- Chainlink’s reserve wallet continues absorbing supply, quietly reducing circulating LINK

- Spot inflows have dropped sharply, signaling patience but weaker organic participation

- Rising leverage and downside liquidity clusters suggest volatility may come before continuation

Chainlink’s reserve wallet has quietly added another 94,267 LINK, bringing total holdings to roughly 1.41 million tokens. The move looks intentional, less about passive accumulation and more about active balance management behind the scenes. By shifting tokens into reserves, Chainlink effectively reduces circulating supply without needing fresh market demand to do the work.

This kind of supply absorption doesn’t usually spark fireworks in the short term. Instead, it slowly reshapes liquidity conditions, easing sell-side pressure over time. The reserve also plays a longer game, acting as a stabilizer for ecosystem incentives and overall network sustainability, even if the price doesn’t react right away.

Spot Activity Slows as Traders Step Back

On the spot side, activity has cooled noticeably. LINK spot inflows dropped from around $3.22 million to roughly $480,000, signaling fewer tokens moving onto centralized exchanges. That typically reduces immediate sell pressure, which sounds positive, but it also points to weaker spot participation overall.

Traders seem less interested in rotating LINK actively right now. Many appear content holding positions, while others shift their attention toward derivatives instead. This dynamic makes price action less dependent on organic spot demand, often resulting in thinner order books and higher sensitivity to sudden moves. Still, the lack of inflows suggests patience more than fear, a market waiting, not fleeing.

Leverage Builds as Open Interest Climbs

Derivatives data adds another layer to the picture. Open Interest jumped by about 8.61%, reaching roughly $607.9 million, confirming renewed engagement in LINK futures. Rather than buying spot, traders are expressing directional views through leverage, which can accelerate momentum but also increase fragility.

Leverage magnifies reactions to relatively small price changes. When spot demand stays muted alongside rising Open Interest, it can signal a speculative phase where traders position early, expecting expansion. That conviction, however, needs confirmation. Without spot follow-through, leverage-driven moves can unwind fast, and sometimes without much warning.

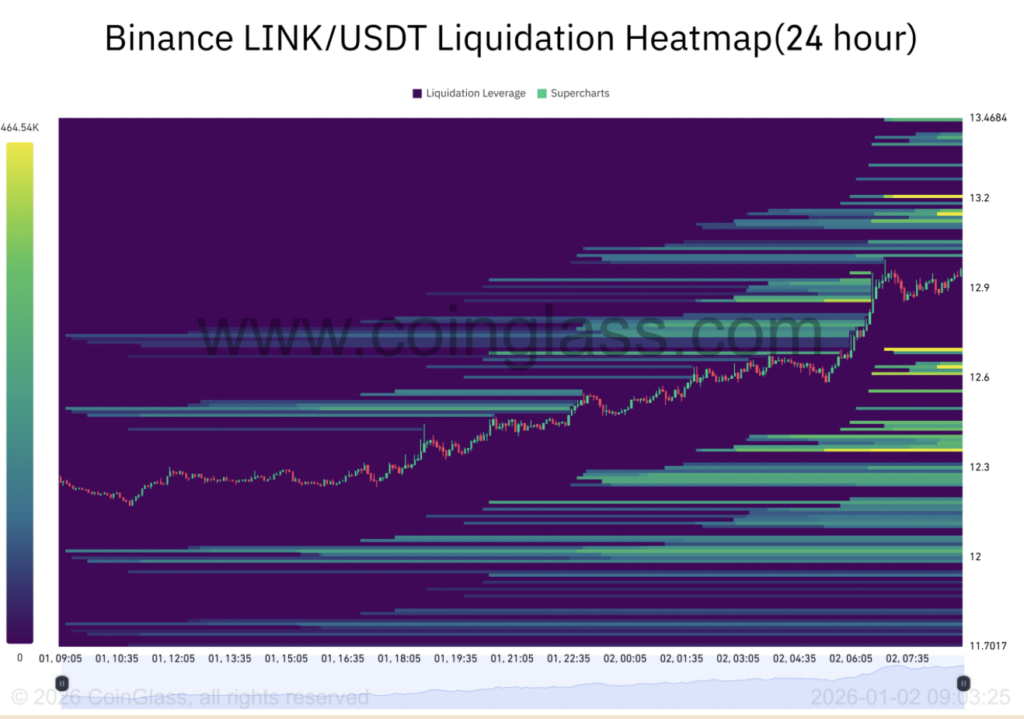

Downside Liquidity Defines the Risk Path

Liquidation heatmap data shows dense liquidity clusters stacked below current price levels. These zones often act like magnets during volatility spikes, making downside sweeps a real risk. Upside liquidity, by contrast, appears thinner, offering fewer immediate targets if price pushes higher.

This structure often leads to short-term pullbacks before any continuation plays out. Leveraged longs sitting below these zones remain exposed, and if price dips, liquidations could cascade quickly. Once those levels are cleared, pressure tends to ease, but the path there can be choppy and uncomfortable.

Can LINK Sustain Its Structure?

From a structural standpoint, Chainlink’s reserve accumulation strengthens the long-term setup, while declining spot inflows point to restraint rather than distribution. At the same time, leverage is clearly driving short-term price dynamics, bringing both opportunity and risk into focus.

Ultimately, sustainability hinges on whether spot demand returns to support the leverage building underneath. If it does, reduced circulating supply could amplify upside moves. If not, LINK may need to shake out excess leverage first before any meaningful expansion takes hold.