- Traders are heavily shorting LINK, with over $8.6M in shorts and a 0.935 long/short ratio.

- Price is stuck under resistance, volume is fading, and it’s trading below the 200-day EMA.

- A break below $12.70 could trigger a 17% drop—unless bulls reclaim the trendline and $16 level.

Chainlink (LINK) just can’t seem to catch a break. With tariff tensions bubbling up again, the token’s already shaky momentum took another hit—and the market’s mood isn’t helping. Sentiment is sliding fast, and traders are eyeing shorts more than ever.

Traders Lean Bearish—Hard

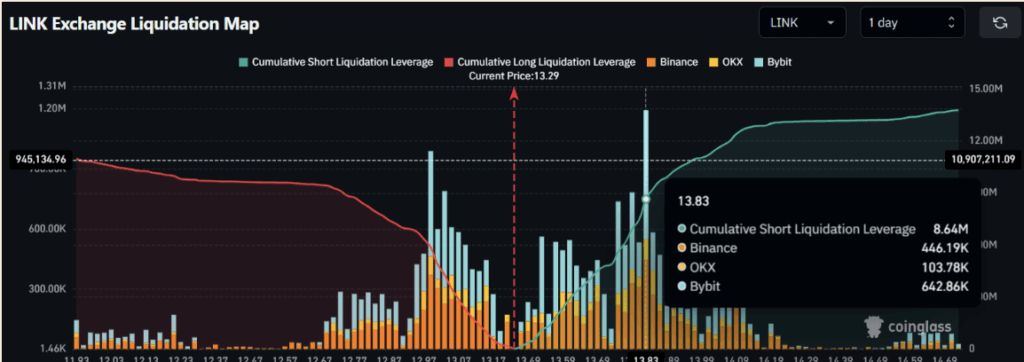

On July 8th, bearish vibes dominated the LINK market. According to CoinGlass, traders have started piling into short positions, setting up for potential downside. A lot of action is clumped around the $12.99 support and $13.83 resistance levels—two zones that are now drawing heavy attention.

Data’s painting a pretty clear picture: $8.64 million in shorts vs. $5.87 million in longs. That imbalance? Not great for the bulls. The long/short ratio is sitting at 0.935, which means more than half the market (around 51.68%) is betting LINK’s going lower. Only 48.32% are still holding out hope on the long side.

Price Slides, Volume Fades

As of now, LINK’s hovering around $13.49—a 0.55% dip in the past 24 hours. Doesn’t sound like much, but given the context, it’s not reassuring. The ongoing tariff chatter seems to be zapping confidence, not just in LINK but in the broader crypto sentiment too.

Volume’s taken a hit as well. Per CoinMarketCap, trading activity has dropped about 12% compared to the day before. Fewer participants, more indecision. Not the best combo if you’re hoping for a rebound.

Make-or-Break Territory Ahead

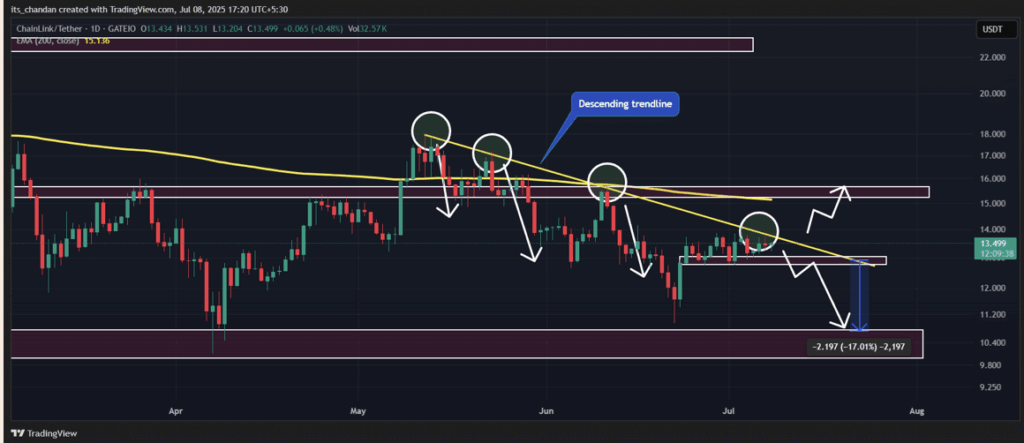

Technically speaking, LINK is sitting on a critical ledge. The price has been locked in a tight consolidation range for weeks—and it’s now brushing up against a descending trendline that’s acted as resistance multiple times before. This is the fourth time it’s testing that line, and history says… not great odds.

If LINK breaks below the $12.70 zone, things could spiral quickly. We’re talking about a potential 17% drop if sentiment doesn’t flip. But—and it’s a big but—if the bulls manage to rally and push price above that trendline, we might just see a reversal. Key thing to watch for? A clean daily close above that resistance.

Final Word: Caution Rules for Now

As it stands, LINK is still under its 200-day EMA on the daily chart. Until that’s reclaimed—and price breaks through $16—this is still very much a downtrend. There’s potential for a breakout, sure, but only if momentum returns and the broader market plays along.

Right now, traders are cautious. Shorters have the upper hand. And unless something shakes things up soon, LINK could be heading for another leg down.