- Chainlink reserves are expanding rapidly, pulling 40K+ LINK off the market weekly while whales added nearly $43M in tokens last month.

- Exchange balances keep falling, a bullish sign that investors are moving LINK into self-custody as partnerships like the U.S. Commerce Department deal boost utility.

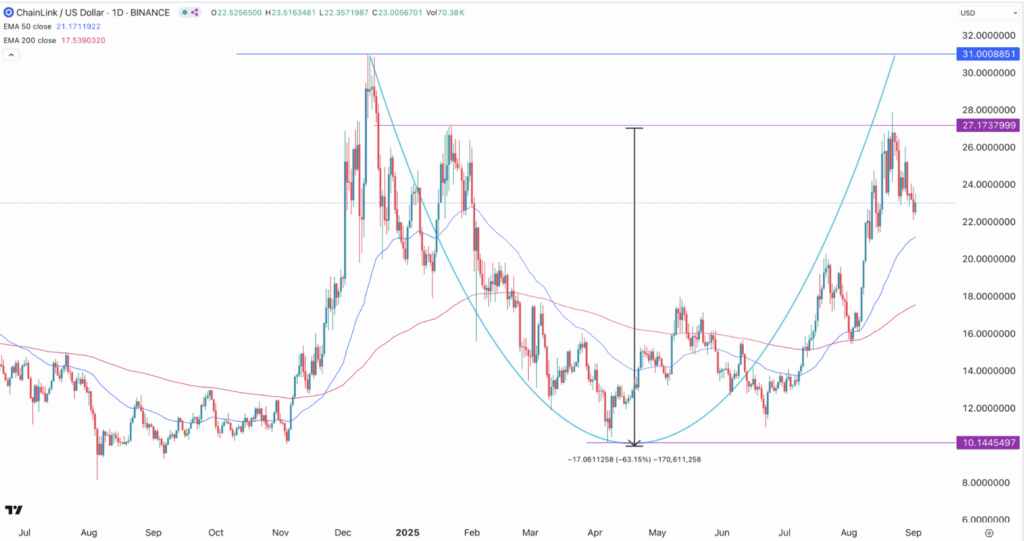

- Technicals show a cup-and-handle pattern with targets around $27 and $31, backed by a golden cross and rising momentum.

Chainlink has taken a breather after dropping about 17% from its yearly high, sliding into a technical correction. Still, the setup doesn’t look all that bad. On the charts, LINK is shaping up a cup-and-handle pattern, which traders often see as a bullish sign. Backing it up, some of the project’s fundamentals are quietly strengthening in the background.

Strategic Reserves and Whale Buying

One of the big tailwinds for LINK is the new strategic reserves. These have already scooped up over 193,000 tokens worth around $4.5 million, and they’re growing at a pace of more than 40,000 LINK each week. The idea is simple: funnel fees into reserves, buy up tokens, and cut down circulating supply. That creates a cushion under the price and supports long-term growth.

Whales seem to agree with the play. Nansen data shows they’ve grabbed about 1.9 million LINK (worth $43 million) in the past month, boosting their stash from 3.8 million to 5.1 million. Usually, when the “smart money” piles in, it signals confidence in a recovery. At the same time, exchange balances have been shrinking—falling from 280 million in August to 268 million. When tokens leave exchanges, it often hints investors are moving them to safer storage, a bullish clue for price stability.

Partnerships Boost Real-World Utility

Chainlink hasn’t just been relying on traders—it’s also expanding partnerships. The U.S. Commerce Department published GDP data through Chainlink, a first for a government using an oracle provider this way. More recently, Chainlink teamed up with Solv Protocol to launch a Secure Exchange Rate feed for SolvBTC, powered by its Proof of Reserve. Thousands of new data points have also been pushed to the network, broadening its use cases across industries from finance to real-world asset tokenization.

Technical Outlook: Cup-and-Handle Points Higher

On the daily chart, LINK climbed from $10 in April to $28 in August before easing back to $23. The pullback fits neatly into the “handle” phase of its cup-and-handle formation, with the upper boundary sitting at $27. A golden cross back in July (when the 50-day MA crossed above the 200-day) adds more fuel to the bullish view. If the pattern plays out, targets around $27 and $31 could be next in line.

Even with the recent correction, the fundamentals—rising reserves, whale accumulation, shrinking exchange balances, and major partnerships—paint a picture of a project building real traction. LINK may still wobble in the short run, but the broader setup leans toward another leg higher.