi

- Ethereum Sepolia

- Optimism Goerli

- Polygon Mumbai

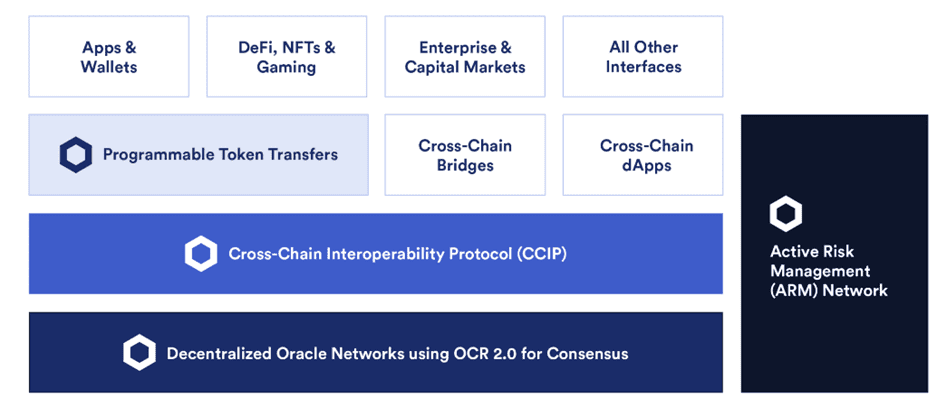

CCIP has already begun integrations across the Mainnets of the networks listed above and has been adopted by DeFi protocols Synthetix and Aave. Using Chainlink Decentralized Oracle Networks (DONs), CCIP establishes a reliable and secure foundation for developers to build cross-chain applications and services. CCIP supports two main features: Token Transfers (simplified and programmable) and Arbitrary Messaging.

Token Transfers Explained: Simplified and Programmable

Simplified Token Transfers

A standout feature of CCIP is the Simplified Token Transfers, which enables protocols to transfer tokens across chains swiftly using audited token pool contracts. This functionality eliminates the need for custom code and significantly reduces development time.

By leveraging Simplified Token Transfers, protocols gain the ability to transfer tokens seamlessly and securely between blockchains, enabling them to interact with DeFi protocols, DApps, and DEXs.

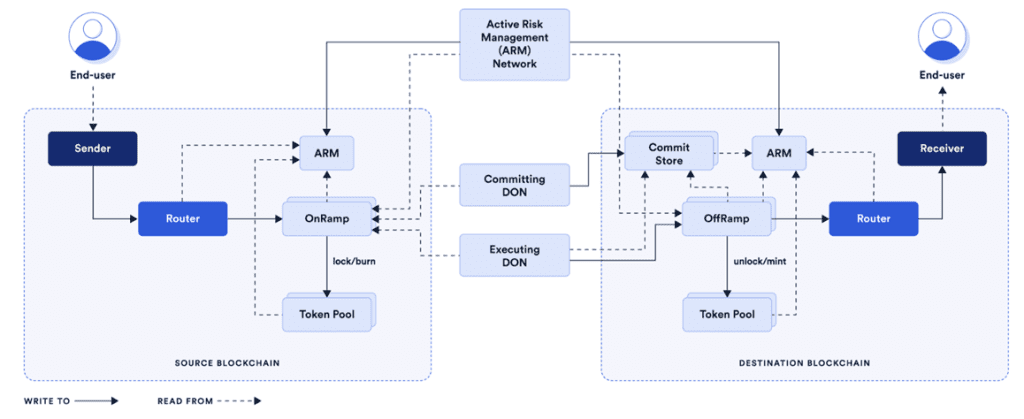

To ensure the validity of all cross-chain transactions, CCIP implements an Active Risk Management (ARM) Network, further fortifying its safety mechanisms.

The ARM Network acts as a decentralized network of validators within CCIP. Its primary role is monitoring and evaluating the validity and security of cross-chain transactions across different blockchain networks. It actively identifies potential risks, exploits, or fraudulent activities that may occur during cross-chain transactions.

Through real-time monitoring and analysis, the ARM Network helps maintain the security and reliability of the CCIP ecosystem.

In addition to monitoring, the ARM Network can implement customizable rate limits on token transfers. This feature allows developers and protocols utilizing CCIP to set specific parameters for cross-chain transactions, enabling them to control and manage the flow of assets across different blockchains.

Programmable Token Transfers

Programmable Token Transfer is a powerful capability that enables users to transfer tokens while including additional encoded data within a single transaction. This mechanism allows for the simultaneous transfer of tokens and the inclusion of specific instructions on how those tokens should be utilized.

For instance, a user could transfer tokens to a lending protocol and include instructions for those tokens to be used as collateral for a loan. Prompting the lending protocol to leverage the transferred tokens as collateral and initiate the borrowing process, resulting in another asset being sent back to the user.

The capability of including additional encoded data in Programmable Token Transfers is only applicable when interacting with smart contracts. If the data and token transfer are sent to an externally owned account (EOA), only the tokens will be transferred, and the additional encoded data will not have any effect.

Programmable Token Transfers offer enhanced flexibility and functionality when managing and utilizing tokens within the context of smart contracts. They allow for the seamless integration of token transfers with specific instructions, enabling complex interactions and the execution of sophisticatedDApp functions.

Arbitrary Messaging Explained

Arbitrary Messaging, a core feature of CCIP, empowers developers to transmit encoded data to smart contracts residing on different blockchains. This data can encompass any desired information, allowing developers to encode various instructions and actions.

The versatility of arbitrary messaging allows developers to encode multiple instructions within a single message, facilitating the orchestration of complex, multi-step, and multi-chain tasks. By leveraging arbitrary messaging, developers can initiate informed actions on receiving smart contracts.

For instance, a developer could utilize arbitrary messaging to trigger an index rebalancing operation on a separate blockchain when certain predefined conditions are met. This action could be accompanied by minting a specific NFT and invoking a custom function that utilizes the transmitted data as parameters.

By incorporating arbitrary messaging into the CCIP framework, Chainlink offers developers a robust and flexible toolset to facilitate seamless cross-chain communication and the execution of complex tasks.

Blockchain Abstraction Layer:

CCIP also operates as a robust blockchain abstraction layer, enabling enterprises to seamlessly connect and interoperate across various public and private blockchain environments. Cross-chain account abstraction refers to creating smart contract wallets with built-in capabilities to interact with multiple blockchain networks through CCIP.

These wallets have native capabilities to send transaction requests, execute smart contract function calls, and approve transactions across different chains from a single interface.

For example, users can utilize a cross-chain account abstraction wallet to initiate and approve transactions on multiple blockchains without switching between wallets or managing private keys.

This approach simplifies the user experience and promotes interoperability and composability between blockchain networks. Users can leverage the features and functionalities of various chains without being familiar with each chain’s technical nuances. By integrating CCIP into their existing backend systems, businesses can harness the power of different blockchains without the complexity of building separate in-house implementations.

CCIP Payments: Reducing Friction

One of CCIP’s primary objectives is to reduce payment friction for DApps, enterprises, and end-users utilizing Chainlink services.

CCIP has been designed as the most secure and user-friendly cross-chain solution to support the scalability and adoption of the protocol. A key consideration of the design was the potential for fee payments to originate across multiple independent blockchains.

As such, CCIP incorporates fee payments in LINK and alternative assets, which are currently represented by native blockchain gas coins and their ERC20-wrapped versions. It is worth noting that payments made in alternative assets will incur a higher fee rate than LINK payments.

An automated on-chain conversion mechanism is being developed to facilitate the transition between alternative assets and LINK. Until this mechanism is deployed, payments made in alternative assets will be withdrawn to separate maintenance pools and replaced within the CCIP contracts with LINK based on the prevailing exchange rate at the time of payment. Eventually, when the on-chain conversion mechanism is live, alternative assets held in the maintenance pools can be converted to LINK.

Token Pools

Within CCIP, token pools are an abstraction layer for various tokens, enabling OnRamp and OffRamp operations. Each token has its own pool, and the handling mechanism depends on the specific characteristics of the token.

For blockchain-native gas coins like ETH, MATIC, and AVAX, a “Lock and Mint” approach is employed, where the token is locked at its source, and a wrapped or synthetic asset representing the locked token is minted on the destination chain. Tokens like LINK, which have a fixed total supply minted on a single chain (Ethereum mainnet), also utilize the “Lock and Mint” approach.

Tokens such as stablecoins and wrapped assets utilize the “Burn and Mint” method, where the token is burned on the source chain and natively minted on the destination blockchain. In cases where tokens have a Proof of Reserve (PoR) feed on a specific chain, the preferred approach is the “Lock and Mint” method due to conflicts with the PoR feed.

Fee Structure

CCIP implements a gas-locked fee payment mechanism called Smart Execution, ensuring reliable execution of cross-chain transactions regardless of gas spikes on the destination chain.

The CCIP ecosystem maintains a cache of destination gas prices denominated for each source chain, regularly updating them to prevent staleness. This model significantly reduces user friction and allows for the scaling of CCIP to more blockchains by supporting fee payments originating from various chains over time.

CCIP fees include both gas cost overhead and a flat price or basis point premium. Gas overhead represents the average additional gas cost on the destination chain for processing messages and token transfers.

The flat network premium is a fixed fee paid for cross-chain messages. In contrast, the basis point premium is a percentage-based fee for token transfers calculated using the token amount, price, and basis point ratio.

Currently, the CCIP premium fees are aligned with industry standards within the cross-chain ecosystem, with a 10% surcharge for premium fees paid in alternative assets compared to LINK payments. It’s important to note that these fee values are subject to potential adjustments.

If the fees paid on the source chain are within an acceptable range of the execution cost on the destination chain, messages will be transmitted promptly after being approved by the ARM Network. However, if the execution cost increases between the request and execution time, CCIP will incrementally raise the gas price to attempt eventual execution, which may introduce additional latency.

The payment and fee structure within Chainlink CCIP ensures smooth and efficient cross-chain transactions while maintaining alignment with industry standards. With a focus on reducing payment friction, scalability, and user experience, Chainlink continues to innovate and evolve its protocols to support seamless interactions across multiple blockchains.

Conclusion

The CCIP has emerged as a potential leading solution for achieving seamless connectivity and interoperability across diverse blockchain networks. Through its secure and straightforward interface, CCIP enables developers, enterprises, and users to harness the full potential of blockchain technology while minimizing complexities.

With Simplified Token Transfers, support for Arbitrary Messaging, and an Active Risk Management Network, CCIP ensures the safety and efficiency of cross-chain transactions. As the web3 ecosystem continues to evolve, blockchain interoperability protocols like CCIP will play a crucial role in realizing the full potential of decentralized applications and services.