- Chainlink plunged over 20% this week, tracking Bitcoin’s broader market decline.

- $717M in liquidations intensified the selloff amid U.S.–China trade tensions.

- Fed rate cuts later this month could spark a recovery if liquidity improves.

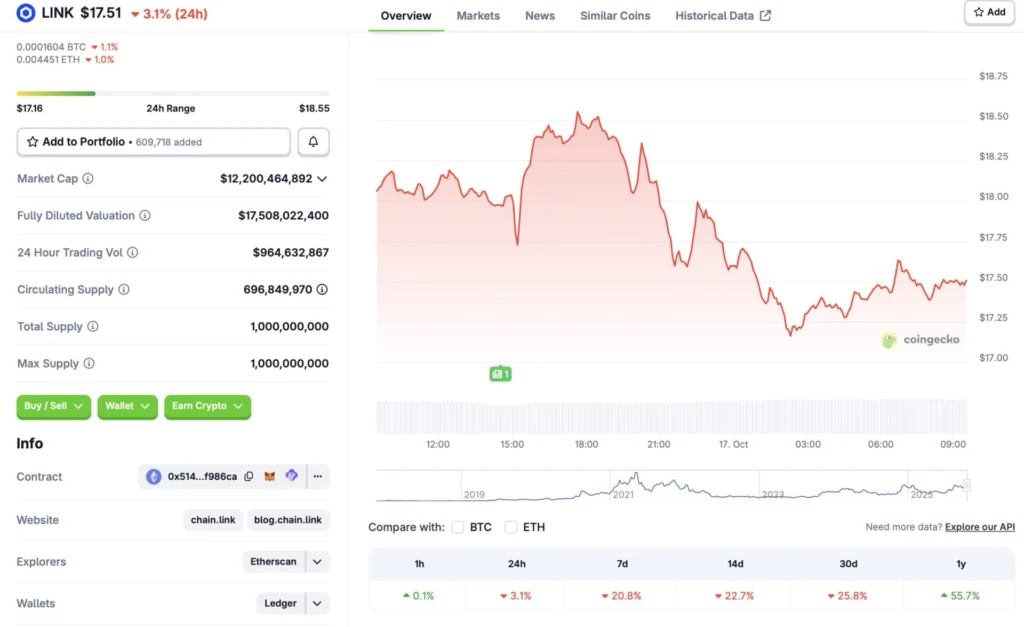

Chainlink (LINK) has taken a heavy hit this week, mirroring the broader market’s correction as Bitcoin slipped below $110,000. According to CoinGecko, LINK is down 3.1% in 24 hours, 20.8% for the week, and nearly 26% over the past month — a steep drop that’s left many wondering if the worst is over or just beginning.

Market Turmoil and Liquidations Drag LINK Lower

The selloff comes amid a volatile stretch for the entire crypto market. A massive $717 million in liquidations hit within the last 24 hours, following renewed U.S.–China trade tensions that rattled global risk sentiment. Chainlink, like most altcoins, has followed Bitcoin’s trajectory closely, sliding as investors de-risked across the board.

This wave of liquidations marked the largest single-day event of the month, erasing weeks of cautious accumulation. Analysts suggest that investor anxiety remains high despite modest recovery signs, as traders brace for further macro-driven turbulence.

Rate Cuts Could Offer Relief for LINK and Altcoins

There’s a potential silver lining on the horizon. Federal Reserve Chair Jerome Powell recently hinted at another interest rate cut, which would be the second of 2025. Lower borrowing costs typically boost liquidity and risk-taking, which could help altcoins like LINK rebound as capital flows back into speculative assets.

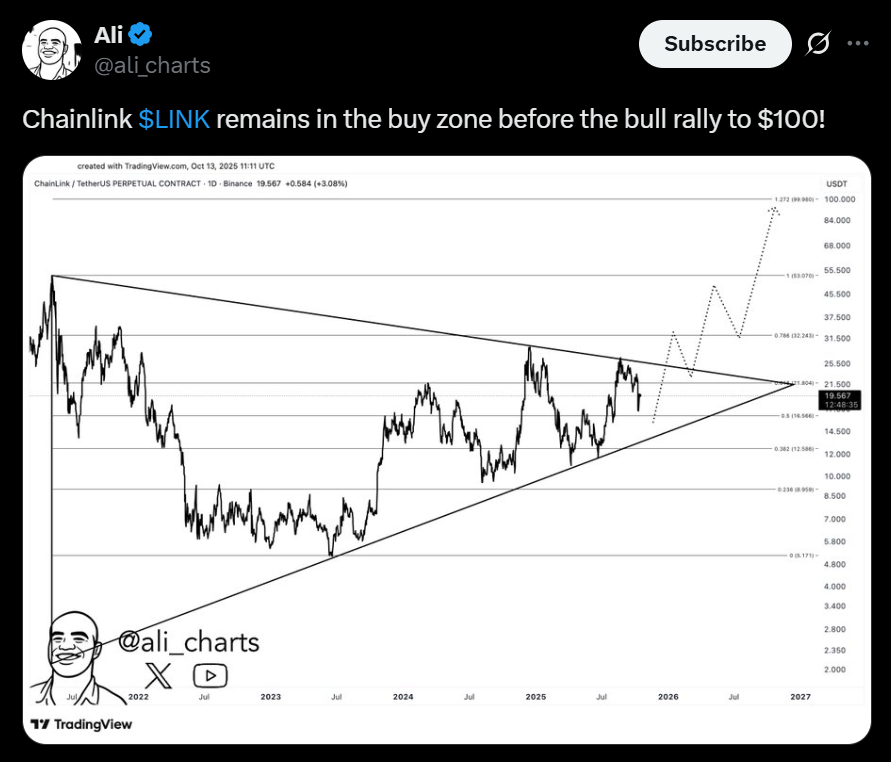

Historically, Chainlink has recovered strongly during easing cycles, as institutions re-enter the market seeking yield in decentralized finance and oracle-powered ecosystems. However, timing remains uncertain — and a shaky recovery in Bitcoin could still limit LINK’s upside momentum in the near term.

What Comes Next for Chainlink?

While optimism around rate cuts provides a potential tailwind, market volatility remains elevated, and LINK may consolidate around current levels before any major move higher. The last rate cut in September sparked a brief rally that quickly reversed into another correction. Traders should remain cautious, as the next bounce could be short-lived if macro pressure persists.

Still, Chainlink’s fundamentals — from rising oracle integrations to new staking demand — remain intact beneath the market noise. If liquidity returns post-rate decision and Bitcoin stabilizes, LINK could regain footing above the $12–$14 range by early November.