- The SEC approved Bitwise’s Chainlink ETF, marking LINK’s first U.S. ETF launch.

- LINK has rebounded recently but remains well below its all-time high.

- ETF access improves long-term demand potential, even if short-term price action stays muted.

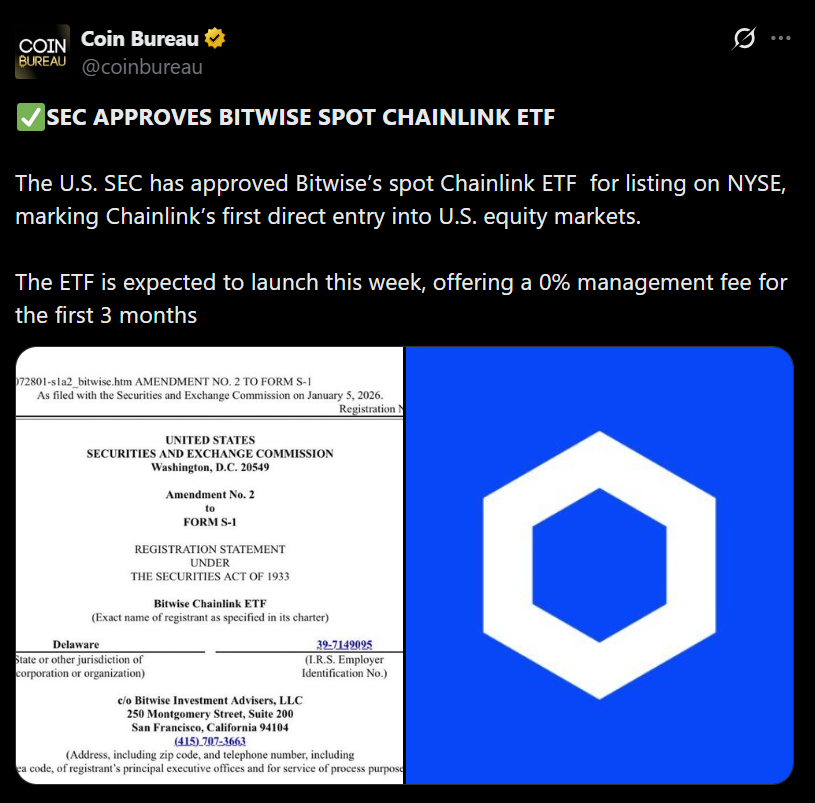

The SEC has officially approved Bitwise’s Chainlink ETF, marking a major milestone for the asset and its first direct entry into U.S. equity markets. The ETF is set to launch on the New York Stock Exchange, with reports suggesting trading could begin as early as this week. Bitwise is also waiving management fees for the first three months, a move designed to attract early institutional interest. For LINK, this isn’t just another product launch — it’s a structural shift in accessibility.

LINK Is Rebounding, Even If the Bigger Picture Still Needs Work

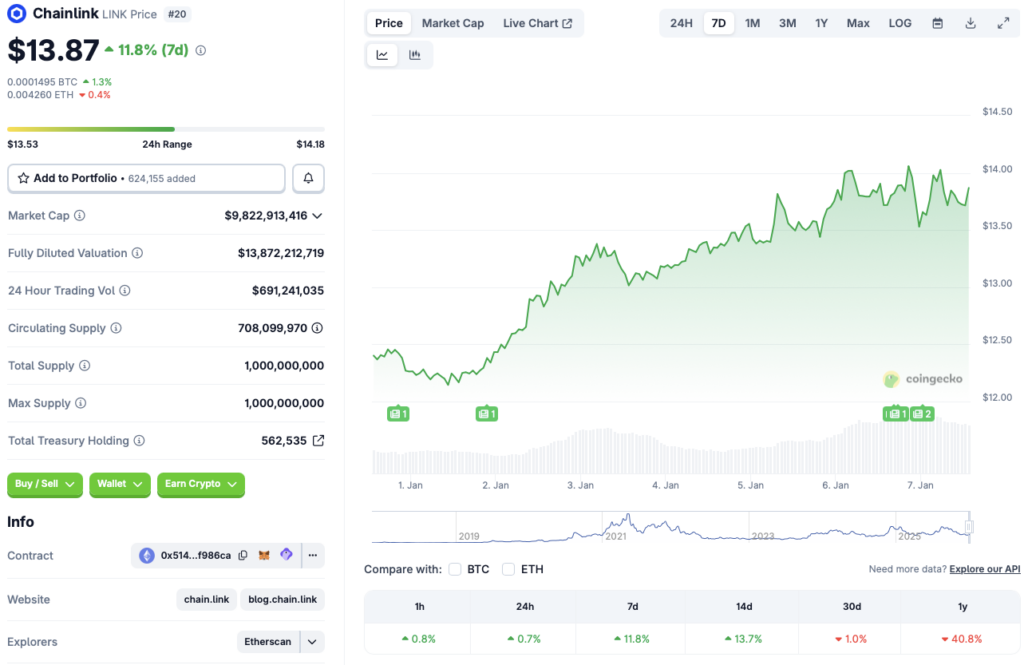

Chainlink’s price has quietly started to stabilize. CoinGecko data shows LINK is up 0.7% over the last 24 hours, nearly 12% on the week, and close to 14% over the past 14 days. Those gains come after a prolonged drawdown, with LINK still down about 41% since January 2026 and slightly red on the monthly chart. That context matters. ETF approvals don’t usually spark instant parabolic moves, but they often improve the base that future rallies are built on.

Why the ETF Matters More Than the First Week of Trading

ETFs were a defining force during the 2025 market cycle, helping push Bitcoin and Ethereum to new highs as capital flowed in through regulated channels. While Bitcoin was the only asset to hit fresh all-time highs immediately after its ETF debut, Ethereum, Solana, and XRP all saw delayed reactions. That pattern suggests patience matters. For Chainlink, the ETF opens the door to long-only capital that previously couldn’t touch LINK directly, which tends to reshape demand over time rather than overnight.

Can LINK Realistically Push Toward $50?

LINK’s all-time high near $52.70 remains a distant reference, with the token still more than 70% below that peak. Reclaiming those levels will likely require more than just an ETF launch. Broader market conditions, macro stability, and renewed risk appetite all play a role. That said, the ETF approval removes a major barrier and gives LINK something it’s never had before — direct exposure to U.S. institutional flows. If sentiment improves and capital rotates back into infrastructure assets, LINK’s upside ceiling becomes easier to imagine, even if the path there isn’t immediate.