- ARK says Bitcoin’s low correlation boosts diversification and risk-adjusted returns.

- Bitcoin’s correlation with bonds and gold remains far below traditional asset pairings.

- Fixed supply and rising demand continue to underpin Bitcoin’s long-term case.

Bitcoin’s value as a diversification tool is becoming harder for institutions to ignore, according to ARK Invest CEO Cathie Wood. In ARK’s 2026 outlook released Thursday, Wood argued that Bitcoin’s unusually low correlation with traditional asset classes positions it as a powerful way to improve returns without proportionally increasing risk. Rather than behaving like a leveraged tech stock or digital gold proxy, Bitcoin continues to move on its own axis.

The Correlation Data That Stands Out

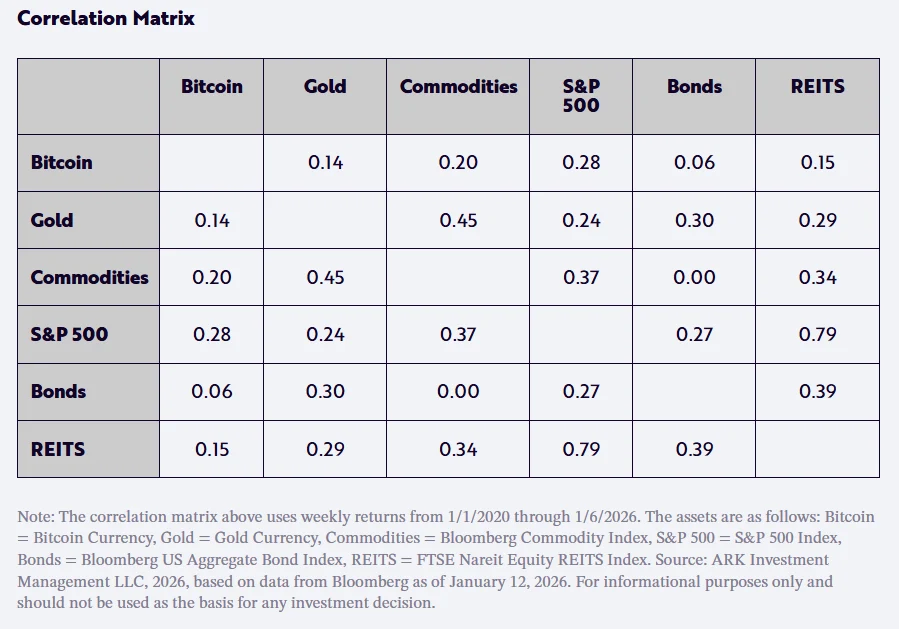

ARK’s analysis looked at weekly returns from January 2020 through early January 2026. Over that period, Bitcoin showed a correlation of just 0.14 with gold, significantly lower than the 0.27 correlation between the S&P 500 and bonds. Its relationship with bonds was even weaker at 0.06, while correlations with gold and REITs remained modest. Bitcoin’s highest correlation was with the S&P 500 at 0.28, still far below traditional pairings like the S&P 500 and REITs, which move together at a correlation of 0.79.

For portfolio managers, those numbers matter. Low correlation means Bitcoin can potentially smooth portfolio volatility while boosting overall returns, especially during periods when traditional assets move in lockstep.

Why Bitcoin’s Scarcity Works Differently Than Gold

Wood also pointed to Bitcoin’s supply mechanics as a key differentiator. Bitcoin’s issuance is locked by code, with new supply expected to grow by roughly 0.8% per year over the next two years before slowing to about 0.4% annually. That’s a sharp contrast to gold, where higher prices can incentivize more mining and eventually increase supply.

Because Bitcoin’s supply schedule is fixed and predictable, Wood argues it creates a unique form of scarcity. As demand grows against that rigid issuance curve, price pressure builds mechanically. She noted that this dynamic has already played out, with Bitcoin rising roughly 360% since late 2022.

A Broader Macro Backdrop That Favors Bitcoin

Beyond crypto, Wood outlined a constructive outlook for the broader economy. She described the US economy as a “coiled spring,” suggesting pent-up growth could be released as inflation cools and tax policies improve household income and corporate cash flows. In her view, emerging technologies — including AI, robotics, energy storage, blockchain, and multiomics — could meaningfully lift productivity and support stronger GDP growth over the coming years.

Within that framework, Bitcoin sits at the intersection of scarcity, technology, and macro hedging. For asset allocators focused on long-term risk-adjusted returns, Wood’s message was clear. Bitcoin isn’t just a speculative trade anymore. It’s increasingly behaving like a structural portfolio component.