- LINK jumps nearly 14% in 24 hours, fueled by new Chainlink Reserve and $97M in whale accumulation.

- Price breaks above $21, clearing 200-day EMA and long-term resistance with bullish technicals intact.

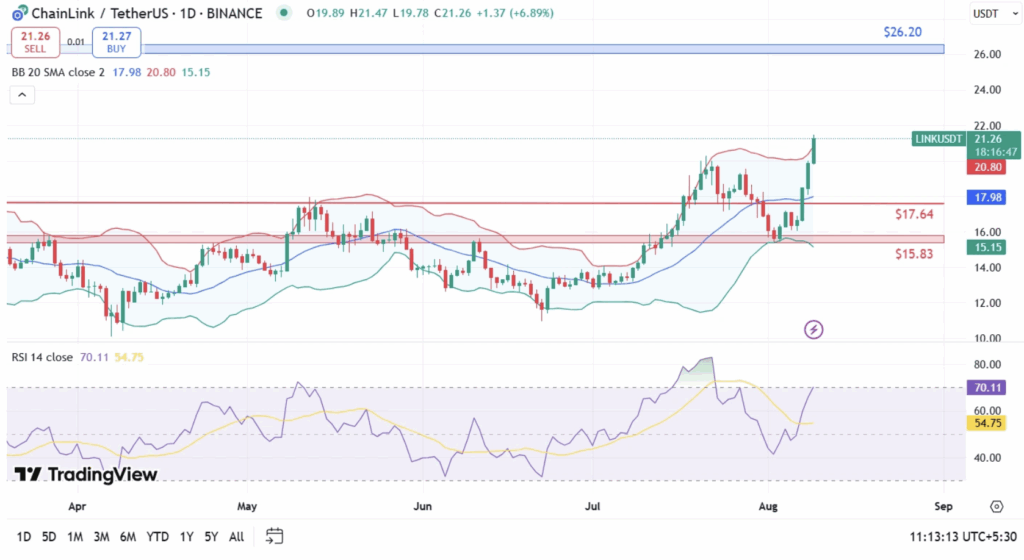

- Upside targets sit at $23.99 and $26.20, with key support levels at $19.51 and $17.64.

Chainlink has stormed into the spotlight, posting a 13.83% jump in the last 24 hours and a hefty 32.25% gain over the past week. This isn’t just a random uptick — it’s backed by strong technical setups and major on-chain catalysts. The biggest driver? The launch of the Chainlink Reserve on August 7th, which has already locked over $1 million in protocol revenue into LINK, creating a deflationary loop that could keep price strength alive for the long haul.

Adding fuel to the fire, whale wallets holding between 100k–1M LINK boosted their balances by 4.2% earlier this month, scooping up 4.55 million LINK worth about $97 million. Meanwhile, derivatives open interest jumped 27%, and trading volume spiked a staggering 271% to $2.7B — all without signs of dangerous overleveraging.

Breaking Through Key Resistance Levels

At the moment, LINK is sitting at $21.41, with a $14.52B market cap and $1.33B in daily volume. The break above the $21 psychological level signals a confirmed shift in market structure, as price holds well above major supports after a daily high of $21.24 and a low of $18.78.

From a technical perspective, LINK has cleared the 200-day EMA at $17.02 and broken through the long-standing descending resistance at $18.40. The RSI is at 65.56 — showing strong momentum without tipping into overbought territory — and the MACD confirms a bullish crossover, hinting at more upside.

Potential Price Targets and Risks

If bullish momentum stays intact, the next resistance zones to watch are $21.89 and $23.99 (June high). A clean break above these could pave the way toward the $26.20 zone. On the downside, immediate support lies at $19.51 and $17.64, with a deeper correction potentially sending LINK toward $15.83.